Blockchain-Backed Loans Hit $582M, Doubling Yearly Figures

Blockchain-based lending is rising, showing a significant uptick, with the value of active tokenized private credit reaching $582 million. This marks a whopping 128% increase from the figures recorded just a year ago, according to data from real-world asset loan tracker RWA.xyz.

Despite falling from the $1.5B peak in June 2022, the resurgence reflects growing interest in blockchain alternatives for finance. The trend is especially notable amid the recent uptick in interest rates. The average percentage rate for blockchain credit protocols is currently 9.64%. This surpasses the average personal loan interest rate of 11.5%, according to a NerdWallet article from December 1st.

Digging into the specifics, RWA.xyz has meticulously tracked $4.5 billion in blockchain-based loans across 1,804 deals. This averages about $2.5 million per loan, reflecting a robust utilization of blockchain lending.

Prominent players include UK-based asset management firm Fasanara Capital, which received a $38.3 million loan from Clearpool at an APR of less than 7 % base (sometimes known as yield). Based on Ethereum, Centrifuge has maintained its dominance in this league table, commanding over 46% market share and an impressive $255 million active loans. This marks a substantial growth of 203% from the beginning of last year, when it stood at $84 million.

Centrifuge takes the lead. Goldfinch and Maple follow closely, boasting $143 million and $103 million in active loans, respectively.

Blockchain Loans Surge: $506M Market, Risks Assessed

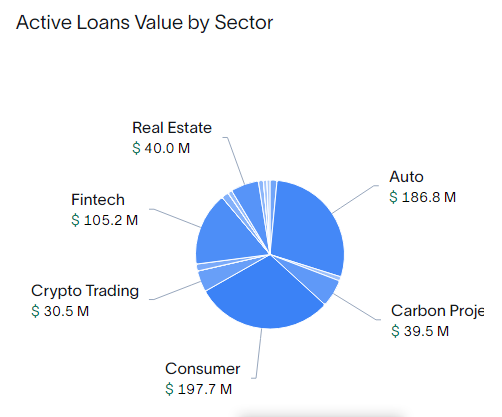

Stablecoins such as Tether (USDT), US Dollar Coin (USDC), and Dai (DAI) serve a crucial function in these blockchain loans. The highest level of interest in loans comes from sectors covering consumer ($197.7 million), automotive($186.8 million), and fintech, followed by real estate ($, launchpad sub-market for cryptocurrency trading).

Yet although this soaring grew the active loan market to $506 million, it is still a fraction, accounting for only 0.3 % of the giant traditional private credit market worth an estimated $1.6 trillion dollars in total terms alone. As loan-seekers look into these blockchain approaches, they must consider the threat of insolvency and security.

Related Reading | BlackRock Bitcoin ETF Gains Traction in SEC Talks