Ethereum staking is approaching a significant milestone of 20% of the total supply staked. However, staking inflows have slowed in recent months due to regulatory uncertainties and long waiting times for new validators.

Ethereum’s Shanghai upgrade, which was implemented in April 2023, enabled withdrawals from its PoS network for the first time and increased the demand for staking ETH.

According to a Dune Analytics dashboard by Hildobby, investors have deposited 23.9 million ETH to Ethereum’s staking network, including tokens committed and waiting in a queue. This represents about a fifth of the token’s 120 million supply.

Since the recent Shanghai upgrade, there has been a significant influx of deposits, surpassing withdrawals by approximately 4.5 million ETH. Based on the current market value, this amounts to a staggering $8.4 billion.

Consequently, a backlog of eager validators seeking to join the network has formed, resulting in an extended waiting period of roughly one and a half months.

ETH Staking Flows Recover But Remain Low

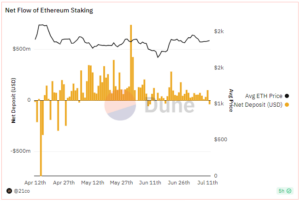

However, the pace of staking inflows declined in June compared to May as investors became more cautious about the regulatory risks associated with centralized staking services.

In early June, according to Wan, a significant turning point occurred in terms of inflows when the Securities and Exchange Commission (SEC) filed lawsuits against major crypto exchanges Binance and Coinbase.

The SEC accused both platforms, which are among the largest ETH staking services, of offering unregistered securities with their staking products.

Following the lawsuits, net flows into ETH staking dropped significantly and even turned negative on some days for the first time since early May, according to a Dune Analytics dashboard by 21Shares. Since then, flows have recovered but at a lower level than in May.

Unstaking Queue Matters More Than Staking Queue

The reduced demand for staking has also helped ease the validator queue, which is the amount of time it takes for new validators to become active on the network. The waiting time has decreased to 36 days from a peak of almost 46 days in early June.

Irina Timchenko, Ethereum blockchain manager at staking service Everstake, tweeted that increasing the limit of new validators entering the network per day also helped Ethereum clear the backlog, reducing the queue by five days.

As #Ethereum has just passed a milestone of 655 360 active validators, 10 validator activations/exits per epoch (or 2 250 validators daily) has been unlocked!

This is very promising: just take a look how activation queue has decreased from 42 days to 37 in the blink of an eye🚀 pic.twitter.com/t4WperHkoq

— Irina | Everstake (@irina_everstake) July 9, 2023

According to John Omakase Lo, managing partner of the investment firm Recharge Capital, the prolonged waiting time has a negative impact on investors, diminishing their interest in staking and leading to a decrease in investment flows.

Related Reading | Ripple vs. SEC: Policy Alignment, Precedent, and the Fate of XRP

However, Katie Talati, head of research at digital asset investment firm Arca, said that investors were more concerned with the unstaking queue, or how long it takes to remove money from ETH staking.