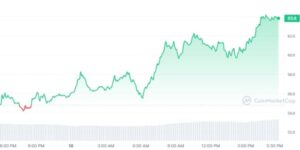

Avalanche (AVAX) has witnessed a significant increase in investor activity. AVAX has surged 15.78% in the last 24 hours and 37.12% in the last seven days. AVAX is also up by 60% in the last 30 days.

AVAX broke above $63 on March 18, 2024, its highest since the TerraUST crash back in May 2022. Derivatives market trends indicate that the rally is mainly driven by organic spot market demand rather than leveraged speculative trading.

Can Avalanche Hit $80 This Weekend?

According to Changelly, AVAX could rally to $73.61 on March 22, 2024. Furthermore, the platform predicts that AVAX will keep rising over the next few weeks, hitting the $90 mark by the end of the month.

CoinCodex also presents an optimistic outlook for AVAX for the next few weeks. The firm anticipates Avalanch to hit $200 by mid-April and $80 by March 24. Hitting $200 would be a new all-time high for the asset, surpassing its previous peak of $144.96 reached in November 2021.

However, Telegaon is quite bearish on AVAX, predicting the asset to reach a maximum price of $81.12 in 2024. The platform expects AVAX to not reach its highest value until 2026, possibly hitting a maximum of $157.34 for the year.

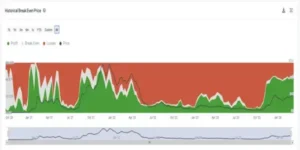

75% of AVAX Holders Are Now Profitable

After the recent rise in its market value, an impressive 75% of AVAX holders, totaling 5.6 million individuals, are now profitable. This represents a significant shift from the stability seen in the last two months when the percentage of profitable AVAX holders stayed between 50% and 60%.

A similar rise to 75% profitable holders was last seen in 2021. After that surge, AVAX’s price increased significantly from $75 to $117 in just 20 days. This historical context shows the significance of the Historical Break Even Price as a metric.

Basically, this metric estimates the average price at which all current holders neither make nor lose money, providing insight into the overall profitability of investing in the cryptocurrency market over time. For AVAX, 23% of holders are still in the red. This could suggest that these holders will continue holding their AVAX, anticipating further price increases to become profitable.

Avalanche RSI Is Close to 70, but It’s Still Healthy

In recent days, AVAX’s 7-day Relative Strength Index (RSI) has dropped from 75 to 69. Despite this decline, its price remarkably jumped from $40 to $61 in just one week.

The RSI is a tool used to measure the velocity and magnitude of directional price movements. It ranges from 0 to 100. A reading above 70 usually means the asset is overbought, possibly overpriced, while below 30 suggests it’s oversold, potentially undervalued.

The drop in the RSI alongside a significant price increase suggests that while AVAX’s buying momentum has slightly decreased, its market price has managed to climb higher. This situation could be due to strong investor confidence. The RSI is close to 69, which means it’s almost in the overbought zone. But it’s still in a healthy range, suggesting that AVAX isn’t significantly overvalued or undervalued.

If Bitcoin (BTC) maintains its bullish trend, other altcoins will follow it. However, if the price of BTC falls to $60,000, AVAX is unlikely to reach $80.