The Proof-of-Work mechanism is still relevant in securing blockchains today. Bitcoin, the top cryptocurrency, relies on this model to secure its network through miners using expensive mining hardware. However, mining hardware is cost-intensive, and miners grapple with other issues like electricity costs, space, and environmental taxes.

Hence, most miners opt to join mining pools for a fee and save on costs. These pools reward each miner according to their stake in the mining pool. It is difficult for an individual miner to generate enough power to compete with these pools; instead, they opt to join them.

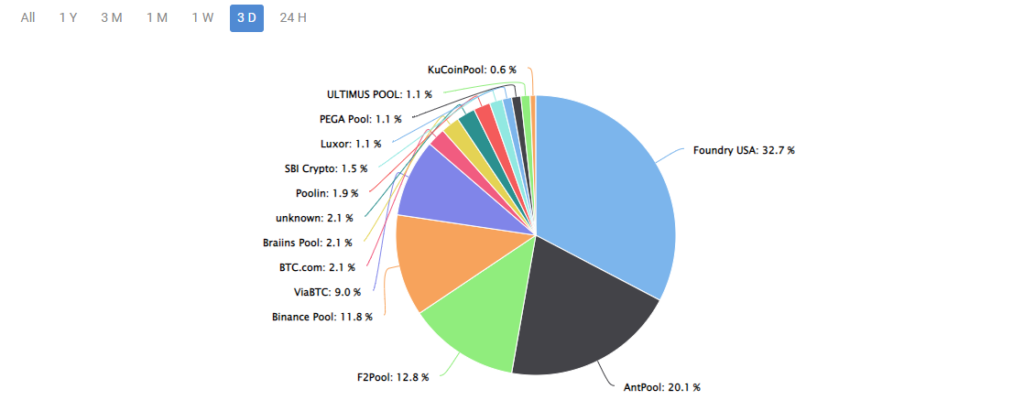

Recently, analysts revealed that Foundry USA and Antpool share half of Bitcoin’s hashrate. The blockchain mining power is centralized by these large pools giving them an advantage over individual miners.

Foundry USA and Antpool Now Leading The Way

Mempool data reveals that Foundry USA has retained a hashrate of more than 30% for weeks. The mining pool achieved a record-breaking feat, becoming the first pool without a Chinese background to top the list. Foundry USA achieved this feat in November 2021, aided by the ban on bitcoin mining in China in 2021.

Fun fact: In the last few days just _two_ Mining pools had more than 50% hashrate on #Bitcoin.

Much decentralization. https://t.co/dNPM1NakjF

— tante (@tante) December 21, 2022

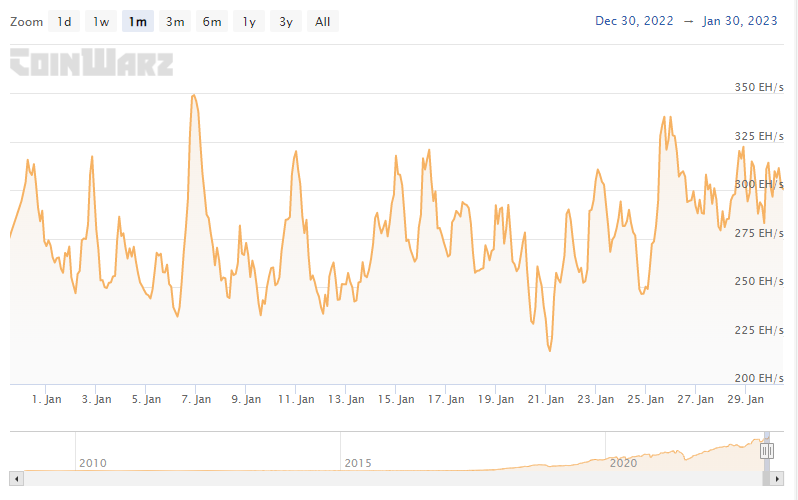

Foundry USA 2021 produced 17% of BTC’s total hashrate. Currently, the pool contributes 34.1 of Bitcoin’s hashrate on average. This percentage represents almost 104 EH/s, while the total bitcoin hashrate is approximately 300 EH/s.

Antpool is second on the hashrate production list contributing close to 18.0% of BTC’s hashrate equivalent to 58 EH/s. As of 2021, Antpool was the largest Bitcoin pool. However, since its operations are Chinese-based, the crypto mining ban in China affected its productivity. Numerous miners in China had to leave the region and seek profit elsewhere.

What Is Giving Foundry and Antpool The Upper hand?

The location of these mining pools is one of the reasons behind this centralized hash power. The closer a server is to a mining rig, the faster information can transmit on the network. It implies that a miner will get more rewards from the pool and earn more Bitcoin by connecting to a nearby server.

Also, the financial incentives that major mining pools offer to attract more miners to these networks. The big pools can afford to split profit among their members, who pay commissions to benefit from their mining power.

Also, the Increased mining difficulty in the past weeks has aided some miners’ transition from personal mining to pool. Bitcoin’s bullish run was behind the increase in mining difficulty making it more difficult for smaller pools to profit. So some of these smaller miners now prefer to join the large pools.

The Risks Of Centralized Bitcoin Hashrate

Data reveals that above 80% of Bitcoin mining power revolves around five pools. It shows an increase compared to figures in 2022, when these five pools controlled approximately 60% of the entire hashrate on the Bitcoin network.

However, a more centralized mining system could be counter-productive in the long run as it carries potential risks. Miners can agree to reject certain transactions that do not meet specific requirements. Such a scenario will constitute a 51% attack on the network. Ethereum Classic is an example of a Proof-of-Work network that has experienced such an attack.

The Bitcoin network will suffer significant losses if exposed to such an attack. Also, regulatory bodies pushing for more regulations could influence the activities of these mining pools. Since these mining pools are registered companies, they must comply with the laws in their region. If such events occur, they will hurt the Bitcoin network and the asset’s price.

Bitcoin Price Where Is The Asset Headed?

Bitcoin has enjoyed a positive start to the year, with an impressive price surge in January 2023. The asset is currently trading at $ 23,245.36, with minor price fluctuations within the $23k level. BTC has been on an uptrend in previous days from the price chart. However, this rally has hit resistance and is currently in a sideways trend showing indecision in the market.

The asset trades above its 50-day Simple Moving Average (SMA) and 200-day SMA. The 50-day SMA is moving upwards and will likely form a golden cross in the coming days. The support levels are $22,249, $22,615, and $23,195; the resistance levels are $24,141, $24,507, and $25,088. Bitcoin might not test the $24k level soon and will likely continue on its sideways trend in the short term.

The Relative Strength Index (RSI) is just in the overbought region, at 74.41. However, it might retrace back into its channel. BTC might retrace before it continues its ascent as it targets the $24k level next.

The MACD (Moving Average Convergence/Divergence) is above its signal line but is showing convergence. It reflects bearish pressure, which might force bitcoin to trade below the $23,195 support level. Expect Bitcoin to remain in the 23k level for some days before it breaks past the next resistance level.

Please note that these opinions do not belong to Margex and should not serve as investment advice. Due to the volatile nature of cryptocurrencies, proper technical analysis and risk management are vital for potential traders. Most importantly, do not risk more than you can afford to lose, as all investments carry a certain amount of risk.