Coinbase, one of the leading cryptocurrency exchanges, and its CEO, Brian Armstrong, face a new legal challenge. A new class-action lawsuit alleges that investors were misled into purchasing securities and that the company’s business model violates state laws.

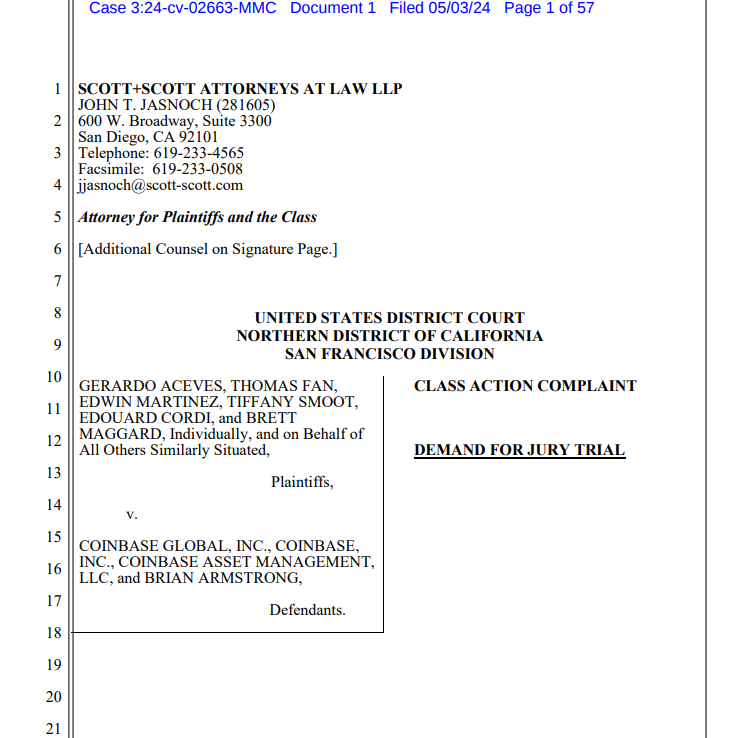

The lawsuit, filed in the United States District Court for the Northern District of California San Francisco Division, represents plaintiffs Gerardo Aceves, Thomas Fan, Edwin Martinez, Tiffany Smoot, Edouard Cordi, and Brett Maggard from California and Florida. The plaintiffs argue that Coinbase’s digital asset sales have knowingly violated state securities laws since its inception.

According to complainants, digital asset sales have been against their knowledge of state security acts since they started operating. The case mainly focuses on tokens alleging themselves as securities, such as Solana, Polygon, Near Protocol, Decentraland Algorand, Uniswap, Tezos and Stellar Lumens.

The complainants claim Coinbase admitted it is a “Securities Broker” in its user agreement, making digital asset securities sold by the exchange investment contracts or other securities. They also claim that Coinbase Prime brokerage is a securities broker.

The plaintiffs seek complete rescission, statutory damages under state law, and injunctive relief through a trial by jury. This lawsuit resembles another class-action suit alleging consumer harm from Coinbase’s sale of securities. Secondary crypto asset sales didn’t meet securities transaction criteria according to Coinbase, which disputed the relevance of securities regulations.”

Legal Challenges for Coinbase

This new lawsuit is separate from Coinbase’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC), which also addresses the classification of tokens sold on the platform as securities. Coinbase recently filed an interlocutory appeal in response to a judge’s decision allowing the SEC case to proceed.

In a filing on April 26 in the U.S. District Court for the Southern District of New York, John Deaton, a crypto lawyer currently running an election campaign to unseat Senator Elizabeth Warren, filed an amicus brief in support of a motion for interlocutory appeal on behalf of 4,701 Coinbase customers.

Despite legal challenges, Coinbase reported a strong rebound in the first quarter of 2024, buoyed by improved market performance and the launch of spot Bitcoin exchange-traded funds. The exchange posted $1.6 billion in total revenue and $1.2 billion in net income for the first quarter, achieving $1 billion in adjusted earnings before interest, taxes, depreciation, and amortization.

Related Reading | U.S. Senate Armed Services Committee Examines Crypto Funding for Adversaries