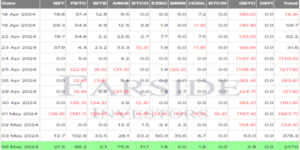

Grayscale’s spot Bitcoin exchange-traded fund (GBTC) saw its second daily net inflows on May 6, drawing in $3.9 million into the converted trust, according to data from Farside Investors. As a result, the overall US spot Bitcoin ETF market recorded net positive inflows of $217 million.

GBTC ended its 78-day streak of net outflows last Friday, May 3, when it added $63 million. Its share price also increased after positive inflows. Since converting to spot Bitcoin Trust in January, GBTC has seen a cumulative net outflow of $17.4 billion.

According to its website, the GBTC fund now holds approximately 292,217 BTC, worth an estimated $18.4 billion at current prices. This marks a significant decrease from 619,220 BTC on January 11. Several factors contributed to the consistent outflows from Grayscale’s Bitcoin ETF

One major reason is GBTC’s annual management fee of 1.5%, which is much higher than that of other Bitcoin ETFs that charge less than 1%. Moreover, the sell-off of GBTC shares by bankrupt crypto companies like Genesis and FTX has also driven the outflows. Genesis liquidated approximately 36 million shares, valued at $2.1 billion, and FTX sold about $1 billion worth of GBTC shares.

Despite the recent positive growth, Nate Geraci, the president of The ETF Store, expressed skepticism regarding its sustainability.

Geraci said:

“It’s difficult to discern what might be behind the flows into GBTC. I would be surprised if the inflows become a trend.”

Fidelity Leads Daily Bitcoin ETF Inflows

According to Farside Investors data, Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the net inflows with $99.2 million, while Ark Invest and 21Shares’ ARKB ETF added $75.6 million. BlackRock’s IBIT, which had posted zero to negative flows the previous week, recorded an inflow of $21.5 million on Monday.

Meanwhile, Invesco and Galaxy Digital’s BTCO also reported $11 million worth of daily net inflows, and funds from Franklin Templeton, VanEck, and Bitwise each added around $2 million. Notably, funds continued the positive flow they regained last Friday, May 3. Before Friday, the funds hadn’t experienced a positive flow since April 23.