Uniswap Labs Survey Reveals User Concerns In DeFi Adoption

Uniswap Labs, a DeFi platform, has released the results of a survey that sheds light on what motivates CeFi users to experiment with DeFi. The survey, received 1,860 responses from US retail users, revealed that CeFi users are willing to learn and explore the possibilities of on-chain activity. However, they see complexity, lack of understanding, and costs as barriers to using DeFi.

CeFi users are interested in DeFi–but need more education, clearer UX, and increased support to get started.

Read more about our new survey of CeFi and DeFi users, and share your own experiences below!👇https://t.co/kKXFpYcsYb

— Uniswap Labs 🦄 (@Uniswap) May 17, 2023

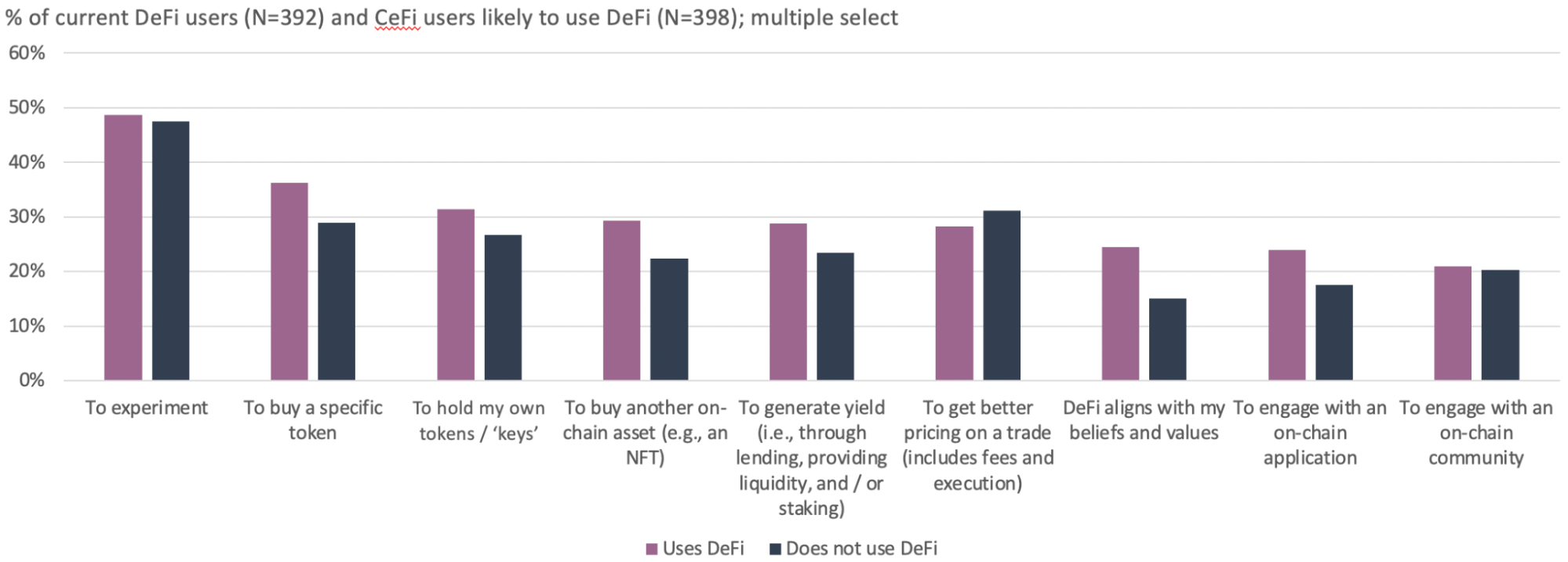

The survey showed that nearly half of the CeFi users were motivated to experiment with DeFi protocols in the next 12 months. Building for this group means focusing on UX and thinking about the first steps as a gateway into the broader crypto ecosystem.

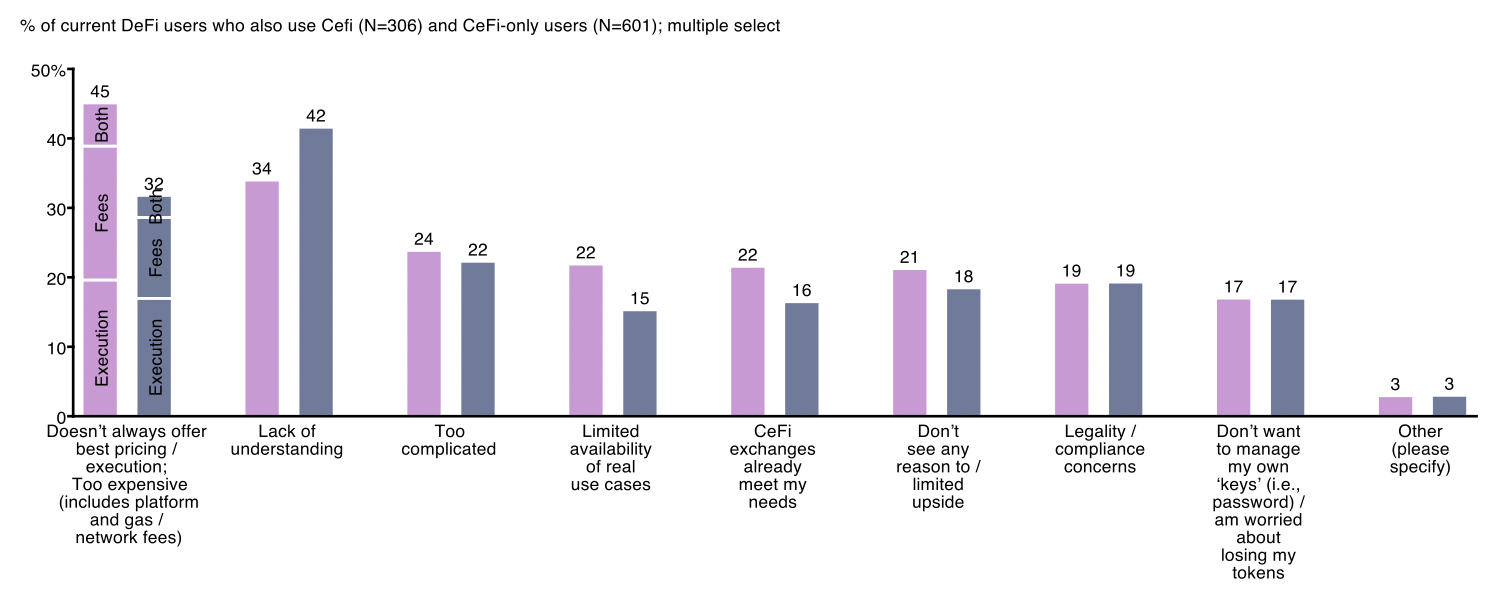

CeFi users see complexity and cost as barriers to entry into DeFi. Products must focus on designing applications that simplify and abstract complexity unique to crypto. Like switching between chains, key management, and reading on-chain data. At Uniswap Labs, they believe in self-custody and transparency and refuse to compromise on those ideals.

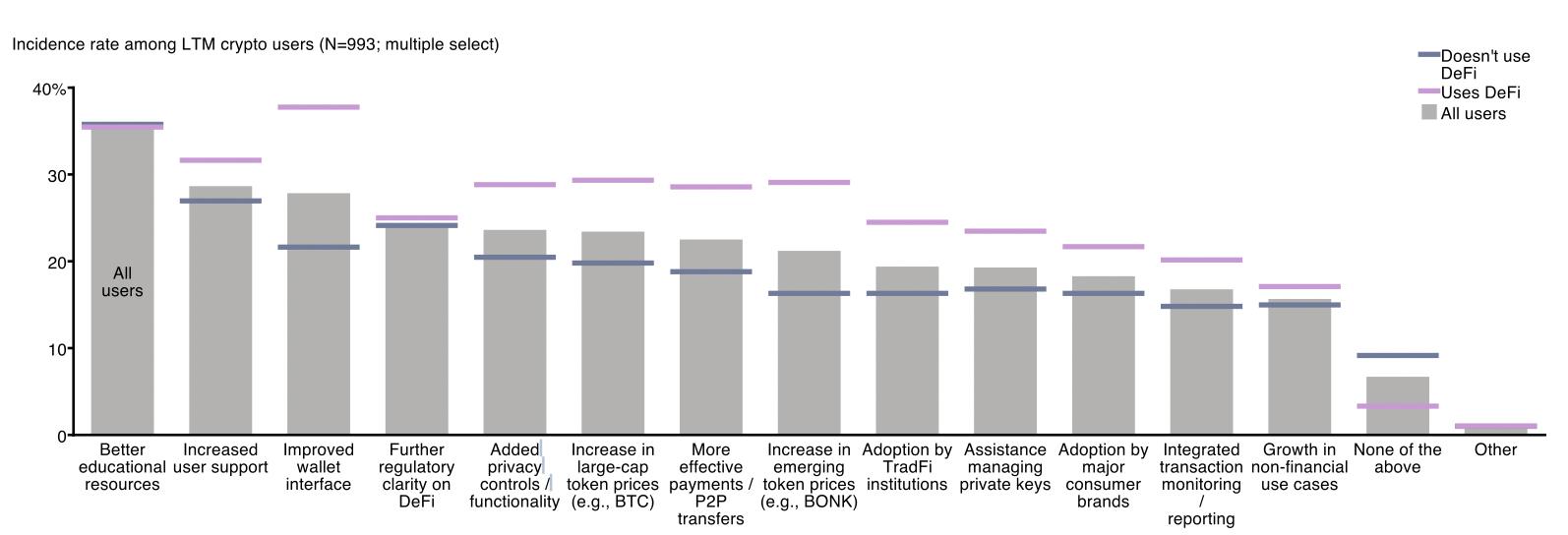

Improved support will boost the comfort with DeFi. CeFi users cited “Better educational resources” and “Increased user support” as improvements that would increase their willingness to trade on DeFi platforms. Uniswap Labs has assembled one of the few customer support teams in crypto. Additionally, the entire industry must work to help educate users about how to use DeFi and the benefits of self-custody.

The survey also showed that transaction fees and costs were notable barriers to entry. As Ethereum continues to scale and L2s see greater adoption, DeFi will become more economically accessible for these price-sensitive users.

Uniswap Labs’ Commitment To Self-Custody & Transparency In DeFi

Uniswap Labs is building useful tools for crypto-native and crypto-curious users, whether using a wallet, purchasing crypto, swapping tokens, or buying NFTs. Surveys like these help them better understand who their customers are and how to build for them in the future. They hope these findings can help other builders in crypto as well.

DeFi is a simpler, more accessible tech stack for financial markets. DeFi is transparent and self-custodial. It runs on publicly verifiable code instead of middlemen prioritizing profits over consumers. However, DeFi is still new to the average person. Bridging to L2s feels like dial-up networking and exploring Etherscan parallels surfing the web before search engines.

Centralized finance (CeFi) platforms often offer content and onboarding that helps beginners feel more comfortable exploring crypto. But these CeFi products still suffer from the same lack of accountability and transparency that plagues the legacy financial system. FTX, Celsius, and Voyager are examples of centralized custodians. They wiped out customer deposits and prompted a major uptick in DeFi usage.

Nevertheless, the Uniswap Labs survey highlights the need for DeFi products to focus on designing applications that simplify and abstract complexity unique to crypto. Improved support and educational resources will also boost the comfort with DeFi. More CeFi users are expressing interest in experimenting with DeFi. Builders in crypto must educate users about the benefits of self-custody and transparency.