Despite the industry’s ongoing “Crypto Winter,” institutional investors have increased their allocations to cryptocurrencies, according to a survey conducted by the well-known cryptocurrency trading platform Coinbase.

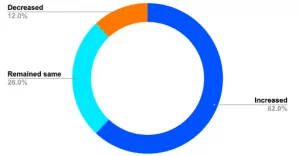

In the past 12 months, 62% of institutional investors in the cryptocurrency market have raised their exposure to digital currencies. Only 12% of respondents said they have cut back on their cryptocurrency spending. It demonstrates that despite the present market circumstances, there is still significant interest in Bitcoin (BTC) and other digital currencies.

Additionally, it is important to remember that the Institutional Investor Custom Research Lab study included decision-makers from U.S. institutions. These investors are currently in charge of $2.6 trillion of assets.

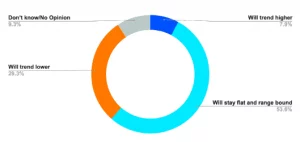

Investor Custom Research Lab questioned respondents on the future of the cryptocurrency sector and their plans for the upcoming three years. 36% of investors indicated they would keep investing in digital assets at the same level as they are present.

While 58% of investors said, they would raise their allocation. At the same time, just 6% of respondents said that they intended to reduce their allocation to cryptocurrencies.

The fact that Bitcoin has dropped from $69,000 to under $16,000 since November 2021 should be considered. It demonstrates that there has been a significant bear market that has driven the price of most digital currencies lower and harmed the cryptocurrency market as a whole. There have already been some business failures, and there may be many more.

Coinbase survey Says Cryptos Are Staying Here

However, the Coinbase survey demonstrates that attitudes regarding digital assets have remained positive. Virtual currencies, according to 72% of respondents, are here to stay.

Cryptocurrencies are overwhelmingly accepted when taking into account both those who now invest in them and those who want to do so (86% and 64%, respectively).

Despite ongoing positive confidence, the crypto winter has lessened the chances of a rise in price in the near future. Regarding price fluctuations, 54% of investors anticipate that prices will remain range-bound in the future year, while 29% anticipate a fall.

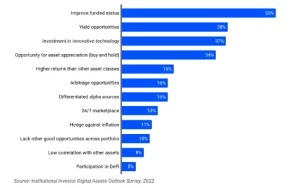

The results of the poll also demonstrate that investors are planting seeds for the future. They were questioned on specific acts they had taken or intended to take in connection with their cryptocurrency investments. The top responses were to obtain market data (36%), followed by research and insights (44%).

Although some investors categorize digital money as either a commodity or an asset, many investors are coming up with their own classifications. The possibility of a long-term opportunity is also demonstrated by this.

56% of investors picked U.S. corporate bonds out of all asset classes for the best returns during the upcoming three years. The property came in third at 35%, closely followed by digital assets at 35%.

It is obvious that regulation is necessary when examining the bitcoin market from the standpoint of an investor. 47% of investors believe that recent crises, such as the failure of Terra Luna and 3AC, should serve as a wake-up call to legislators to improve equity and enact rules that can help prevent future losses.

Moreover, a third (36%) believe that these incidents are sufficient evidence that businesses need improved risk management plans, especially when navigating unpredictable markets.