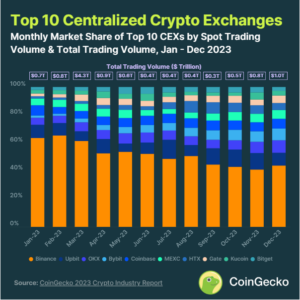

Binance maintained the largest centralized exchange (CEX), with a market share of 43.7%, according to data from CoinGecko. Spot trading volume on Binance soared to $427.1 billion in December 2023, a month-on-month (MoM) hike of 37.5% from the $310.6 billion recorded in November 2023.

The research analyzed data from January 1, 2023, to December 31, 2023. It specifically concentrated on the top ten centralized exchanges by spot trading volume. Apart from Binance, the top candidates included Upbit, OKX, Bybit, Coinbase, MEXC, Gate, HTX, KuCoin, and Bitget.

Analyzing Binance & Its Competitors

Upbit was the second-largest centralized exchange with a 9.3% market share and $90.7 billion trading volume on its spot in December 2023, garnered an increased growth rate of 0.3%, compared to $90.4 billion in November 2023. OKX ended December 2023 as the third largest exchange, with an 8.9% market share and $86.8 billion of trading volume.

As per the report, Binance was ahead of all others, with a 52.6% market share of total spot trading volume in 2023. However, slowly but surely, it lost over its competitors in 2023 and opened at 63.5%, only to finish December at 43.7%. In absolute terms, it generated $3.8 trillion in trading volume in 2023.

Binance had been under regulatory pressure all through 2023, peaking in November when the exchange agreed to pay a $4.3 billion penalty as part of a settlement with the Department of Justice (DoJ) and the Commodity Futures Trading Commission (CTFC) concerning financial breaches. Changpeng Zhao (CZ) also agreed to step down as CEO of the exchange.

With an extraordinary increase in trading volume of 203.7% ($90.4 billion) in the quarter, all top 10 centralized exchanges led by MEXC posted growth in the last quarter of 2023. Bybit achieved a 162.1% volume growth ($107.5 billion), and KuCoin experienced a 161.2% volume increase ($49.2 billion) following the quantum leap accomplished by the exchange.

KuCoin returned in Q4 and reclaimed its position from the Top 10 after losing it in Q3, with a spot above Kraken. The figure was worth a ninth spot with a market share of 3.3% as of December. However, with each platform, such maneuvering of regulatory, market, and customer challenges continues in the dynamic landscape of CEX, which is full of fluctuations to maintain its stand in the crypto backyard.

Related Reading | Floki Responds to Hong Kong SFC Warning on Staking Programs