Grayscale Investments CEO Michael Sonnenshein has hailed the recent wave of spot Bitcoin exchange-traded fund (ETF) filings as a crucial moment of validation for the cryptocurrency.

In an interview on CNBC’s Last Call on July 12, Sonnenshein dismissed any notions that BlackRock’s entry into the Bitcoin ETF race would diminish its appeal, emphasizing that it only reinforces the asset class’s legitimacy and enduring strength.

Convenient Exposure: Spot Bitcoin ETFs Gain Popularity

Over the past month, seven prominent institutional firms, including BlackRock, have submitted applications for spot Bitcoin ETFs in the United States. If approved, these ETFs would offer retail and institutional investors a convenient and compliant way to gain exposure to Bitcoin’s price without directly owning the cryptocurrency.

Sonnenshein highlighted the tried-and-true nature of the ETF wrapper, which has proven effective in facilitating access to various assets such as commodities and stocks. He stressed that Bitcoin, as an asset, is here to stay, and investors deserve the opportunity to include it in their portfolios.

Until now, Grayscale has provided U.S. investors with an indirect method of accessing BTC through its Grayscale Bitcoin Trust (GBTC). However, the company aims to transition GBTC into a spot Bitcoin ETF, offering investors a simpler means of trading BTC’s price without contending with GBTC’s discount to net asset value.

Sonnenshein believed that shifting to an ETF structure would satisfy investors’ desire for additional safeguards and protections. Grayscale previously filed a lawsuit against the United States Securities and Exchange Commission (SEC) in June 2022 after its 2021 application to convert GBTC into an ETF was rejected. Sonnenshein stated that a successful resolution to the lawsuit could unlock billions of dollars in investor capital.

Price Surges on BlackRock’s Spot Bitcoin ETF Filing

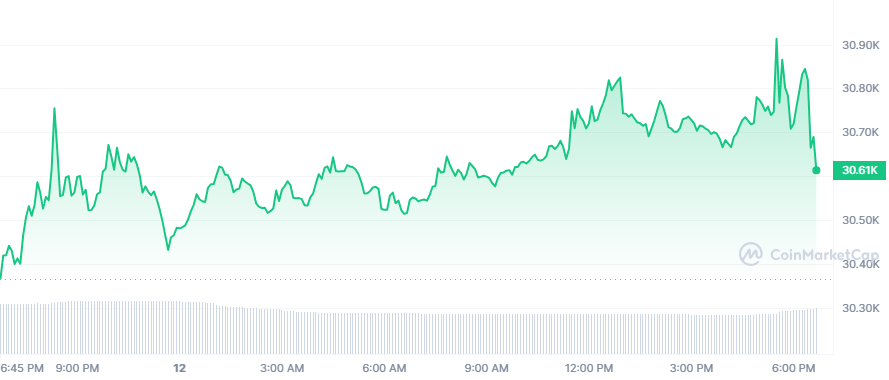

According to data from CoinMarketcap, the price surged by over 20%, reaching a year-high of $31,460 on July 6, following BlackRock’s filing for a spot Bitcoin ETF on June 15. Currently, the price of BTC stands at $30,633, which sets it apart as a distinct value within the market.

The growing influx of ETF filings from major institutional players underscores the increasing validation of BTC as a viable investment asset. Gradual overcoming regulatory hurdles could open the floodgates for broader adoption among retail and institutional investors by launching a Bitcoin ETF.