The bankrupt crypto lender Celsius Network announced on Jan. 5 that it plans to unstake existing Ethereum (ETH) holdings as part of its efforts to distribute assets to creditors. According to the firm, the “significant” unstaking event will occur in the next few days.

Celsius wrote:

“Celsius will unstake existing ETH holdings, which have provided valuable staking rewards income to the estate, to offset certain costs incurred throughout the restructuring process.”

The significant unstaking activity in the next few days will unlock ETH to ensure timely distributions to creditors

— Celsius (@CelsiusNetwork) January 4, 2024

Celsius faced a liquidity crisis due to the downturn in the crypto market in July 2022, leading to a freeze on withdrawals. As a result, the company filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the Southern District of New York.

Since then, it has been working towards a settlement plan that enables eligible users to withdraw 72.5% of their cryptocurrency holdings until February 28. According to a court filing from last September, approximately 58,300 users held a total of $210 million in what the court classified as “custody assets.” Meanwhile, the founder and former CEO of Celsius, Alex Mashinsky, who was arrested for fraud charges and is currently out on bail, is facing his jury trial on Sep. 17.

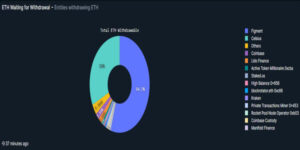

Nansen, a blockchain analytics firm, reports that almost a third of the Ethereum in the pending withdrawal queue currently belongs to Celsius. This is a whopping 206,300 ETH valued at about $468.5 million at current market prices. It also reported that 19,906 validators were waiting for a complete exit and that the firm has already withdrawn 40,249 ETH to date.

Some express concerns about a potential “dump” of Ether on the market, fearing adverse effects on its price. However, contrasting opinions stress the positive long-term consequences, expecting relief for Ethereum as Celsius navigates its restructuring journey.

Celsius Shifts Focus To Crypto Mining

In the previous month, Judge Martin Glenn authorized Celsius to move forward with a second alternative previously approved by Celsius’ creditors, which involves establishing a public company exclusively focused on Bitcoin (BTC) mining. Under the new arrangement, creditors will receive a part of their recovery through shares in the forthcoming Bitcoin mining company.