Terraform Labs & Do Kwon found liable for fraud in SEC Lawsuit

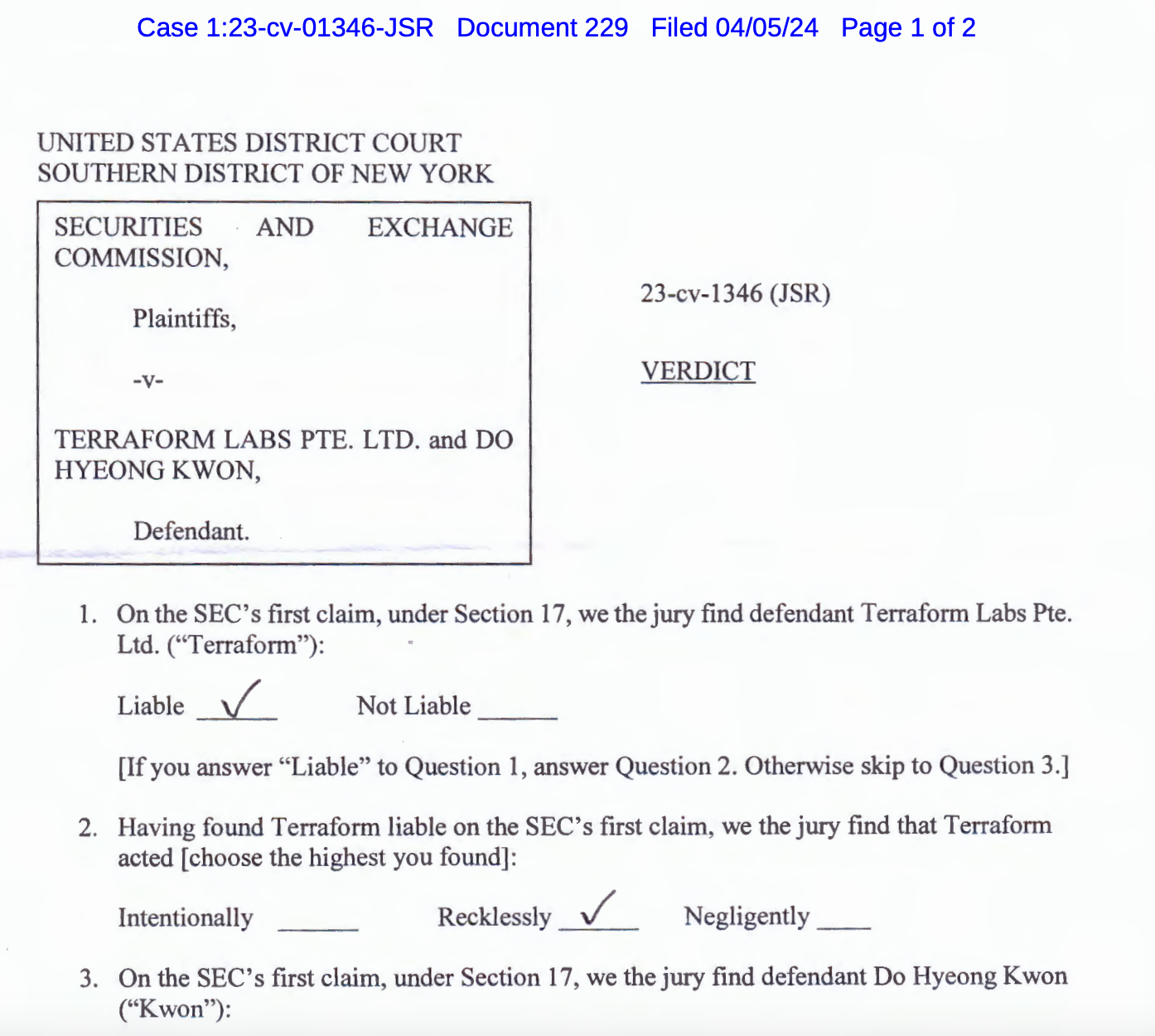

In a significant development in cryptocurrencies, a jury in the United States District Court for the Southern District of New York found Terraform Labs and Do Kwon liable for defrauding investors in crypto asset securities. In an April 5 announcement, SEC Enforcement Director Gurbir Grewal said jurors in the U.S. District Court for the Southern District of New York found Kwon and Terraform liable in the civil enforcement case following a brief deliberation.

Notably, The SEC trial started on March 25. Kwon, who remains in Montenegro, did not attend. Courts are determining whether to grant an extradition request from the U.S. or South Korea.

“We are pleased with today’s jury verdict holding Terraform Labs and Do Kwon liable for a massive crypto fraud,” Gurbir Grewal, SEC Division of Enforcement director, wrote in a statement.

Terraform Labs, ex-CEO Kwon deceived investors on crypto asset security, promoting Terra USD as a stablecoin. In addition, they lied to investors about incorporating Terraform’s blockchain into a popular payment app for processing and settling payments.

Grewal cited Terraform’s lack of registration with the regulator as having “very real consequences” for investors, reiterating calls for compliance. SEC depicted Terraform as fragile, comparing it to a deceitful “house of cards” during the trial.

Terraform Verdict Sparks Negative Reactions

Terraform Labs’ spokesperson expressed disappointment, saying, “We are very disappointed with the verdict, which we believe is not supported by evidence.” “We maintain that the SEC has no legal authority to bring this case. We are carefully weighing our options and next steps.”

A jury in the Southern District Court of California found Kwon and Terraform guilty of six counts, according to a verdict filed on April 5. The jury found the platform acted recklessly, making false statements about TerraUSD (UST), Luna, or wLUNA during sale offers.

Terraform Labs collapsed in May 2022 due to UST’s instability and questioned the credibility of blockchain use cases. The crisis led to a broader slump in crypto markets, with notable firms such as FTX, BlockFi, and Celsius all filing for bankruptcy.

The SEC sued Terra and Kwon in February 2023, alleging they were behind a crypto-based securities fraud worth several billion dollars. This is significant for U.S. cryptocurrency firms. In December, Jed Rakoff, a judge in New York, ruled partly in favour of Terraform and against D.E. Shaw group and Sun Edison Holdings Inc. on the issue of whether unregistered security-based swaps had taken place.

Additionally, it’s still unclear what would happen about Goliath’s extradition. On April 5, the Supreme Court returned his case to a lower court to determine whether he should be extradited to South Korea or the USA. He has criminal charges hanging over him from both countries.

Related Reading | Binance to Fully Restrict Unverified Sub-accounts on Exchange Link Program