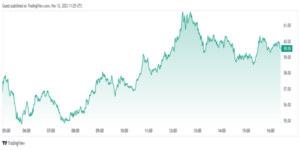

Solana’s price increased by 41% this week, reaching $60 on Sunday. The price surged after breaking past the summer 2022 highs of $47.50 earlier this week. The crypto community’s optimism regarding the approval of Bitcoin and Ethereum spot ETFs is the key factor propelling this positive trend. According to CoinMarketCap, Solana has surged almost 50% in the last 30 days, making it the top performer in the top 20 cryptocurrencies by market capitalization.

At the time of writing, SOL/USD was hovering around $59.5, up around 6.42% on the day.

Solana’s Market Gaining Momentum: Various Indicators Suggest

On-chain metrics indicate a surge in activity on the Solana network. According to data from The Block, the number of active addresses on the Solana network has been consistently increasing in recent weeks. After falling below 200,000 in September, it has now stabilized at an average of 270,000 over the past seven days. Meanwhile, DeFi Llama reported that the total dollar-denominated value of crypto locked in smart contracts on the Solana network, also known as Solana’s TVL, has exceeded $2.1 billion.

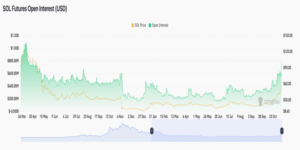

Elsewhere, various indicators suggested that institutional/more sophisticated investors are taking interest, indicating that the market is heating up. According to Coinglass, the Open Interest funding rate for opening leveraged futures positions has turned significantly positive, reaching its highest level since at least May.

Solana’s futures open interest hit a notable level of approximately $772 million on November 11. This is the highest it’s been since November 2021, when Solana reached its record-high price of $260. High open interest levels indicate greater interest and possibly greater liquidity in the market.

Meanwhile, SOL’s rising OI aligns with rising funding rates – a fee paid by one side of the perpetual contracts to the other every 8 hours. A positive funding rate indicates that longs (buyers) are dominant in the market. The SOL’s funding rate rose to 0.035% per eight hours earlier this week.

Solana Price Prediction

Institutional inflows have assisted the Solana market in overcoming daily sales of 250,000-700,000 SOL tokens from FTX over the past two weeks, a popular trader @Bluntz_Capital on Twitter highlighted earlier this week.

He added:

“So far (these tokens have) been getting absorbed like a champ and at current rate their (FTX’s) unlocked tokens should be depleted within a week. Once this seller is gone I can only imagine how hard its gonna pump.”

FTX has been selling between 250k-700k $SOL every day for the last 2 weeks while price has either been going up or sideways.

so far its been getting absorbed like a champ and at current rate their unlocked tokens should be depleted within a week.

once this seller is gone i can… pic.twitter.com/AtnTqz3uxG

— Bluntz (@Bluntz_Capital) November 9, 2023

Since Bluntz’s tweet, Solana has pumped nearly 40%. As the critical resistance at $47.50 is crossed, reaching $75 is only a matter of time.

This suggests that Solana could see further quick increases, potentially around 30%.

Is SOL $100 Incoming?

It looks like the Bulls are clearly in control of Solana.

Assuming spot Bitcoin ETFs receive approval soon, the broader market is anticipated to maintain its rally into 2024. Additionally, if Solana continues to attract significant interest from institutions and on-chain activity keeps recovering, SOL is poised to be a strong performer in the coming quarters.

While the cryptocurrency has risen over 7 times from its 2022 lows near $8, it’s still 77% lower than its 2021 highs around $260. Several factors indicate a positive attitude. Solana’s resilience during market fluctuations and the growing demand for Decentralized Finance (DeFi) and blockchain technology all contribute to a bullish case for Solana. However, it is important to keep an eye on market changes and regulatory developments that may impact the crypto space. Although the current momentum is strong, reaching the $100 mark may not happen before 2024.