A Hong Kong-based crypto exchange, Hashkey, witnessed a massive sell-off of over $90 million worth of Ethereum in the last 10 days. The wallet linked to Hashkey sold 50,115 ETH on Binance and OKX exchanges at an average price of $2,047, withdrawing $89.6 million and $12.95 million.

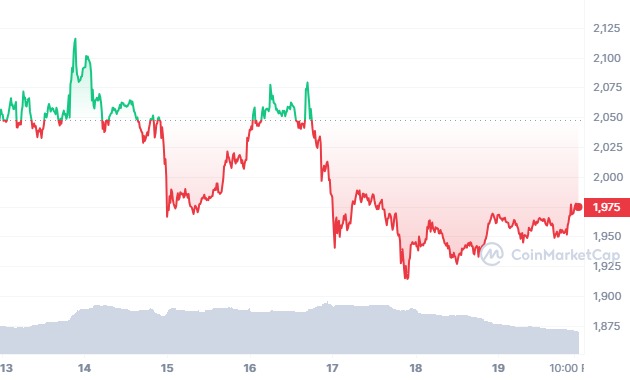

This selling activity led to a 4% dip in ETH over the past week, sparking speculations on its future trajectory. However, the cryptocurrency has shown stability, increasing by 0.92% as it attempts to breach the $2,000 mark again.

As to the blockchain analytics platform’s Sunday post on X, the wallet’s sell-off, conducted by “0xD26e,” might be a precaution against a potential decline, as indicated by the Relative Strength Index leaving the overbought zone. Despite this, the downward trend is expected to be short-lived, given the ongoing Ether spot ETF race in the United States.

A wallet related to #HashKey dumped 50,115 $ETH($97.7M) in the past 10 days.

Wallet"0xD26e" deposited 50,115 $ETH($97.7M) to #Binance and #OKX, then withdrew 89.6M $USDT and 12.95M $USDC.

The average selling price probably is $2,047.https://t.co/qYLUghQetE pic.twitter.com/Nj4LzeytUu

— Lookonchain (@lookonchain) November 19, 2023

Fidelity Investments recently joined the race, submitting its “Fidelity Ethereum Fund” proposal to the SEC, becoming the seventh asset management giant in the competition. Other prominent names such as BlackRock, Hasdhdex, Grayscale, VanEck, 21Shares, and Ark are also vying to launch an Ether Spot ETF.

Ethereum Alert: Possible Precautionary Selling

Anticipation is high for more asset managers to join the race in the coming weeks, fostering positive sentiments toward Ethereum. While SEC approval remains uncertain, the influx of Ether Spot ETF applications signals growing interest in the altcoin from traditional finance investors, influencing cryptocurrency investments.

For instance, after Blackrock’s filing on November 9, ETH experienced a nearly 13% gain, trading above the $2,130 mark due to increased buying pressure. The dynamic landscape of the crypto market continues to evolve, influenced by both selling pressures and traditional finance players entering the Ethereum race.

Related Reading | Bitcoin Whales Surge: Record Holdings Fuel Market Confidence

While writing this news, Ethereum’s value is $1,975.35, reflecting a 0.45% increase in the past 24 hours. The trading volume during this period amounts to a substantial $6,554,589,459 USD.