NFT Market Soars Amid Wash Trading Concerns

Despite the year-long crypto winter, 2022 witnessed a staggering increase in the new Non-fungible token (NFT) collections across Ethereum, Polygon, and Avalanche. Over 610,000 new NFT contracts were created, reflecting an 860% jump from the previous year.

This massive growth led to the creation of over 85 million new NFTs, with the market sales volume reaching $54 billion. The sudden rise in NFT gaming and sports collectibles primarily fueled this trend.

Yuga Labs, the creators of the wildly popular Bored Ape Yacht Club (BAYC) collection, enjoyed a trading volume exceeding $4.4 billion. However, the market’s explosive growth attracted bad actors, resulting in a significant surge in NFT wash trading activity.

The “BitsCrunch NFT Wash Trade Report for 2022″ by bitsCrunch Research revealed a 25x surge in NFT wash trading, hitting nearly $33B in 2022. Wash trading uses fake transactions, copy-minting, and other methods to artificially boost prices for NFTs or collections.

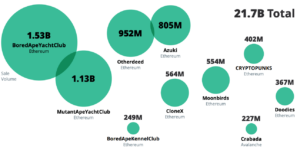

The report shows 59% of 2022’s $54B NFT volume on Ethereum as wash trades. Removing them reveals top collections like BAYC, Mutant Ape Yacht Club, Otherdeed, and Azuki, totaling $21.7B in market activity.

Wash Traders Skew Top NFT Collections And Platforms

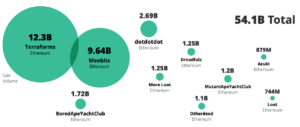

Including wash trading presents a vastly different picture of the 2022 NFT market. Total sales surpass $54 billion, bringing collections such as Terraforms, Meebits, and Dotdotdot to the forefront. Wash traders showed a clear preference for specific collections.

LooksRare, the top NFT marketplace among the five leading platforms, emerged as the wash traders’ hub, with $26.2 billion (96%) of its $27.3 billion total sales suspected to be wash trades.

The loyalty token offered by LooksRare, based on NFT trade volume, is cited as the primary cause. Meanwhile, out of OpenSea’s $18.7 billion in total sales volume, only $1 billion is estimated to be wash trade.

“Sharks,” NFT traders with over $1 million in wash trades, flocked to LooksRare. The report highlights two sharks responsible for 18% of total wash trading activity on the platform, totaling almost $5 billion.

In 2022, there were 613,000 new NFT collections. Interestingly, only 10,000 of them, or 1.6%, achieved notable success. Given the highly competitive environment, thorough research and analysis are essential before investing in NFT collections.

Related Reading | BitGet Joins Lithuanian Cryptocurrency Market with Registration Approval

While annual reports offer insights into the NFT market. However, users need dependable tools. These tools should detect and flag fraudulent activities. BitsCrunch is collaborating with industry stakeholders to establish a sustainable ecosystem and restore confidence in the thriving NFT market.