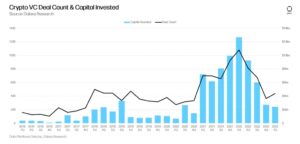

The turbulent year of 2022 for cryptocurrency has given way to optimism due to the current state of the VC industry. Despite lower overall funding, crypto startups showed high demand for pre-seed VC deals in the last quarter.

Crypto deal activity surged in Q1 of 2023, with 439 deals, up 20% from 366 deals in the previous quarter, according to Galaxy Digital. The pre-seed deal activity more than doubled compared to the previous period, primarily driving this rise.

Even with more agreements in the blockchain and cryptocurrency sectors, there was no matching rise in the capital. First quarter 2023 venture capital investments at $2.4B, lowest since Q4 2020.

Galaxy’s firmware research head, Alex Thorn, reports Q1 2023 crypto and blockchain startup funding was less than half of two quarters prior. Companies operating in the Web3, NFTs, DAOs, metaverse, and gaming subsectors recorded the most deals.

Trading, exchange, investing, and lending companies received $538M in venture funding, the highest amount among industries. Startups that operate through wallets came in second place with a total of $519 million.

US-based firms secured most venture deals, while France recently topped the list for capital raises. Newer companies established in either 2021 or 2022 obtained most of these deals. Thorn expects major industry expansion in 2023 if current VC activity levels are maintained.

Positive Outlook For The Future Of Crypto Venture Capital

Venture activity has declined from record levels in 2021 and 2022, but the cryptocurrency venture capital sector is still active. This contrasts with the previous market downturn, known as the “crypto winter.”

High activity in the sector continues despite rising interest rates that have not deterred investors. They project that 2023 will surpass 2018, the peak year for crypto venture capital before the previous market surge, assuming an improbable continuation of the current investment rate.

As said by Mirva Anttila, the director of digital assets research at WisdomTree, the cryptocurrency industry is moving in a favorable direction. She expects a fourth bullish trend in the crypto market, but uncertainty remains, according to her recent note.

Improved blockchain speed, scalability, user-friendly interfaces, wallets, and digital identity innovations are expected to drive the next bull market. These advancements will also pave the way for the development of Web3 applications.

Related Reading | U.K Crypto Firms Struggle With Banking Services, Bloomberg Reports

Venture capital is now enjoying a welcome break from a bear market in cryptocurrency. While Bitcoin has climbed by over 80% this year, Ethereum has increased by 60%. As stated by some experts, the recent bank failures may influence the Federal Reserve to scale down its hawkish monetary policy.