Bankrupt crypto exchange FTX and its debtors have requested the US bankruptcy court of Delaware to approve the sale of some trust assets, including funds from Bitwise and Grayscale, with an estimated value of $744 million. The proposed sale would be facilitated through an investment adviser, per a court document submitted on November 3.

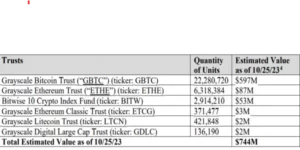

These trust assets are held in five Grayscale trusts valued at $691 million and one Bitwise trust valued at $53 million. These offer investors exposure to crypto assets without direct ownership.

The primary purpose of selling these “trust assets” is to facilitate the estates’ preparations for the upcoming distribution to the creditors and to give FTX the flexibility to sell these assets quickly when the right opportunity arises. The court filing mentioned that combining the sales into one process will cut costs and make the sale procedure smoother, eliminating the need for separate motions for each proposed sale.

The court filing also read:

“The Debtors’ proposed sale(s) or transfer(s) of the Trust Assets will help allow the estates to prepare for forthcoming dollarized distributions to creditors and allow the Debtors to act quickly to sell the Trust Assets at the opportune time.”

Moreover, the troubled crypto exchange explained that selling these assets was necessary to safeguard against potential drops in the value of the Trust Assets and to maximize the worth of the Debtors’ estates. Apart from involving an investment adviser in the sale process, the debtors put forth a proposal to establish a pricing committee with representation from all stakeholders. The investment adviser would receive at least two bids from different parties before concluding any asset sale.

FTX’s Bankman-Fried Could Face A Lengthy Prison Sentence

Last week, a jury in New York found FTX founder Sam Bankman-Fried guilty of all seven counts in his criminal trial. Judge Lewis Kaplan will sentence Bankman-Fried on March 28, 2024. Legal experts anticipate a possible prison term of 15-20 years, even though the maximum could be up to 115 years.

In addition, FTX co-founder Gary Wang, Alameda Research CEO Carolyn Ellison, and FTX Engineering chief Nishad Singh may receive minimal or no prison time for their involvement. All three pleaded guilty to participating in fraudulent activities under Bankman-Fried’s direction, including the transfer of billions of dollars in FTX customer funds to Alameda, a hedge fund majority-owned by Bankman-Fried. However, they may face some consequences. The authorities can demand the return of illegally obtained funds and order compensation for the victims.