Business intelligence firm MicroStrategy has once again bolstered its Bitcoin (BTC) holdings, adding 14,620 BTC to its portfolio between November 20 and December 26. The purchase, valued at $615.7 million in cash, was officially disclosed in MicroStrategy’s 8-K filing with the U.S. Securities and Exchange Commission.

MicroStrategy has acquired an additional 14,620 BTC for ~$615.7 million at an average price of $42,110 per #bitcoin. As of 12/26/23, @MicroStrategy now hodls 189,150 $BTC acquired for ~$5.9 billion at an average price of $31,168 per bitcoin. $MSTR https://t.co/PKfYY59sTW

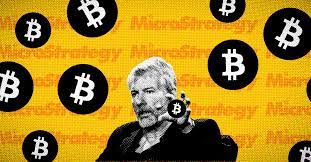

— Michael Saylor⚡️ (@saylor) December 27, 2023

This recent acquisition, priced at approximately $42,110 per BTC, including fees and other expenses, contributes to MicroStrategy and its subsidiaries now holding a total of 189,150 bitcoins. The aggregate purchase price for these bitcoins stands at around $5.9 billion, with an average purchase price per BTC of roughly $31,168.

This move follows MicroStrategy’s substantial purchase of 16,130 BTC in November 2023, acquired at $36,785 per Bitcoin. The company consistently demonstrated its commitment to Bitcoin investment by purchasing 6,067 BTC in September and October 2023 and 12,333 BTC in June.

ETF Excitement Grows with MicroStrategy’s Latest Move

The timing of MicroStrategy’s latest acquisition is noteworthy, occurring just weeks before January 10, a date eagerly awaited by the crypto community. This is the day when speculation is rife that the U.S. Securities and Exchange Commission (SEC) might approve a spot Bitcoin exchange-traded fund (ETF) or multiple ETFs.

MicroStrategy’s co-founder and outspoken Bitcoin advocate, Michael Saylor, views a potential spot Bitcoin ETF approval as a groundbreaking development on Wall Street. Saylor believes that such a product could open the doors for mainstream retail and institutional investors who were previously unable to access BTC.

The $BTC Spot ETF may be the biggest development on Wall Street in the last 30 years. My discussion of #Bitcoin in 2024, Spot ETFs vs. $MSTR, and the emergence of bitcoin as a treasury reserve asset with @KaileyLeinz on Bloomberg @Crypto. pic.twitter.com/QtPdBOhMDr

— Michael Saylor⚡️ (@saylor) December 19, 2023

However, not everyone shares Saylor’s optimism regarding the prospects of a spot Bitcoin ETF in the U.S. Josef Tetek, a Bitcoin analyst at Trezor, warns that such ETFs could lead people away from self-custody and even result in the creation of “millions of unbacked Bitcoin.”

Skeptics, including BitMEX co-founder Arthur Hayes, go as far as expressing concerns that overly successful spot Bitcoin ETFs could pose a threat to the very essence of Bitcoin, potentially leading to its destruction.

As the anticipation builds up for the potential approval of a spot Bitcoin ETF, the crypto community is closely watching the developments, acknowledging both the opportunities and risks associated with this significant financial milestone.

Related Reading | FY2018 Tax Reform Outline Secures Cabinet Approval