BNB eyes new year-to-date highs as BNB Chain DApp activity increases and a new Binance incentive program launches. Launching under BNB Chain as the native token, BNB has since Jan 26 began recovering, with prices gaining 3% to reclaim the $300 level. Weak and without much reason, BNB is seeking a recovery for all weak backed by an increasing network activity in the current recovery.

Binance’s DApp Surge: New Launchpad Product

The value of the BNB token is mostly derived from Binance’s exclusive launchpad offers and services and reduced trading fees. A “dual investment” product recently launched by Binance could add to BNB volumes, which exceeded $998 million over the past 24 hours. One key benchmark to establish the health of a blockchain ecosystem is to compare how well it stacks up against competing chains. According to DappRadar, volumes have only been higher on three days in history.

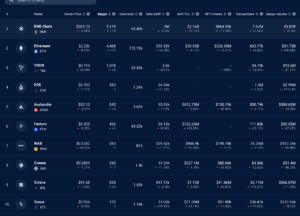

According to the latest analysis, Ethereum and its layer-2 scaling solutions have continued leading DApp volumes and adding another $31.73 billion over the past seven days, with Ethereum’s nonfungible token (NFT) volume settling at $226 million. In contrast, BNB Chain locked up $3.82 billion in DApp volumes but soared its NFT volume by 11% over the same time to $864.93 million.

However, when adjusting for active unique addresses (UAW), BNB Chain tops with 2 million UAWs against 359,380 of Ethereum. From a relative standpoint, the growing volume of transactions and 6.4% growth of addressing numbers engaging DApps in seven days from the BNB Chain could explain the increasing Total Value Locked (TVL).

Data from DefiLlama shows TVL on BSC had been steadily rising since mid-December 2023, when the price started rising to a peak of $3.73 billion on Jan 18. Though this metric had fallen slightly over the last few days, it had begun picking up again as of Jan 25, suggesting increasing user faith in the blockchain.

Does BNB’s Bull Flag Herald Future Trends?

After briefly touching an eight-month high at $340 on Dec 28, 2023, BNB price retraced lower as sellers booked profits and the wider crypto market corrected. Despite the correction, a bull flag can be seen on the daily chart, which hints at the continuation of the uptrend.

Furthermore, BNB bulls meet bearish resistance under the flag’s upper boundary at $316. A break above this level in a daily candlestick close will show an upward signal breakout from the chart pattern to rise to $450. Alternatively, a move higher will mean a 48% increase from the current price.

The 50-day exponential moving average (EMA), the 100-day EMA, the 200-day EMA, and the relative strength index (RSI) were all facing upward, which means that even the market conditions favored the upside at the instance. The price strengthening to 40 from 50 indicated that the bulls are buying on dips.

On the downside, the lower limit of the flag at $282 gives the first line of defense as there is a possibility that the bears could drag the price downwards. Lower support lines could come from the 100-day EMA at $271 and the key support level at $250.

Related Reading | Ripple’s XRP: From Bold Predictions to Trillion-Dollar Impact