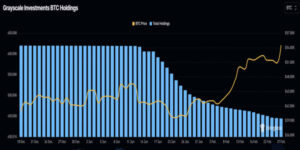

Grayscale, the world’s largest crypto asset manager, has witnessed a significant decline in its Bitcoin (BTC) holdings since converting its Grayscale Bitcoin Trust (GBTC) into an exchange-traded fund (ETF) in mid-January.

According to BitMEX Research data shared on Tuesday, GBTC saw its 36th day of straight outflows on March 4, with 5,450 BTC or $368 million leaving the trust. Since the conversion to an ETF, the cumulative outflow has reached a staggering $9.26 billion.

ETF Conversion and GBTC Outflows

Initially launched in 2013 as a private, open-ended trust for accredited investors, the GBTC got the United States SEC’s approval to operate as a spot BTC ETF on January 10. Prior to this conversion, Grayscale held about 620,000 BTC, according to Coinglass’s report. The inception of Grayscale’s spot Bitcoin ETF introduced a new novel where investors could redeem their shares for BTC, which was impossible in the previous structure.

Moreover, GBTC’s higher fees than other ETFs, such as Fidelity’s FBTC and BlackRock’s IBIT, have contributed to the outflows. The GBTC fund charges investors roughly 1.5%, while other Bitcoin ETFs charge 0.2%-0.9%. The fund currently holds 420,682 BTC, worth about $28.8 billion at current prices, information available on Grayscale’s website and portfolio shows. This marks a 33% decline from its previous holding of 620,000 BTC.

The crypto community has been speculating about when GBTC might stop its “Bitcoin bleed.” Outflows from GBTC decreased in late January and February, prompting some experts to suggest that they could be coming to an end. However, the scenario changed mid-February when bankruptcy courts allowed the crypto lender Genesis to liquidate about $1.6 billion worth of GBTC shares as part of efforts to repay investors.

Performance of Other Spot Bitcoin ETFs

Meanwhile, the other nine spot bitcoin ETFs are doing well amid the ongoing bitcoin rally. These ETFs saw their second-largest volume day on March 4, with about $5.5 billion traded. BlackRock’s IBIT alone recorded around $2.4 billion in daily volume, while its assets under management exceeded $11 billion. All the new ETFs have also experienced a more than 30% increase in volume within six days.

Confirmed: today was second biggest volume day for the Ten at about $5.5b. $IBIT alone did $2.4b of it and has crossed $11b in aum. Each of them is up over 30% in 6 days, which will prob help keep flow ball rolling. Getting a bit of ARK Mania deja vu. pic.twitter.com/BDRYVPBk34

— Eric Balchunas (@EricBalchunas) March 4, 2024

Furthermore, on March 4, Fidelity saw a record day for inflows, with preliminary data from Farside Investors revealing $404.6 million in inflows, which more than offset the GBTC outflows. The Bitwise Bitcoin ETF (BITB) also experienced a good day, with inflows of $91 million, marking its highest since Feb. 15.

Record day for Fidelity today: US$404.6 million of inflow

Fidelity has more than offset the GBTC outflow on its own https://t.co/cr320pbObf pic.twitter.com/ellb4qUoNK

— Farside Investors (@FarsideUK) March 5, 2024