China initiated a clampdown on cryptocurrencies as early as late 2017, threatening their financial stability and sovereignty. Rumors suggest a potential policy change, but there’s scant indication that China will relax crypto restrictions soon.

Chinese authorities have long been suspicious of decentralized digital currencies such as Bitcoin operating outside state control that they say pose a systemic risk to the financial system by enabling capital flight, money laundering, and other illegal activities.

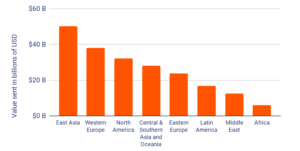

Data from the Chainalysis Blockchain platform shows that between 2019 and 2020, over $50 billion in digital currencies left East Asian accounts. These accounts were situated outside the East Asian region. Chainalysis staff estimate that a significant portion of the net outflow of digital currencies represents capital flight from China.

This is attributed to China’s substantial presence in East Asian cryptocurrency exchanges. China has strict capital controls to limit the amount of foreign currency residents buy or sell yearly. However, digital currencies can avoid this ban, making transferring wealth abroad easier and more anonymous.

Transforming Crypto Taxation in China

In addition to banning digital asset transactions and mining, China has also assumed control over how taxes are imposed on cryptocurrency engagements. The Shanghai Municipal Tax Service released an article in early January 2024 detailing the application of personal income tax to digital currency transactions in China. The publication is available on its official website.

A post by the Shanghai Municipal Tax Service, later deleted by censors, fueled speculation that China was preparing to ease its crypto ban. The piece wasn’t an official policy document and didn’t signal how China’s’ stance on digital currencies stays the same.

Beijing-based lawyer Guo Zhihao emphasizes that individuals must pay income tax on earnings from obtaining virtual currencies through online transactions. This includes selling them at a higher price. Although China has denied legal tenderness for digital currency, it is yet outlawing its attribution as property or a commodity.

Unique Perspectives on China’s Web3 Future

A common misconception is that China will relax crypto restrictions due to interest in Web3. China’s potential interest in Web3 suggests a shift toward blockchain and decentralized applications. However, China’s idea of Web3 differs from most of the world’s visions.

China’s vision here is the development of a Web3 ecosystem in Chinese characteristics, i.e., under the supervision and guidance of the state. In late December 2023, China’s Ministry of Science and Technology unveiled plans to release a Web3 strategy document. The document will focus on innovation, security, and government obligations in the evolving digital landscape.

China wants to use Web3 to enhance its energy, trade, and law industries but does not want to empower non-state financial system actors. In 2024, China’s crypto stance holds, prioritizing risk control over free flow.

China’s crypto policies reflect a broader trend of increasing state intervention across various domains, including the economy and society. This is evident in initiatives such as the “common prosperity” campaign. More challenges and uncertainties are just around the corner for China’s’ crypto investors.

Related Reading | Solana Breakout: $150-$165 Price Surge Predicted