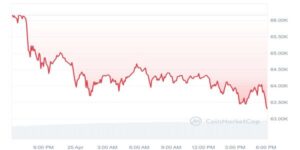

On April 25, the price of Bitcoin (BTC) fell below $64,000, triggering widespread liquidations of long positions across the crypto market. The price drop is attributed to several factors, including the arrest of Samourai Wallet founders, escalating geopolitical tensions in the Middle East, and post-halving volatility. As of writing, Bitcoin is trading at $63,306, down 4.26% in the last 24 hours.

According to data from Coinglass, over $243 million worth of leveraged positions have been liquidated on centralized exchanges (CEXs) over the past 24 hours. Over $209 million in longs and $34 million in short positions have been liquidated. This widespread liquidation activity has affected 97,037 traders. Most liquidations happened on Binance and OKX, with $104 million and $92 million, respectively.

Bitcoin saw liquidations totaling $60 million, with $52 million from long positions and $8 million from short positions. The second-largest crypto, Ethereum (ETH), also witnessed a 5.25% downturn over the past day — now trading at $3,100. ETH recorded liquidations amounting to $51 million, comprising $43 million from long positions and $8 million from short positions.

Solana’s SOL fell 9.51% to trade at $143, while Dogecoin (DOGE) dropped over 7.81%. Dogecoin and Solana saw the liquidation of $6 million and $13, respectively, in the past 24 hours. Currently, the entire crypto market cap stands at $2.34 trillion, reflecting a 4.55% decrease over the past 24 hours.

Factors Behind Bitcoin’s Recent Drop to $64K

One of the main reasons behind the market collapse is the ongoing military conflict between Lebanon and Israel. The Israeli military’s recent attacks on 40 sites in Southern Lebanon have heightened geopolitical tensions in the region, making investors more cautious. Consequently, the demand for cryptocurrencies temporarily decreased, contributing to the downward pressure on prices.

The arrest of Keonne Rodriguez and William Hill, co-founders of Samourai Wallet, for charges related to money laundering and operating an unlicensed money-transmitting business is another big reason for the market downturn. The United States Department of Justice (DOJ) alleges that Samourai Wallet facilitated over $2 billion in illegal transactions and made millions in fees. Moreover, the recent Bitcoin halving on April 20 contributed to the market’s current volatility.

In the crypto market chaos, spot Bitcoin ETF traders are also rushing to sell off their holdings for safety. According to data from Farside, Grayscale’s GBTC saw a significant net outflow of $130 million within a single day. Out of the 11 spot BTC ETFs, only FBTC and ARKB experienced inflows of $5.6 million and $4.2 million, respectively. Meanwhile, other funds, including Bitwise’s BITB and BlackRock’s IBIT, recorded zero flows.