BitcoinGlassnode data reveals that the recent resistance of Bitcoin at the $23,800 mark was noteworthy due to the specific cost basis of a group of whales. Glassnode’s weekly report shows all three whale groups had losses after last year’s FTX market crash, as per their analysis.

The “realized price,” which is a price generated from the realized cap, is the pertinent indication in this case. The Bitcoin capitalization approach values each coin based on its most recent exchange price rather than the market cap. It assumes actual worth differs from market cap.

The realized price is obtained by dividing this cap by the total number of coins in circulation. This metric is crucial since it displays the average purchase cost in the Bitcoin market.

If the average price of Bitcoin falls below its realized price, the average holder incurs losses. This realized price represents the average cost base of the whole market, and one can also create the indicator for specific market segments.

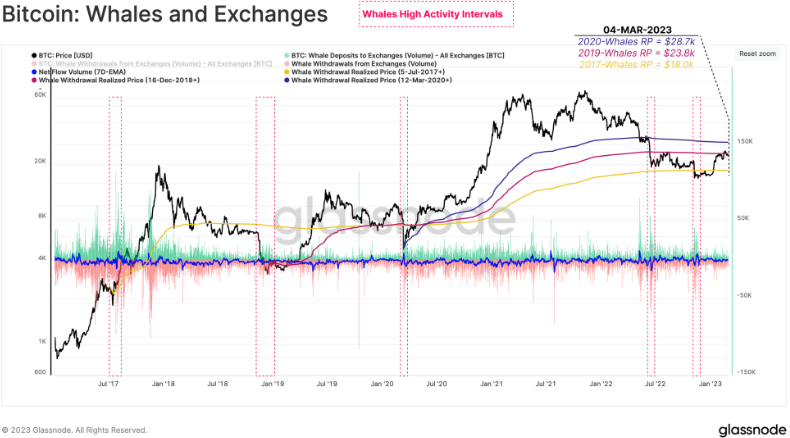

The “whale” group, which comprises all investors holding at least 1,000 bitcoin in their wallets in the case of Bitcoin, is a crucial cohort for any cryptocurrency. Due to the size and diversity of this group, Glassnode has separated it into three subgroups to research the best-realized pricing over time.

The analytics company split these groups using various acquisition start points for each. The cutoff date for the first group is July 2017, the month that saw Binance’s debut as a cryptocurrency exchange.

The second one is December 2018 (bear market lows), and the last is the COVID bottom in March 2020. Also, Glassnode has solely considered exchange transactions here to determine the precise pricing at which these whales have purchased their coins (since this group often buys and sells on these sites).

The whales from the 2017+ timeframe have realized prices currently around $18,000, as seen in the graph above. This indicates that the typical whale who purchased their coins between today and 2017 is profitable.

Nevertheless, the 2018+ and 2020+ whales are now at a loss; their realized values are $23,800 and $28,700, respectively. The current resistance of Bitcoin matches the previous wave of whale’s cost basis. This correlation is an intriguing observation in cryptocurrency.

Related Reading | Bybit Suspends USD Bank Transfers Due To Service Outages From Partner

This is clear in the chart, where the most recent surge ended as the cryptocurrency price hit this mark. In the past, cost basis levels like these have frequently supplied resistance to the price because investors, who had previously been at a loss, perceived such levels as perfect selling windows.