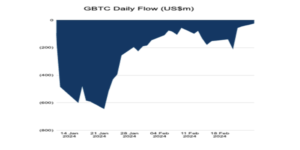

On Feb. 26, Grayscale’s spot Bitcoin (BTC) exchange-traded fund (ETF) experienced its third consecutive trading day of declining net outflows, reaching a record low of $22.4 million. According to data from Farside Investor, GBTC had three back-to-back days of slowing net outflows on Feb. 22, 23, and 26.

The week concluded on Feb. 23 with a daily net outflow of $44.2 million, which further halved on Feb. 26. Daily net outflows for GBTC peaked on Jan. 22 at $640.5 million.

GBTC experienced a significant $7.4 billion outflow over the last 30 trading days, marking a continuous drain since it transformed into an ETF in mid-January, as per Bloomberg data. Nine recently approved Bitcoin spot ETFs attracted billions in new investment capital, while Grayscale’s GBTC experienced extended outflows during the same period. GBTC faces challenges with a high 1.5% expense ratio and liquidations from bankrupt crypto lending firms.

Adam Back, the CEO of Blockstream, posted on X that he’s “waiting for the day GBTC flashes an inflow.” Back mentioned that it “could happen,” but it would require “just enough premium” to encourage investors to arbitrage the ETF.

Spot Bitcoin ETFs Records $520M Net Inflow

Farsides data indicates the combined net inflows of all Bitcoin ETFs hit $520 million — the highest in two weeks. On Feb. 13, the ETFs recorded a combined net inflow of $631.3 million. However, they faced challenges sustaining this momentum, experiencing a net outflow of $35.6 million on Feb. 21. This was attributed to a relatively larger outflow day from GBTC and smaller inflows to other funds.

On Feb 26, BlackRock’s IBIT saw a remarkable inflow of $111.8 million, contributing to a total net inflow of $6 billion. The BlackRock Bitcoin ETF has nearly $7 billion in assets. However, the Fidelity’s ETF was the star of the day. Fidelity (FBTC) and Ark 21Shares (ARKB) saw $243.3 million and $130.6 million, respectively. VanEck (HODL), Bitwise (BITB), and others also saw substantial inflows amid bullish sentiment.