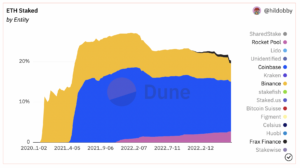

Investors are moving away from centralized exchange giants like Binance and Coinbase to stake their Ethereum holdings on decentralized alternatives, according to crypto analysts.

Blockchain statistics indicate that centralized cryptocurrency exchanges have experienced substantial outflows of staked Ethereum (ETH) since Ethereum Shanghai upgrade. This is due to the growing interest of investors in decentralized alternatives.

Coinbase’s staking platform has experienced a net outflow of $367 million in staked Ethereum since April 12. Withdrawal requests, including reward withdrawals and complete exits, have surpassed new deposits, according to Dune Analytics data dashboard.

This indicates a significant decline in investor interest in Ethereum staking on Coinbase. Binance’s staking service, the world’s largest crypto exchange, has experienced a net outflow of $340 million.

Decentralized liquid staking protocols have enjoyed a sharp rise in deposits. Respectively, the net inflows recorded by Frax Finance and Rocket Pool were $56 million and $68 million.

Liquid staking systems provide a derivative token that indicates the number of locked tokens. This allows investors to utilize DeFi services such as lending and borrowing.

According to DefiLlama data, due to fresh deposits, the amount of Ethereum bet on Frax and Rocket Pool has increased by 32.5% and 31% in the last 30 days.

Since April 12, deposits have exceeded withdrawals by $28 million (15,208 ETH) at Lido Finance, the largest decentralized liquid staking protocol with over $11 billion in deposits.

Regulatory Concerns And Higher Yields Drive Decentralized Staking

Investors are likely being driven to decentralized staking methods due to regulatory concerns and reluctance to centralize crypto platforms after last year’s bankruptcy.

Regulatory pressure on centralized entities may continue, which could cause investors to move to decentralized options, said John “Omakase” Lo, head of digital assets at investment firm Recharge Capital.

Higher staking rewards from decentralized protocols could also away investors. Staking with Ethereum, Coinbase, and Binance can result in approximately 4% annualized returns. Lido Finance and Frax Finance provide decentralized protocols with returns between 5% and 7%, in contrast to centralized options.

The yield profile of centralised liquid staking is often lower. Compliance and personnel are both important,” stated Omakase. Despite recent withdrawals, Binance and Coinbase remain among the largest Ethereum staking providers.

Binance’s market share dropped to 4.5% from 5.7% in a month, while Coinbase’s share fell to 12.3% from 13%. This follows Ethereum widely anticipated Shanghai upgrade on April 12, which let investors withdraw over $35 billion in tokens previously locked up in staking contracts.

Analysts have forecasted that the event will serve as a crucial milestone for the $225 billion network. It could potentially attract more staking participants, entice institutional investors and shake up competition among staking services.

“The development has been a major catalyst for decentralized liquid staking solutions,” said Ahmed Ismail, founder, and CEO of the liquidity aggregator platform FLUID Finance.

Related Reading | Bitcoin’s Hash Rate ATH: Surge in Ordinal Inscriptions & Transactions

Decentralized staking protocols attract investors seeking higher yields and avoiding regulations. Binance & Coinbase still offer Ethereum staking, but their market share is declining as investors look for decentralized options.