Uniswap Exchange Review 2024

Uniswap is the most popular decentralized crypto exchange (DEX), allowing users to swap crypto easily with just a few clicks and without signing up for an account or completing any identity verification. Users can also earn interest on their crypto holdings through Uniswap’s liquidity pools. Moreover, Uniswap lets traders purchase cryptocurrencies with debit or credit cards, which puts it ahead of many other decentralized exchanges. Read our full Uniswap review to learn about its features, fee structure, pros and cons.

An Overview of Uniswap

Uniswap is a decentralized exchange, meaning a company like Gemini or Coinbase does not control it. It uses smart contracts (liquidity pools) to facilitate automated transactions between crypto assets on the platform. Updates to the Uniswap protocol are voted on by traders and investors who hold the native token of the Uniswap ecosystem called UNI. Uniswap Labs, a New York company, designs and maintains the Uniswap app, but the protocol itself is governed by the community. Early users of the exchange received the UNI token through distribution, but it is also available for purchase now.

Hayden Adams launched the Uniswap exchange on Nov. 2, 2018. Before developing Uniswap, Hayden was a mechanical engineer at Siemens. Currently, it is the largest DEX and is among the top 5 crypto exchanges by trading volume. Because it is Ethereum-based, the exchnage is fully-compatible with all ERC-20 tokens and other Ethereum platforms like MyEtherWallet and MetaMask.

Moreover, Uniswap is fully open-source, allowing anyone to copy its code and use it to create a similar DeFi protocol. Other exchanges like SushiSwap are essentially Uniswap’s code under a different name. The exchange offers a basket of services, including swapping tokens, buying and selling NFTs, buying and selling crypto assets, and earning on trading fees via liquidity pools.

How Uniswap Works

Problems in Centralized Exchanges

A single authority governs centralized exchanges. They require users to put funds under their custody and trade using a typical order book mechanism. Order book trading lists all open orders for a particular trading pair currently accessible on an exchange. For instance, if we want to sell one Bitcoin (BTC) at $45,000 on a CEX, we would have to wait for a buyer to arrive on the other side of the order book who wants to purchase an equal or larger amount of BTC at that price.

Solutions By Uniswap

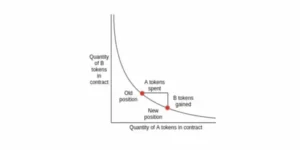

Firstly, Uniswap utilizes the automated liquidity protocol to overcome the liquidity problem. It implements a Constant Product Market Maker design (CPMM), a variation of the Automated Market Maker (AMM) technology. AMM are the smart contracts that maintain liquidity reserves or liquidity pools that traders may trade against. Liquidity providers add funds to these reserves.

In return, traders pay a fee to the pool. Anyone can become a liquidity provider by putting two tokens into the pool. The fee collected from traders is divided among liquidity providers based on their pool share. Liquidity providers create a market by depositing the equivalent of two tokens. For instance, these might be ERC-20 and ETH tokens or two ERC-20 tokens. Pools generally comprise stablecoins like USDT, USDC, or DAI.

Imagine a pool with ETH and USDT. We call the amount of ETH “x” and the USDT amount “y.” Uniswap multiplies them to get “k,” and this k stays the same. It means the total liquidity in the pool always stays constant. For example, Jack buys 1 ETH for 2000 USDT from the ETH/USDT pool. By doing so, he increases the USDT component of the pool while reducing the ETH portion. This basically indicates that the price of ETH increases. Even with less ETH, the total overall liquidity (k) must remain constant. This process determines the price.

Uniswap Top Features

User-friendly

Unlike some crypto exchanges with confusing designs, Uniswap gained popularity early on due to its simple and user-friendly design. Connecting a crypto wallet, swapping one crypto for another, or depositing in a liquidity pool is straightforward.

Crypto Swaps

Users can easily swap Ethereum-based coins on Uniswap and even use bridges to swap tokens from other protocols. With a selection of over 600 tokens and no need for registration or KYC, Uniswap provides an easy way to swap tokens anonymously. Moreover, the exchange efficiently routes transactions to reduce swap fees. Users can check the route to understand the transaction’s path and where the fees are directed.

Liquidity Farming To Earn Yield

Uniswap does not offer its own liquidity for tokens but relies on individuals to join and contribute their assets to liquidity pools. Users can make their pools by pairing different digital assets like USDC/BTC. By depositing an equal amount of each coin, users earn fees when their pool is used for transactions.

Users can check out the best pools (based on total value locked) and add liquidity to join the existing pool. Higher-volume pools pay more often because they handle more transactions. However, each transaction might have slightly lower fees. Users can check out the best pools (based on total value locked) and add liquidity to join the existing pool.

Volume and Liquidity

Users provide liquidity to Uniswap by delegating funds to liquidity pools governed by smart contracts on the Ethereum network. The total liquidity in pools depends on the assets inside. Pools with Ethereum (ETH) and stablecoins like USDC or DAI have the most liquidity, while smaller projects and lower cap coins have less. Uniswap tops the list of DEXs with a daily trading volume surpassing $700,000,000 at the time of writing.

NFT Marketplace

Uniswap NFT officially launched on November 30, 2020. It enables users to trade, discover more listings, and find better prices across major NFT marketplaces. The platform aggregates NFT listings from NFT marketplaces like NFTX, X2Y2, SudoSwap, Larva Labs, OpenSea, Foundation, NFT20, and LooksRare.

To use NFT collection filters, click on the filter icon on the NFT page. The available filter options include:

- Price: Set the minimum and maximum price range to display only NFTs within that range.

- Traits: Streamline your search by specific traits of the NFTs.

- Listed marketplace: Choose the NFT marketplace for the listings you want to see.

- For sale: Use this filter to see only the NFTs in a collection currently for sale.

Supported Countries

Uniswap, being decentralized, is accessible to users worldwide. However, in December 2019, it blocked access for 10 countries: Sudan, Syria, Iraq, Zimbabwe, North Korea, Iran, Ivory Coast, Belarus, Liberia, and Cuba.

Supported Wallets

Uniswap works with various crypto wallets, such as:

- MetaMask

- WalletConnect (check for compatible wallets)

- Coinbase Wallet

- Fortmatic

- Portis

Uniswap Fees

| Fee Type | Fees |

| Network fees | Fees differ based on the network; Ethereum (ETH) usually costs more for transactions compared to Polygon (MATIC) or other networks |

| Swap fees | 0.01%, 0.05%, 0.3%, or 1% |

| Purchase fees (MoonPay) | 3.25% US Credit Card, 2.55% US Debit Card (Fees differ internationality) |

Uniswap’s trading fees compare well with CEXs like Coinbase. Most Uniswap swaps cost 0.3%, while Coinbase Advanced charges 0.6% for market orders if your trading volume in the last 30 days is below $10,000. Swapping on Uniswap might get expensive with Ethereum’s high gas prices during high network activity. Fortunately, you can opt for cheaper and faster networks like Polygon.

Is Uniswap Safe?

Uniswap Exchange is extremely safe because it’s decentralized and built on Ethereum, meaning it has the same security as the Ethereum blockchain. Hacking to gain access to users’ funds is impossible since there is no central server. When you put funds in a liquidity pool, a smart contract locks them, and only you can take them out. In this case, hackers need everyone’s account details to access anything from the pools.

The only problems you might encounter with Uniswap Exchange are user errors. The code and smart contracts have been thoroughly audited and tested for safety. Moreover, when you add your assets to a pool, like in Uniswap, there’s a chance you might face impermanent loss. It’s a common thing in all liquidity pool systems, not just with Uniswap.

How to Sign Up on Uniswap

- Create an account: Visit Uniswap’s website, fill in your email, set a password, and share your phone number and name.

- Verify account: Check your email and click to verify your account.

- Transfer funds: Once verified, deposit funds using supported methods. Remember, you can only deposit fiat currencies through third-party apps Uniswap supports.

- Start trading crypto: You’re ready to trade crypto on Uniswap.

Customer Support

Uniswap doesn’t have customer service like other platforms. Instead, you can visit the “Help Center” page in English, where you’ll find FAQs. If your question isn’t there, you can “Submit a request.” The community helps out with their combined knowledge.

Pros

- Decentralized and non-custodial

- Swap all ERC-20 tokens

- Automated market maker (AMM) system offers liquidity

- Earn fees by providing liquidity

- No identity verification or sign-up required

- Open-source platform

- Offers a native token

- Has an NFT marketplace

Cons

- Transaction costs/ Gas fees can be very high

- Risk of permanent loss in liquidity pools

- Only supports ERC-20 tokens

- Lack of customer support

- No fiat on-ramps

Conclusion

Uniswap demonstrates the innovative progress in the crypto world. Its automated market maker system gives a different and independent trading experience compared to traditional centralized models. Users can easily swap their preferred tokens without needing to create an account. Moreover, NFTs and the ability to earn with liquidity pools add to Uniswap’s value.

Uniswap (or any other DEX) might be tricky for crypto beginners. The platform requires a comprehensive understanding of the Ethereum blockchain, digital wallets, and how to pay the gas fees on the network. For newcomers, it’s recommended to begin with a centralized exchange such as ByBit or Binance.