Polygon’s MATIC Surges 15% Amidst Whales’ Multimillion Token Shuffle

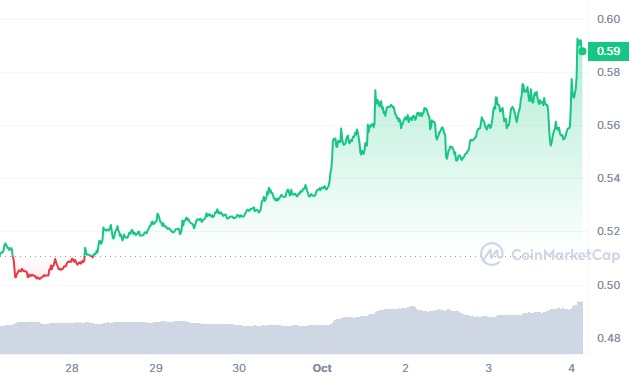

Polygon’s MATIC experienced a remarkable surge of over 15% during the recent weekend, shining brightly in a cryptocurrency market. Surprisingly, this rapid increase in price coincided with an astonishing transfer of 37 million tokens from a massive Proof-of-Stake address owned by a crypto whale to a wallet that has been active for three years.

Santiment’s scrutiny reveals an extraordinary spectacle within the crypto community. This transfer ranks among the grandest individual transactions witnessed on the Polygon Network since July. Now, speculation immerses enthusiasts as they delve into the labyrinth of potential implications spawned by this monumental maneuver.

🐳 37M $MATIC was moved from a whale PoS address to a 3 year-old wallet today, coinciding with a mild +4% price rise for the 13th market cap asset while the rest of #crypto slumps. This was the largest single transaction on the #PolygonNetwork since July. https://t.co/MKKNKDuQJU pic.twitter.com/dTI0qiB1zX

— Santiment (@santimentfeed) October 3, 2023

The transaction captured widespread attention due to its sheer magnitude, representing a monumental event that coincided with a modest yet significant 4% increase in the value of MATIC, according to CoinMarketcap.

This unexpected price surge propelled MATIC to secure the notable 13th spot in terms of market capitalization, an achievement worth acknowledging amidst the ongoing decline affecting many other cryptocurrencies.

Renowned for its rapid and cost-effective transaction capabilities, Polygon, Ethereum’s favored layer-2 scaling solution, continues to attract admiration.

The sudden infusion of MATIC tokens into an older wallet sparks a flurry of inquiries, raising questions about the motives and potential consequences of this move.

The unwavering defiance of MATIC’s price movement against broader market trends is further supported by another important indicator.

In the past week, crypto analytics platform IntoTheBlock uncovered a surge in large transactions worth $100,000 or more linked to the underlying token. According to this data, transaction growth led by these investors cohort has surged by 17% to $17.5 million.

MATIC’s On-Chain Analysis- More Accumulation Incoming

If these big holders keep accumulating MATIC, it might cause a sudden and substantial price increase. This ongoing trend strengthens the belief that this pattern might become a lasting feature in the market.

Therefore, whale holdings surged, with exchange net flows up by an astounding 460%. This positions MATIC as the top token in this category among the top 10 digital currencies analyzed

Moreover, experts believe this movement could indicate a change in the market strategy. It may be a clue about upcoming developments or partnerships with Polygon.

However, investors are eagerly waiting for statements from Polygon or related parties. These statements might explain the significant movement of tokens and how it could affect the project’s future.