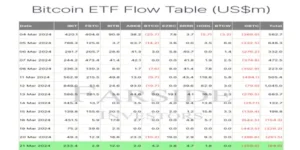

Crypto asset manager Grayscale’s Bitcoin exchange-traded fund (ETF) experienced another day of significant outflows, with nearly $359 million exiting the fund on March 21. This follows a massive week of outflows, with March 18 seeing the largest single-day outflow of $643 million, according to data from Farside Investors.

The total outflow from Grayscale’s GBTC for this week has reached a staggering $1.83 billion. March 21st marks the fourth consecutive day of net outflows across all 10 Bitcoin ETFs.

Grayscale said its BTC Trust held $23.2 billion in assets under management (AUM). Since converting to an ETF on January 11, GBTC has lost $13.6 billion. Experts believe that the trend of outflows from Grayscale’s fund may soon end.

Bloomberg’s ETF analyst, Eric Balchunas, speculated that most outflows resulted from crypto firms’ bankruptcies. He said any outflows from Genesis or Gemini, two prominent players in the industry, are likely being used to buy BTC, thereby supporting the market.

Balchunas noted:

“Takeaway: the worst is [probably] close to being over. Once it is, only retail will be left and flows should look more like the Feb trickle.”

Independent researcher ErgoBTC suggested that about $1.1 billion worth of recent GBTC outflows over the last few weeks seem to be associated with bankrupt crypto lender Genesis.

The volume and timing of the outflows align with Genesis’ activity, suggesting a correlation between the two. Genesis received court approval on February 14 to liquidate $1.3 billion worth of GBTC shares to repay its creditors. Moreover, in January, bankrupt crypto exchange FTX sold 22 million GBTC shares, worth nearly $1 billion.

Genesis is back from the dead, taking down more than ~16.8k BTC (+$1.1B) in the last few weeks to 2 new addresses.

Likely these coins are primarily sourced from GBTC outflows. pic.twitter.com/19ALn1jyTs

— ∴FreeSamourai∴ (@ErgoBTC) March 21, 2024

Will Bitcoin ETF Demand Recover?

CryptoQuant CEO Ki Young Ju says the recent slowdown in Bitcoin spot ETF netflows shows reduced interest in these investment options. However, he suggests that this pattern could potentially reverse if Bitcoin’s price reaches critical support levels.

Ju highlighted that new buyers have established a $56,000 on-chain cost basis, which could impact market dynamics. In assessing historical data, he noted that corrections in bull markets usually involve a drop of about 30%.

#Bitcoin spot ETF netflows are slowing.

Demand may rebound if the $BTC price approaches critical support levels.

New whales, mainly ETF buyers, have a $56K on-chain cost basis. Corrections typically entail a max drawdown of around 30% in bull markets, with a max pain of $51K. pic.twitter.com/vZCG4F0Gh5

— Ki Young Ju (@ki_young_ju) March 22, 2024

Despite the recent drop in BTC price, Bernstein, an investment firm, has raised its year-end forecast for the cryptocurrency. The company adjusted its price target for BTC to $90K, up from the previous projection of $80K.