The cryptocurrency markets are experiencing a significant boost as a wave of exchange-traded fund (ETF) applications in the United States brings a bullish catalyst to the much-battered region. This week’s report delves into several key trends shaping the market landscape.

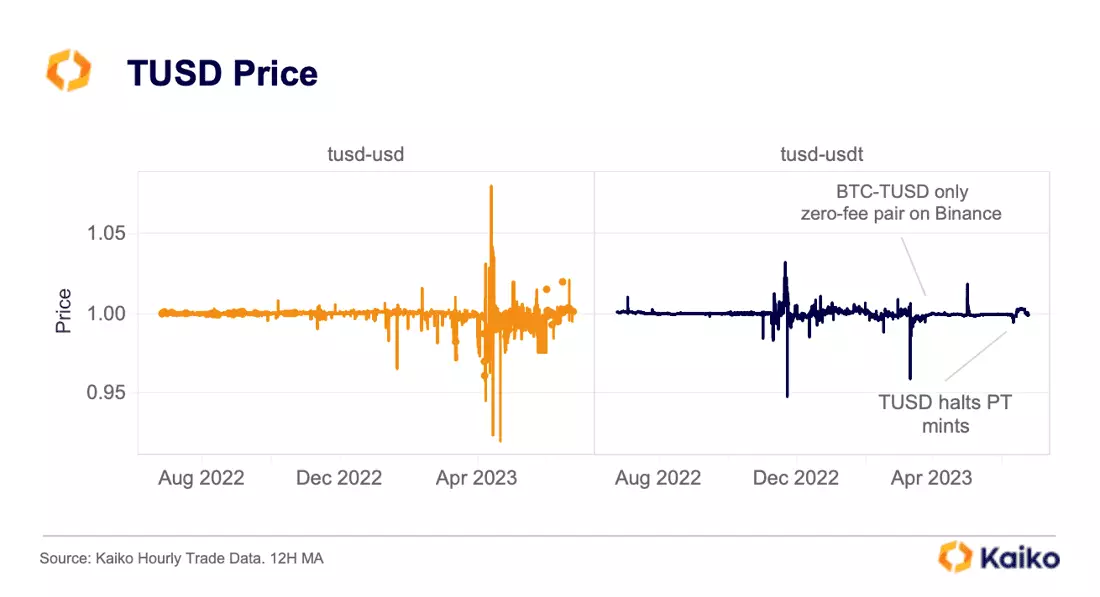

Firstly, TUSD, the stablecoin issued by TrustToken, has seen a soaring market share amidst troubles faced by Prime Trust. This Nevada-based trust company provides custodial and fiat banking services for stablecoins. The rising pace of delistings on exchanges is another notable trend, with the number of delisted spot instruments reaching a multi-year high in June.

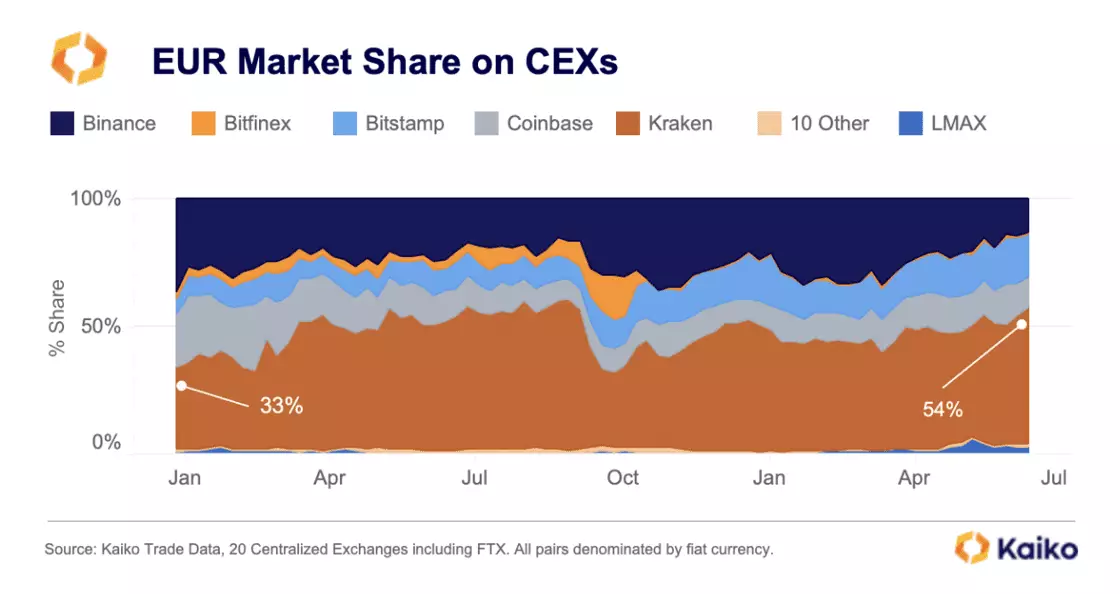

Kraken, one of the leading cryptocurrency exchanges, has shown resilience in terms of liquidity. Despite the challenges faced by the market, Kraken continues to maintain a strong position in providing liquidity for traders. Binance’s market share has declined on the derivative markets, dropping to pre-FTX lows.

Bitcoin Open Interest: Inflows & Speculation

The rally of Bitcoin (BTC) is a major topic of interest, as it briefly hit yearly highs over the weekend and saw a 15% increase in value week-on-week. While the filing of a Blackrock ETF has undoubtedly played a role in the surge, analyzing the data reveals other factors at play.

BTC open interest has reached its highest level since January, indicating increased inflows and speculation. Short liquidations have resulted in significant market movements as prices push higher.

However, when considering volumes, the rally is not solely driven by spot or derivatives markets. The ratio of Binance to Coinbase BTC volume has dropped significantly since the SEC lawsuit, suggesting a potential shift in spot market dynamics.

Within the U.S. markets, rising relative Coinbase volumes indicate that this exchange may be leading spot market movements since the beginning of June. Additionally, BTC’s dominance in U.S. markets is evident, accounting for nearly 50% of the BTC to altcoin volume ratio.

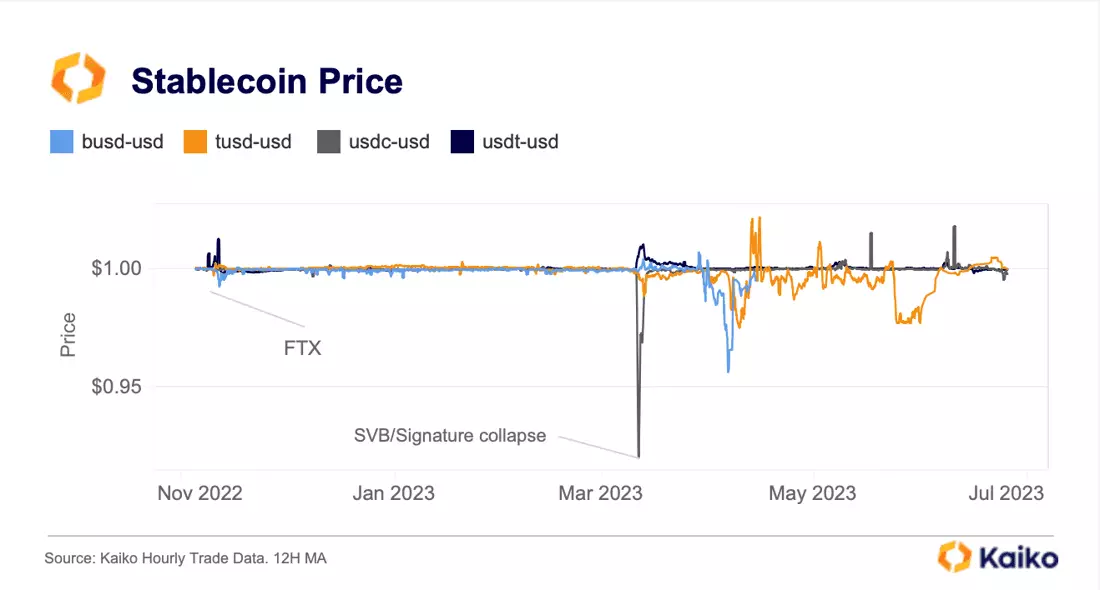

Stablecoin volatility is another trend worth noting. In 2023, stablecoin de-pegging events have become increasingly common, resulting in a decline in the combined market cap of top stablecoins such as BUSD and USDC. However, Tether’s USDT and TrueUSD’s TUSD have experienced growth and reached all-time highs in market capitalization.

Delistings on offshore exchanges, particularly Huobi and HitBTC, have been the primary driver behind the increasing number of delistings. Nonetheless, U.S.-based platforms like Bittrex and Binance.US have also witnessed a rise in delistings, largely due to charges brought against them by the U.S. SEC for violating securities laws.

Meanwhile, Binance’s market share in perpetual futures volumes has declined, losing nearly 10% since the beginning of the year. On the other hand, OKX has experienced a boost, with its market share increasing from 21% to 26% year-to-date.

BTC Dominance in Perpetual Futures

Bitcoin’s dominance in perpetual futures trade volumes has reached its highest level since 2021, reflecting a rising share of BTC spot volume dominance. In contrast, capital inflows into ETH derivatives markets have slowed significantly since the Shanghai upgrade in April.

Lastly, Grayscale’s Bitcoin Trust (GBTC) has outperformed BTC itself, as its discount to BTC has fallen from nearly 45% to 33% since the BlackRock ETF news. It has led to substantial gains for GBTC in year-to-date terms. Despite ongoing litigation with the SEC, Grayscale remains hopeful that GBTC will eventually transform into an ETF.

Bitcoin’s correlation with the tech-heavy Nasdaq 100 has dropped to its lowest level in nearly three years, highlighting a divergence in performance. Bitcoin outperformed tech equities in June, weakening its correlation with traditional risk assets compared to the previous year.

As the crypto markets experience a resurgence driven by ETF applications and various market dynamics, traders and investors remain eager to see how these trends will unfold in the coming weeks and months.