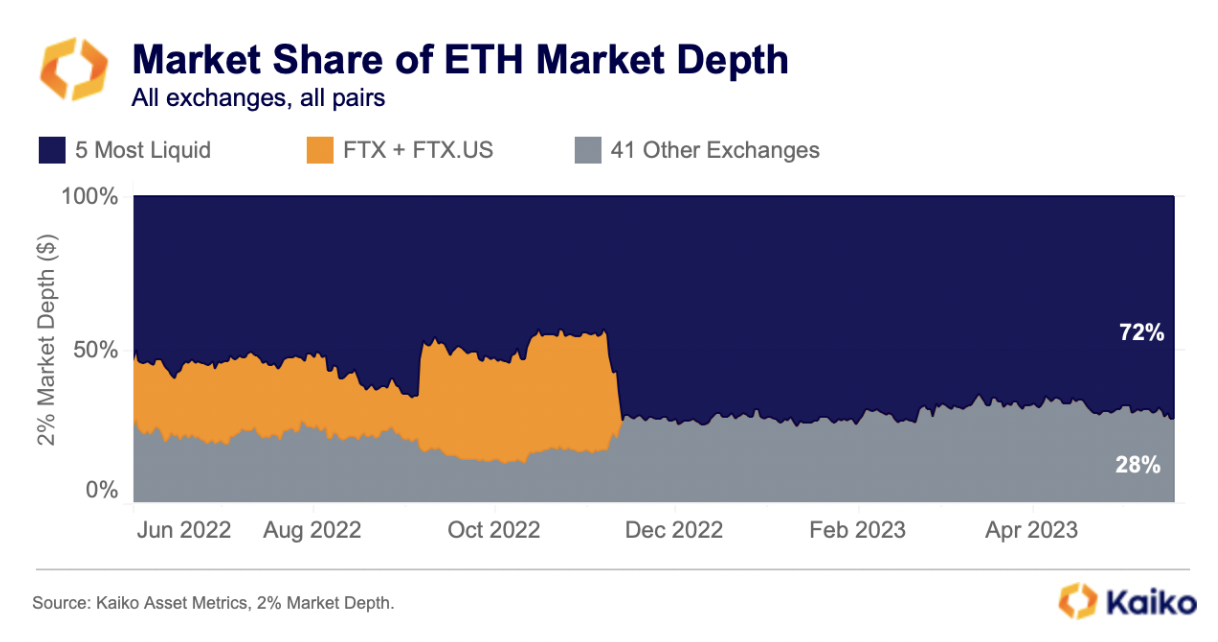

Kaiko, a prominent cryptocurrency data provider, has released its latest research report revealing a significant concentration of liquidity in the Ethereum (ETH) market. According to the report, 72% of Ethereum liquidity is concentrated on just five exchanges. This finding sheds light on the current state of liquidity in the crypto asset space, which has been struggling since the collapse of FTX last year.

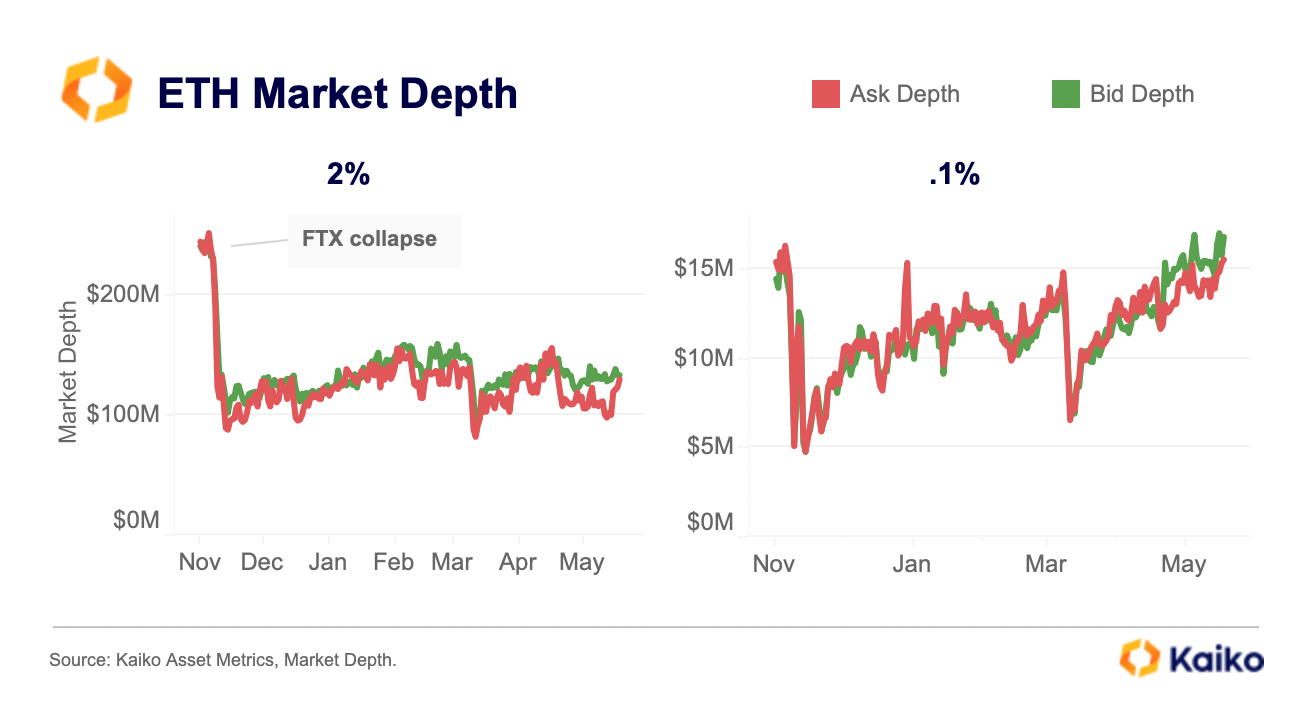

The closure of the Signet and SEN fiat settlement networks in the United States has had a detrimental impact on market makers’ operational efficiency. As a result, the market depth for Ethereum has only reached 2%, failing to recover to pre-FTX levels. However, the 0.1% depth, which measures liquidity immediately around the mid-price, has returned to pre-FTX levels. This suggests that market makers are becoming more comfortable offering liquidity within a tight range.

The report highlights that order book liquidity has become highly concentrated on a few exchanges since the FTX collapse. Specifically, 72% of Ethereum’s market depth exists on just five exchanges: Binance, Bitfinex, OKX, Coinbase, and Kraken. All other exchanges combined account for only 28% of market depth. Prior to the collapse of FTX, the exchange and its U.S. counterpart represented nearly 40% of market depth.

Shift in Liquidity Patterns: Moving Away from the United States

Interestingly, while liquidity is consolidating on a handful of exchanges, it is also shifting away from the United States. The share of market depth on U.S.-available exchanges has decreased to approximately 40%, down from a high of 54% before the collapse of Terra last May. Global exchanges are benefiting from the regulatory crackdown, attracting market makers who want to avoid uncertainty.

Looking ahead, it is expected that liquidity will continue to consolidate on a small number of exchanges for all assets, not just Ethereum. The exchange space is struggling to attract market makers amid the ongoing bear market, leading to further concentration.

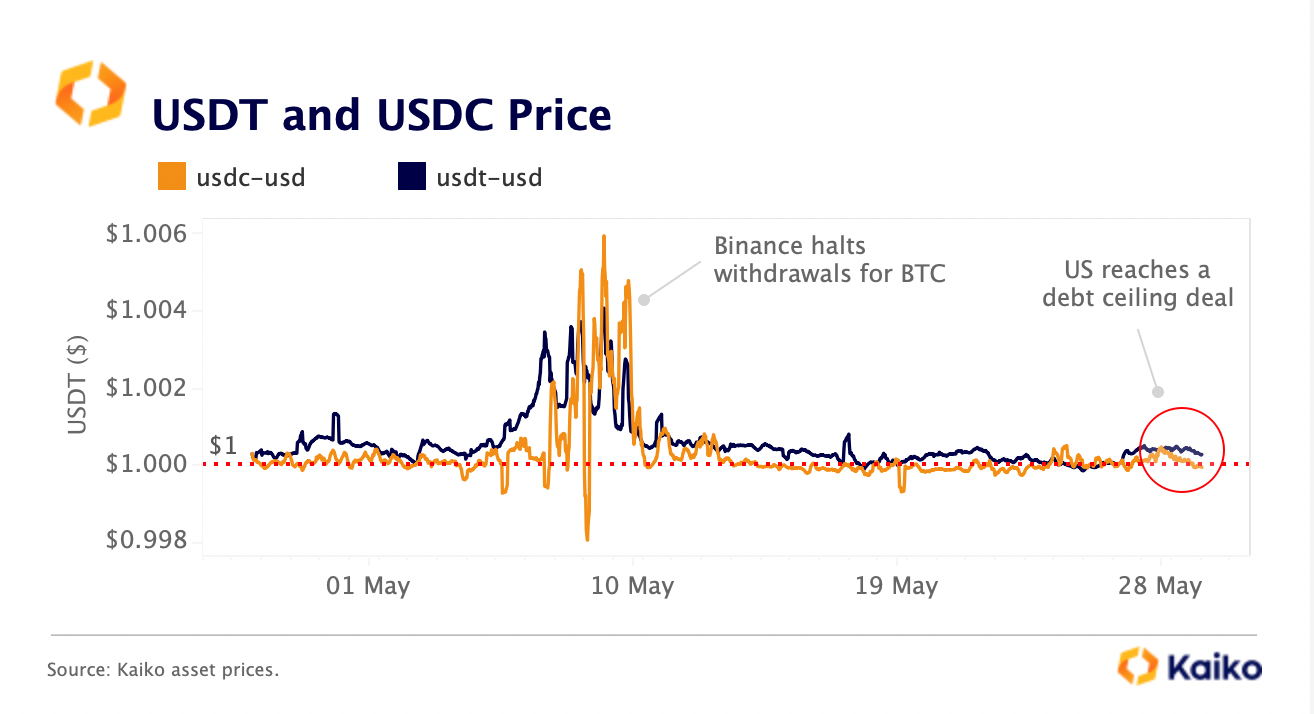

In other news, stablecoins have shown little volatility despite the ongoing debt ceiling drama in the United States. The two largest stablecoins, USDT and USDC, traded at a slight premium during the week as the resolution of the debt ceiling issue approached. This indicates that the markets did not anticipate a U.S. default. The stability of stablecoins mirrored the muted reaction in equity markets. The Nasdaq experienced an 8% increase this month, driven by the booming AI-related stocks.

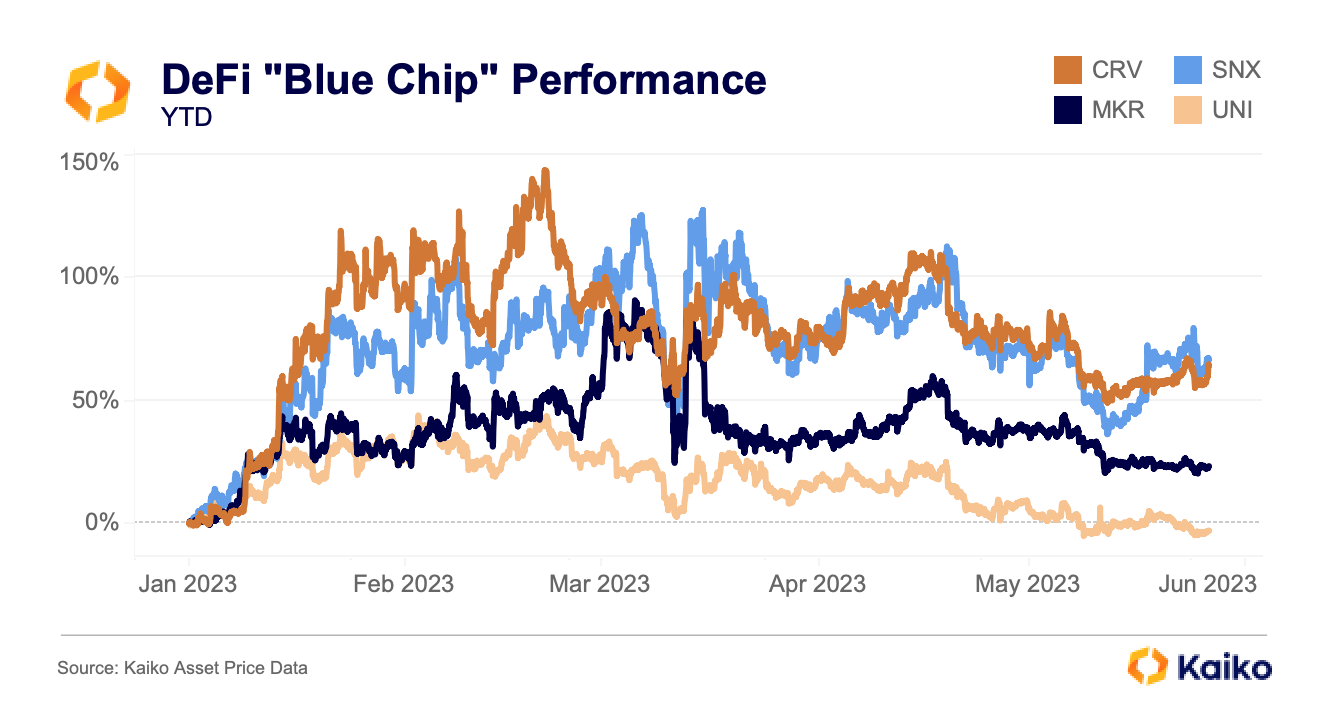

Among the decentralized finance (DeFi) sector, Curve DAO (CRV) and Synthetix Network (SNX) have emerged as the top performers. CRV benefited from the release of crvUSD, a new stablecoin utilizing a novel collateral and liquidation method. SNX saw a rally due to new trading incentives on Optimism, propelling its derivatives trading exchange Kwenta to become one of the largest decentralized derivatives exchanges by volume. Meanwhile, Uniswap’s token UNI remained flat despite expanding to new chains.

The liquidity of MakerDAO’s native token MKR experienced a decline following a significant transfer to Binance. This transfer, often seen as preceding transactions, suggests a possible sell-off. The market depth for MKR on Binance dropped, and liquidity for the MKR-USDT pair remained low throughout the week. Liquidity providers remain cautious due to perceived risks in MakerDAO and its stablecoin DAI.

OKX: A Promising Position for the Reopening of Hong Kong’s Crypto Asset Market

OKX is well positioned for the reopening of Hong Kong’s virtual asset market. The city’s financial regulator, SFC, announced that a new licensing regime for virtual assets will come into effect on June 1st. This news has increased optimism that a portion of China’s substantial household savings could flow into the crypto market. OKX has fared better than Huobi, maintaining a significant market share thanks to its derivatives market.

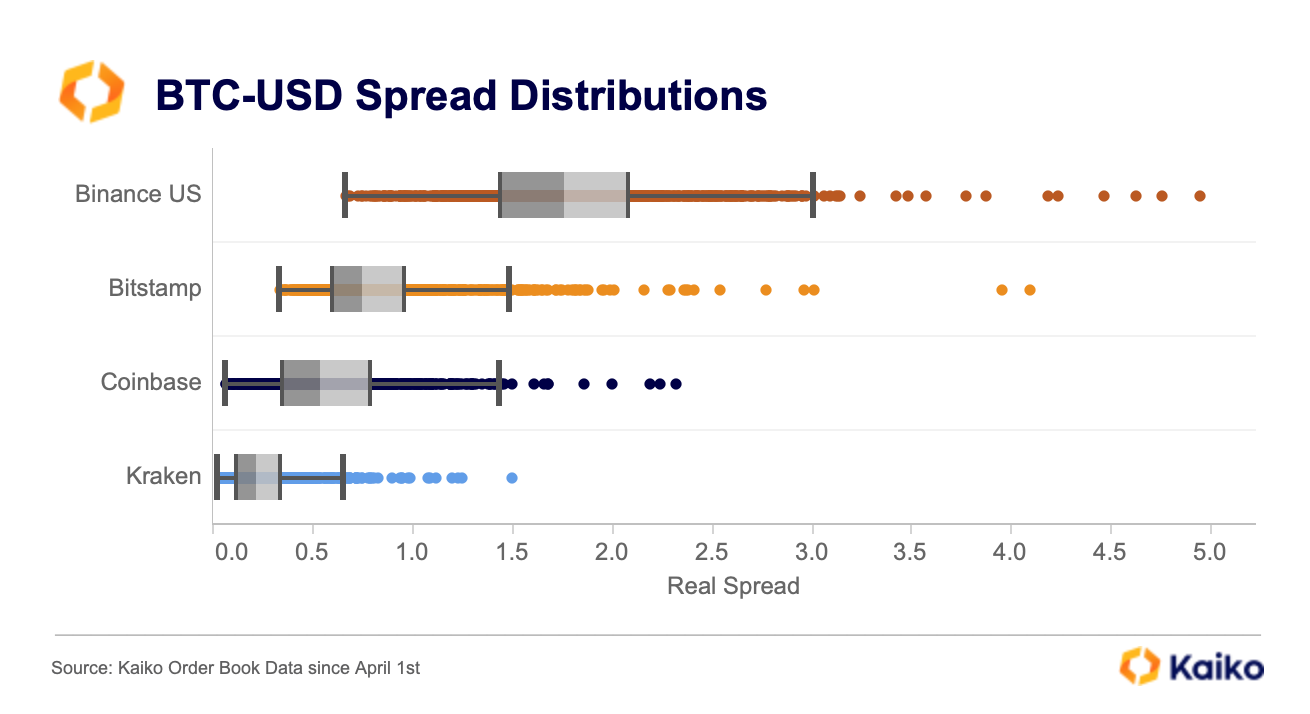

Among the chosen U.S. exchanges, Kraken has the tightest spread range, indicating narrower spreads and fewer outliers. Coinbase has wider spreads than Bitstamp but overall offers narrower spreads and fewer outliers. On the other hand, Binance.US suffers the most from large outliers and has a significantly wider range of spreads, indicating lower liquidity. In the derivatives market, the recent BTC rally can be attributed to bullish bets in perpetual futures. Over $250 million worth of new BTC perpetual futures contracts were opened, indicating a bias towards long positions.

Despite the worsening liquidity outlook, Bitcoin managed to rise above $28,000 as the U.S. avoided a disorderly debt ceiling episode. However, signs of accelerating U.S. inflation, robust corporate earnings, and a tight labor market have increased the likelihood of an 11th consecutive interest rate hike in June. Furthermore, the U.S. Treasury’s plan to replenish its cash balance at the Fed will remove liquidity from the market, amplifying the impact of the ongoing quantitative tightening.

Bitcoin’s correlation with Chinese equities has strengthened this year, suggesting that the regulatory and economic reopening in China is increasingly influencing crypto market sentiment. The correlation between BTC and U.S. equity markets has decreased.

Overall, Kaiko’s latest research report highlights the liquidity concentration in the crypto market, specifically in the Ethereum market. It provides insights into the current state of liquidity, stablecoins, DeFi, asset metrics, derivatives, and the macro environment. It sheds light on the ongoing trends and developments in the crypto space.

Related Reading | Past Week’s Trends In Crypto Market: Kaiko Report