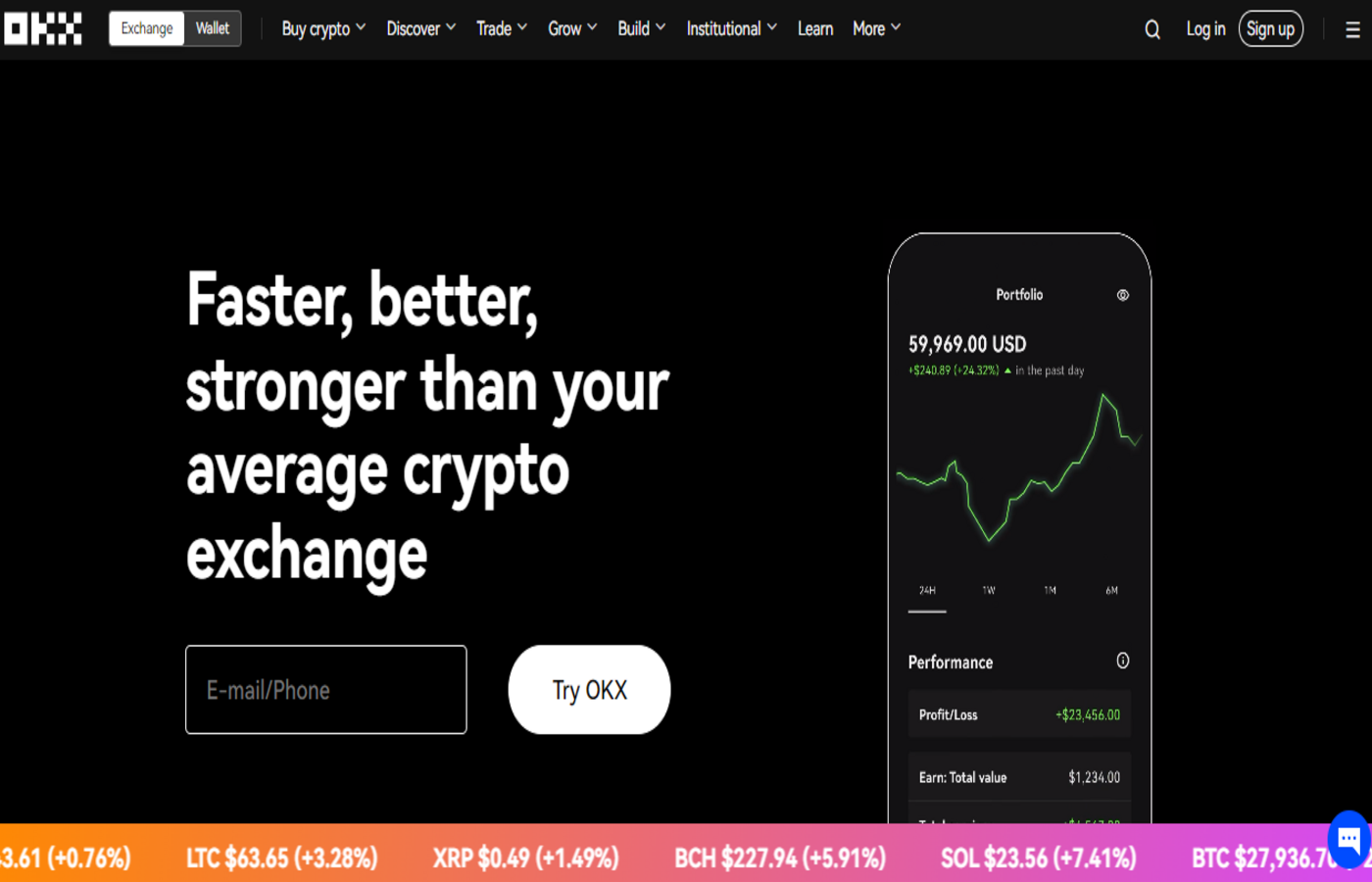

OKX Exchange Review: Details, Pricing, & Features

Overview & Background

The OKX exchange, previously known as OKEx, stands out as an innovative cryptocurrency platform that provides both fundamental and advanced financial services. Established in 2017 by Star Xu, the exchange is based in Seychelles.

According to Coinmarketcap, OKX ranks among the top 10 crypto exchanges for trading volume, liquidity, and traffic. Unfortunately, it’s unavailable to users in the US and Canada. However, it’s a top-notch choice for international crypto traders seeking affordable exchange fees. OKX allows users to trade a wide range of digital assets and pairs, delve into its NFT marketplace, access crypto-backed loans, and employ yield-generation tools for passive income.

Its parent company, OK Group, also owns the San Francisco-based crypto exchange OKCoin. OKCoin was established to serve the US market. However, OKCoin only deals in crypto trading (purchasing and selling) and ICO tokens.

OKX Summary

| Platform Name | OKX |

| Mobile App | Yes – iOS & Android |

| Products | Exchange, Wallets, Lending, Loans, Staking |

| Available In US | No – Use OKCoin |

| Native Token | Yes |

| Interest Rates | 5% on BTC, Up to 0.08% APY on Stablecoins |

| Regulated | Yes – geo-restrictions apply |

| Trading Fees | 0.08–0.10% |

| Withdrawal Fees | Varies by crypto |

| Deposit Fees | No fee |

| Customer Support | 24/7 |

Yield Generation

Staking

Staking involves locking assets for a brief period to earn rewards. On OKX, users can stake over 80 assets for durations of 15, 30, 60, 90, or 120 days. The rewards depend on the asset type and staking duration, typically ranging from 1.5% to 72%.

Savings

OKX Savings offers an alternative way to earn, albeit with a lower Annual Percentage Yield (APY) than staking. Users can accumulate interest on their assets hourly with this flexible savings product. There are over 150 cryptocurrencies to choose from, and the APY varies depending on the deposited asset, ranging from 1% to 36.50%. Rewards are distributed in the same crypto as the deposit.

Dual Investment

Dual investment in OKX is a high-risk, high-reward opportunity, allowing traders to invest in cryptocurrencies like BTC, ETH, or USDT. Traders participate in term-based deals, aiming to sell assets for a higher price in USDT or receive additional crypto. Profit is significantly influenced by market volatility, and returns are not guaranteed. Traders can determine their profits only at the offer’s expiration date.

Flash Deals

Flash deals on OKX are high-yield opportunities that appear intermittently. Traders must commit their cryptocurrency to a project in the order they sign up. Participants receive interest based on their deposit amount, with interest payments made within 24 hours after the project concludes. It’s crucial to note that once subscribed, you cannot withdraw from a flash deal, so participants should consider this limitation before joining.

DeFi

The OKX platform acts as a bridge to DeFi services. Users can seamlessly tap into earning opportunities from renowned DeFi platforms such as Compound Finance, Aave, Sushiswap, and more via OKX. This product eliminates the need to navigate the steep learning curve associated with DeFi protocols. Moreover, users can generate passive income by staking in DeFi, contributing liquidity to lending pools, and engaging in decentralized exchanges.

Supported Coins

The platform supports over 350 cryptocurrencies and 500 trading pairs. Customers can purchase and sell assets with over 90 fiat currencies, including AUD, NZD, USD, CAD, THB, EUR, and BGP. The following are the most popular coins on OKX:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Terra

- Litecoin

- Ripple

- TRON

- OKB

- Dogecoin

- Avalanche

Supported Countries

OKX is available in over 100 countries but not in Hong Kong, the United States (including all US territories), North Korea, Syria, Bangladesh, Bolivia, Sudan, Malaysia, Cuba, Ecuador, Iran, or Kyrgyzstan.

Regulatory Compliance

OKX holds licenses in multiple countries to offer legal trading services. In Malta, it operates under the Virtual Financial Asset Act (VFAA). In Hong Kong, it complies with the Money Laundering Prevention Law and adheres to Financial Action Task Force (FATF) regulations. OKX also has a temporary license from the Dubai Virtual Assets Regulatory Authority (VARA) for virtual assets, extending services to the United Arab Emirates (UAE).

Spot Trading

The most basic trading type accessible on OKX is spot trading. It’s beginner-friendly when compared to the other complex options. Spot trading executes transactions immediately at the current market price, regardless of potential price fluctuations. The exchange allows the trading of over 350 crypto assets across multiple trading pairs.

You can immediately start trading with preferred assets After funding your spot account. Additionally, advanced traders can use various spot trading order types, including market, limit, and trail orders, to enhance their trading strategies.

Margin Trading

OKX permits registered traders to borrow funds from the exchange. Traders can initiate positions with more capital than their initial deposit. The company provides margin trading ratios of 10:1 and 20:1, which go up to 100:1.

Trading Bot

OKX provides customizable trading bots. Crypto traders can easily implement a variety of trading strategies. These bots conduct automatic crypto trading. The bots can trade in seven modes:

- Futures grid

- Smart portfolio

- Recurring buy strategies

- Spot grid

- Iceberg

- Arbitrage

- TWAP

Some of these methods carry higher risks and are more complex. Therefore, they are more suitable for experienced investors.

OKB Token

OKB is a utility token launched by OKX exchange and OK Blockchain Foundation in 2017. This exchange allows users to access exclusive features and pay less for fees. Usually, the OKB is utilized to determine and pay trading fees. However, it also lets holders vote on platform governance and development. Interestingly, users can stake the OKBs for passive income and access other platform incentives.

Exchanges can discount up to 40% on transactions based on token holdings. It’s capped at 300 million shares, and the company commits to repurchasing and burning shares every three months.

OKX Wallet

This wallet is a gateway to DeFi, NFT, and Web3. It works with several protocols and blockchains. Users can mint, swap, trade, and store NFTs and crypto using the wallet. OKX Wallet gives users full control over their crypto assets, including accessing their private keys. Moreover, it also connects users to DeFi protocols and DApps for the purposes of trading, investing, and making money.

Fees

The exchange’s fee structure is relatively cost-effective compared to other crypto platforms. The trading fee depends on factors such as transaction volume, trade type, and the user’s status. OKX provides two user statuses: VIP and regular. The regular status comprises five levels based on the number of OKBs (native tokens of OKX) owned and the total USD value of assets.

| Tier | Total OKBs | 30-day trading volume (USD) | Maker fee | Taker fee | 24h withdrawal limit (Bitcoin) |

| Level 1 | < 500 | < $5 million | 0.080% | 0.100% | 500 |

| Level 2 | ≥ 500 | < $5 million | 0.075% | 0.095% | 500 |

| Level 3 | ≥ 1,000 | < $5 million | 0.070% | 0.090% | 500 |

| Level 4 | ≥ 1,500 | < $5 million | 0.065% | 0.085% | 500 |

| Level 5 | ≥ 2,000 | < $5 million | 0.060% | 0.080% | 500 |

In contrast, the VIP status consists of eight levels determined by a user’s trading activity over the past 30 days and their total asset value.

| Tier | 30-day trading volume (USD) | Maker fee | Taker fee | 24h withdrawal limit (BTC) |

| VIP 1 | ≥ $5 million | 0.060% | 0.080% | 600 |

| VIP 2 | ≥ $10 million | 0.040% | 0.075% | 800 |

| VIP 3 | ≥ $50 million | 0.020% | 0.070% | 1,000 |

| VIP 4 | ≥ $100 million | 0.000% | 0.060% | 1,200 |

| VIP 5 | ≥ $200 million | -0.002% | 0.050% | 1,500 |

| VIP 6 | ≥ $500 million | -0.005% | 0.040% | 1,800 |

| VIP 7 | ≥ $1 billion | -0.010% | 0.030% | 2,000 |

OKX Security

The exchange uses several industry-standard security measures to secure its clients’ funds. OKX keeps 5% of its assets in a hot wallet while the remaining 95% is in a cold wallet. The company also gives users extra security features like withdrawal passwords, 2FA, and anti-phishing codes. Notably, OKX hasn’t experienced any major security breaches or hacks.

However, in October 2017, a few OKX users complained that their accounts had been compromised, causing them to lose their cryptocurrency. The company blamed the incident on account holders’ failure to adopt adequate security measures, particularly managing passwords and login credentials.

Customer Support

OKX offers around-the-clock customer support to assist users with any platform-related concerns. You can get in touch with them through various channels, including:

- Telephone

- Email ticketing

- Live Chat

- FAQs on the support center

Furthermore, the support team is available in over 30 languages. If you face deposit issues, cryptocurrency losses, misplacements, or security problems like hacking or scams, contact the team. You should also check the FAQs because your question might already have an answer there.

How To Create An Account On OKX

- Visit the OKX website.

- Click on “Sign Up” on the homepage.

- Enter your phone number, email, or use Google/Telegram for registration.

- After providing the required information, verify your account with a code.

- Enable 2FA.

- Connect your preferred payment method to your trading account.

Pros

- User-friendly

- +350 cryptos & 100X Leverage

- Spot, Margin, Perps, Options

- Educational resources

- Low trading fees

- Zero deposit fee

- 24/7 support

Cons

- N/a for US citizens

- Limited fiat deposit methods

Final Thoughts

OKX exchange offers an excellent crypto trading experience. You can generate passive income and explore DeFi services. Its educational resources are a valuable asset for beginners, providing insights into the crypto world. If you’re security-conscious, OKX can be a good choice.