Unlocking Solana’s Future: A VanEck Deep Dive into SOL’s Potential by 2030

A recent in-depth analysis conducted by VanEck, a highly regarded asset management group, has shed light on the potential future of Solana, an increasingly prominent blockchain platform celebrated for its innovative scalability solutions.

Our Solana Valuation by 2030: Base, Bear, Bull Case piece dropped in time for @SolanaConf. 🔗https://t.co/5jijxItZip

— VanEck (@vaneck_us) October 27, 2023

VanEck’s analysis provides a forward-looking perspective on SOL’s pricing, the native token of Solana, poised to captivate by 2030. These projections range from a conservative $9.81 to an exciting high of $3,211.28. These deep predictions are based on a foundation of careful consideration. They involve revenue forecasting and market dominance, offering a glimpse of the potential meteoric rise of SOL.

The research’s distinct potential accreditation belongs to the team’s approach, for which it applies bolder innovations coupled with concrete scientific application. The approach has propelled great steps toward Solana’s scalability, separating it from other competitors

Unlike most monolithic-centered blockchain ventures, Solana focuses on maximization, intending to achieve peak efficiency at every step. Such carefulness makes it one of the best systems from the processing point of view among blockchain solutions.

In addition, Solana is unique in that it emphasizes throughput or data flow and not transaction per second TPS. Throughput is a measure of how much data a blockchain can handle at a time in its process, which makes it a better measure of capacity. SOL is currently faster in data throughput than other blockchains, with the Firedancer upgrade to increase its speedier pace.

SOL’s Promising Future: Challenges and Governance

The report highlights how fast Solana handles transactions compared to alternatives such as Ethereum on an average user interface. Solana has some unique features that allow faster transaction processing that, in turn, result in improved user experience by making them faster.

From the report, despite the technical accomplishments of Solana, doubts about its ability to remain sustainable in the long run rise. Low transaction pricing can increase costs and impact Solana’s earnings. To eliminate this issue, either its transaction fee or its storage price on the chain may be the target of Solana.

The second concern arose from the unpredictability of the network which has in the past brought about some downtime. Solana’s experimental consensus mechanism lacks robust formal verification, making network failures unpredictable and harder to prevent. While there have been some strides realized according to that report, unforeseen problems will continue to prevail.

Though such issues arise, the report acknowledges SOL’s chances of utilitarian governance in token voting, improving its economic sustainability. The growth potential is one major factor justifying a lot SOL token allocation in portfolios.

Solana Price Analysis

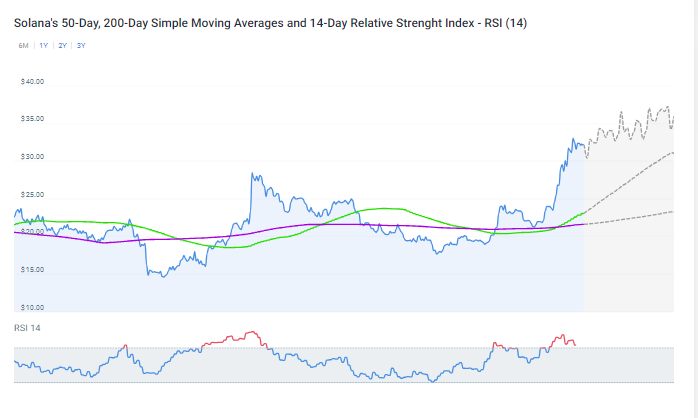

SOL is currently trading at $31.83, boasting a 24-hour trading volume of $1.25 billion. It commands a market capitalization of $13.34 billion and holds a market dominance of 1.05%. Over the last 24 hours, SOL has experienced a slight price decrease, falling by -0.55%.

According to the latest Solana price forecast by Coincodex, the price of Solana will experience a modest increase of 0.84%, reaching $32.45 by November 1, 2023. Technical indicators suggest that the prevailing sentiment in the market is Neutral, while the Fear & Greed Index reports a value of 65 (indicating Greed). Over the past 30 days, Solana has exhibited 18 out of 30 green days, reflecting a 60% price volatility of 15.02%.

Based on the analysis of technical indicators, it is anticipated that Solana’s 200-day Simple Moving Average (SMA) will rise in the upcoming month, reaching $23.32 by November 26, 2023. Simultaneously, the short-term 50-day SMA for Solana is expected to reach $31.11 by the same date.

The RSI value implies that the SOL market is currently in an overbought condition. Consequently, the RSI indicator suggests a potential price increase for SOL in the near future.

Related Reading | Justin Sun’s HTX Reports $98 Million Profit In Q3 Following Layoffs