Kaiko Research, a crypto market data provider, has released a new report highlighting the recent trends in the crypto market. One of the key observations is the approaching ATH of Tether’s market cap, despite lackluster trade volume and price movements in the overall market.

Tether’s Rising Market Cap

Tether (USDT) is currently the dominant stablecoin used for trading on CEXs, with over 50% of trades executed using USDT. On decentralized exchanges (DEXs), USDC remains the dominant stablecoin, but USDT still holds a significant market share. However, Tether’s market cap increase cannot be solely attributed to its increased usage on either CEXs or DEXs.

One possible explanation for Tether’s rising market cap is the significant issuance of USDT on the Tron network. Around $46B worth of USDT is issued on Tron, compared to $36B on Ethereum. Offshore exchanges like Binance and OKX, which hold the largest USDT balances on Tron, prefer the network for its low transaction fees.

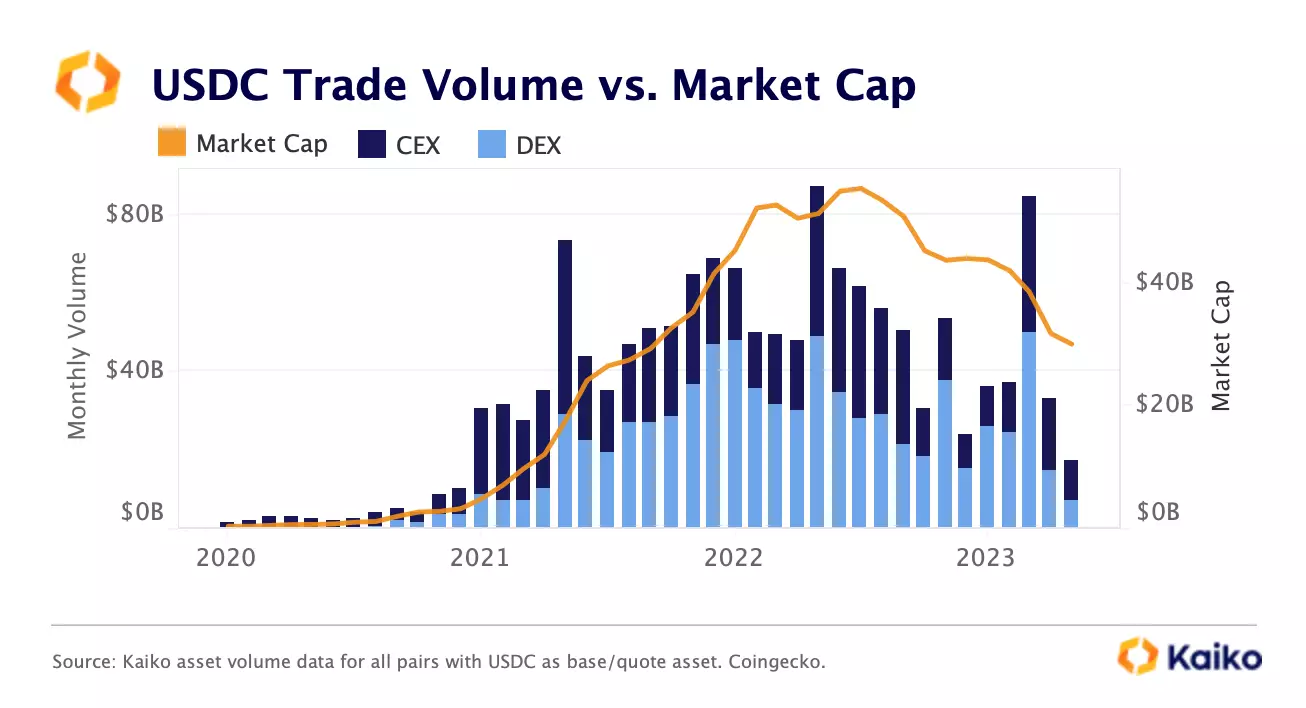

In contrast, the market cap of USDC, another major stablecoin, clearly correlates with its trade volume. As USDC volume grows, its market cap increases accordingly. This correlation is notably absent in the case of Tether, which raises questions about its market dynamics and usage.

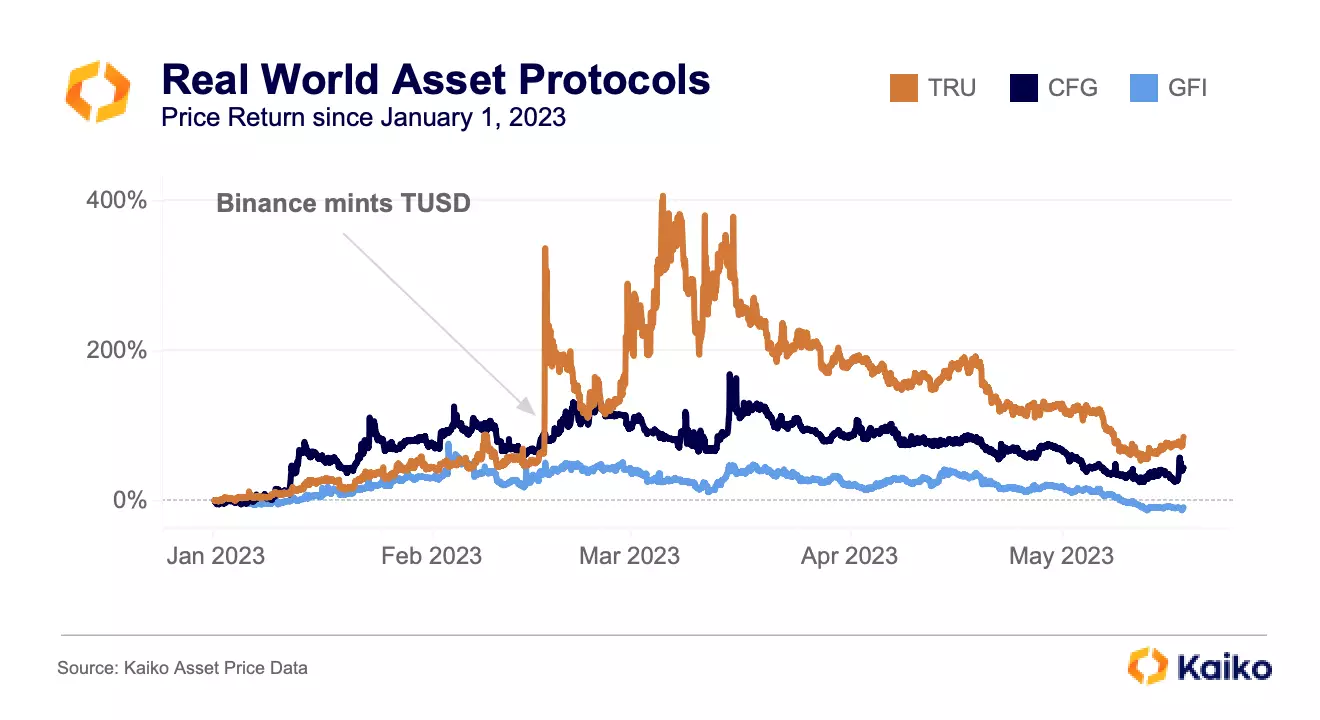

Real-World Asset Protocols & Token Performance

The report also examines the performance of real-world asset (RWA) protocols, which enable users to generate yield by providing loans using stablecoins. These protocols experienced a surge in popularity in March but have since seen their token prices decline. One notable exception is Centrifuge (CFG), which rallied this week and remains one of the best-performing tokens this year.

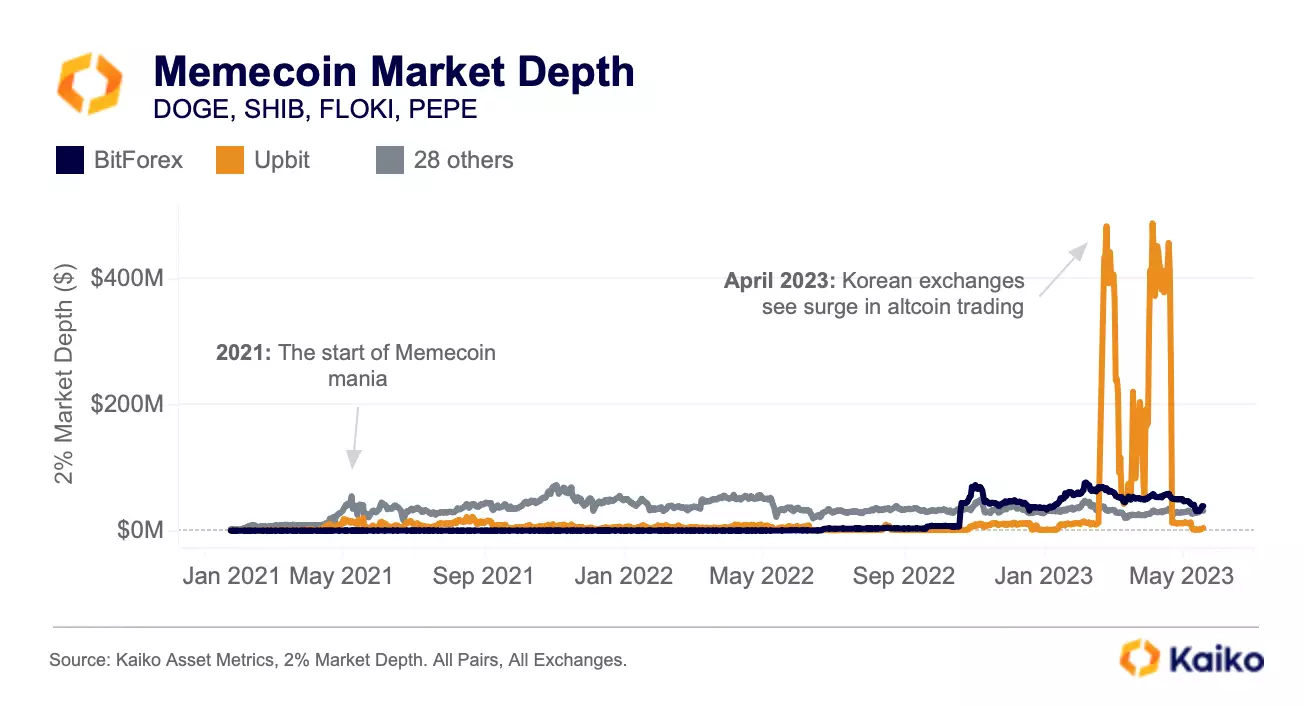

Memecoins, such as the PEPE token based on the Pepe the Frog meme, has seen an unexpected market capitalization surge. Market makers, who provide liquidity for these tokens, have deployed significant capital to support meme-coin order books. Kaiko’s “Asset Metrics” data indicates that around $55M in liquidity has consistently supported meme-coin order books since the meme-coin craze began in April 2021.

The report also discusses liquidity trends in the crypto-currency market. The largest staked ETH (stETH) pool on Curve, a decentralized exchange, has experienced a decrease in liquidity since April 2023. Despite the decline, the stETH-ETH pool remains the largest on Curve, highlighting its importance in the ecosystem.

Crypto Market Share Shifts

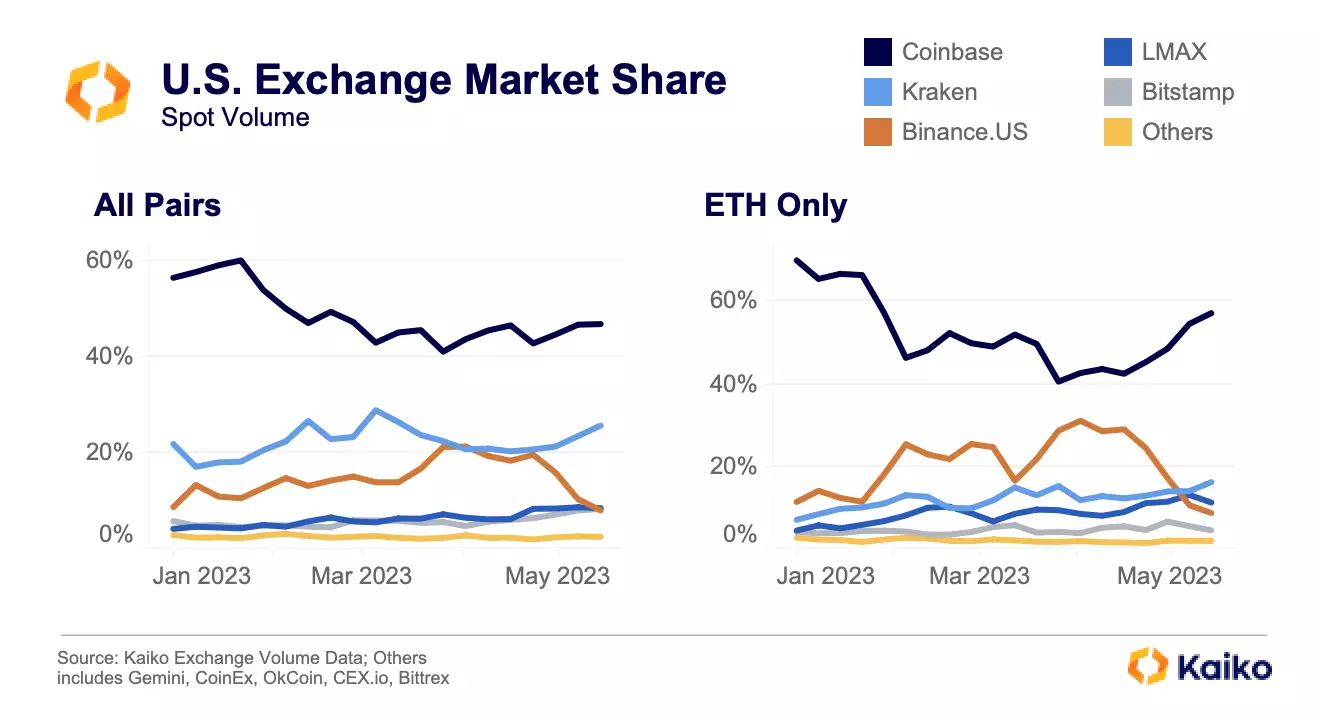

In the U.S. exchange landscape, Binance.US has cut its market share in half since April, with LMAX and Bitstamp gaining ground. This shift may be attributed to regulatory pressure on Binance.US and the reputation of the other exchanges, which institutional traders favor.

Sushiswap, a decentralized exchange forked from Uniswap V2, has struggled to regain market share. Despite operating on multiple blockchains, including Ethereum, it currently holds less than 1% of the market share relative to Uniswap V3. Ineffective product rollouts and a lack of traction have hindered Sushiswap’s growth.

The report also delves into funding rate analysis, which can provide insights into market sentiment. However, the interpretation of funding rates should be nuanced due to variations across exchanges in clamps and dampeners. Different exchanges have different mechanisms for funding rate calculations, leading to varying correlations among them.

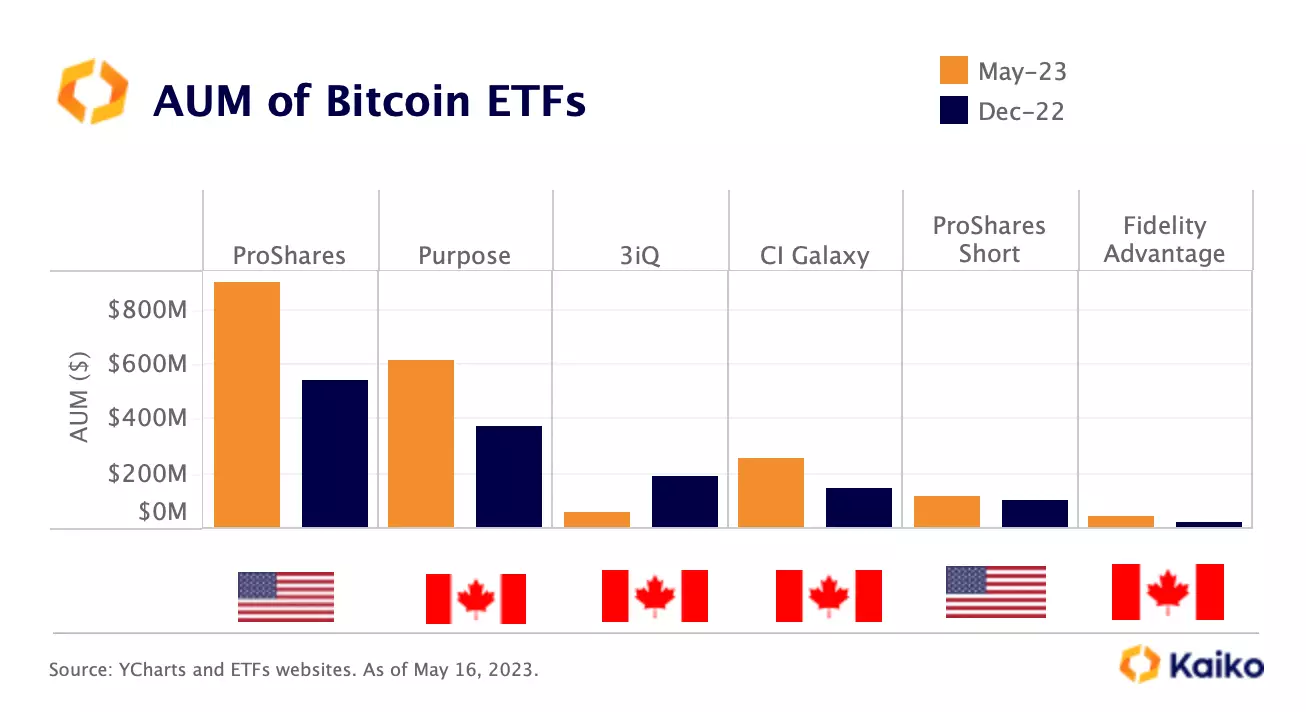

At the end of the report, Kaiko highlights the performance of Bitcoin-linked ETFs. Despite Bitcoin’s price increase this year, the growth in assets under management (AUM) for BTC-linked ETFs has been relatively slower, suggesting limited new capital inflows. Regulatory scrutiny has likely dampened demand for these ETFs, popular among retail investors seeking exposure to BTC.

Nevertheless, Kaiko’s research report sheds light on various trends in the crypto market. Including Tether’s rising market cap, real-world asset protocols’ performance, liquidity dynamics, market share shifts among exchanges, the struggle of Sushiswap, funding rate analysis, and the growth of semiconductor stocks compared to BTC. However, it is to see how market sentiment shifts in the future.