Ethereum roadmap has sparked discontent within the community, with Justin Bons, the founder of Cyber Capital, expressing strong reservations. On Jan 2, Bons took to X, asserting that abandoning plans to increase layer-1 gas limits gradually is a significant misstep for Ethereum.

ETH's latest roadmap has removed this line entirely; "increase L1 gas limits"

That even such a minor commitment was redacted sends a clear signal to the market

That ETH is not scaling at all, a punch to the gut for early adopters

Who supported ETH based on this false promise

— Justin Bons (@Justin_Bons) January 1, 2024

Moreover, Bons argues against pursuing sharding, suggesting reliance on layer-2 platforms such as Arbitrum, Base, and OP Mainnet. According to Bons, this shift may pose a perilous risk for Ethereum. Bons states that omitting “increase layer-1 gas limits” implies Ethereum’s lack of progress in scaling, signaling the market accordingly. Bons argues this is a blow to early adopters drawn to Ethereum based on the promise of enhanced scalability.

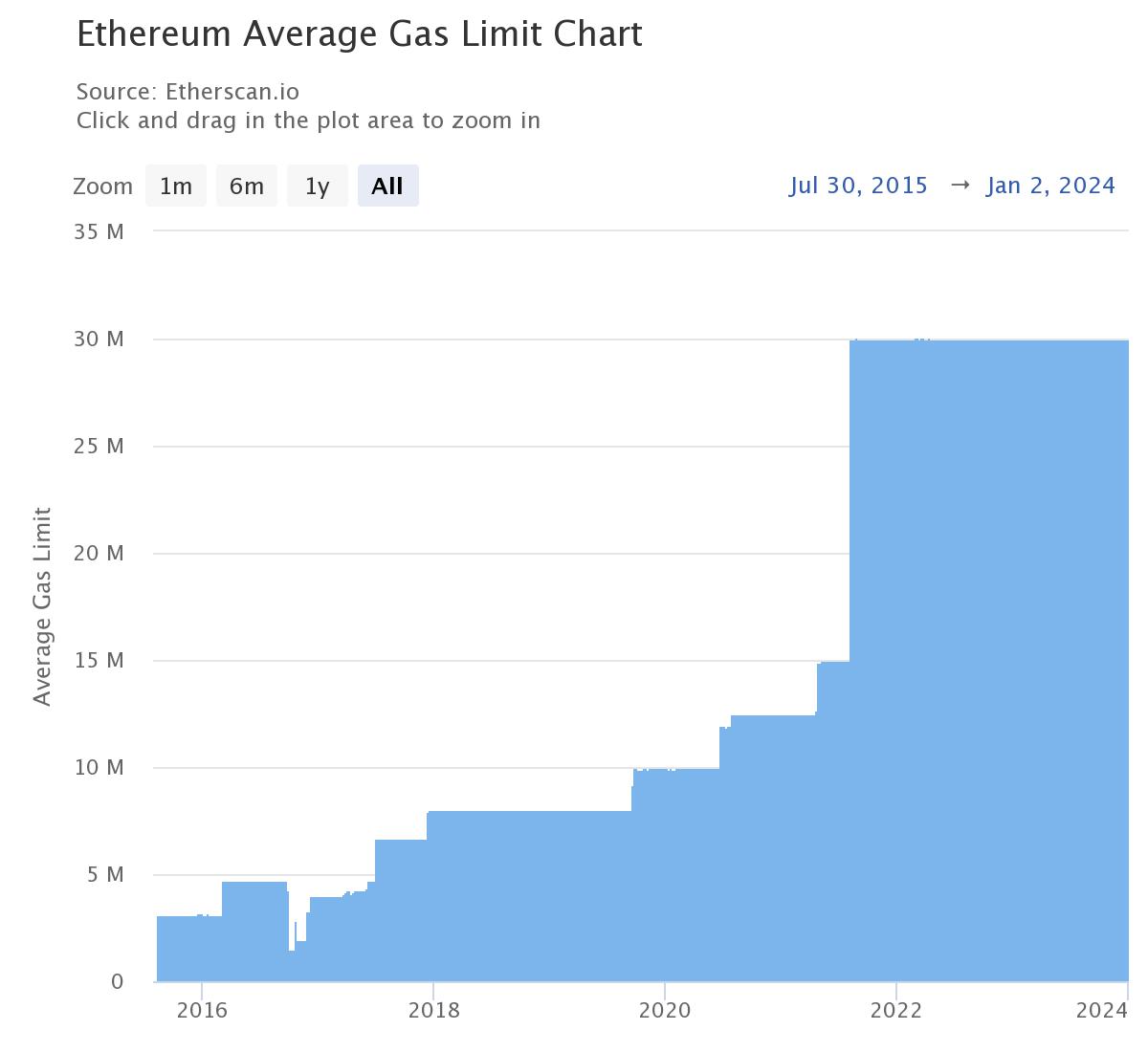

In the Ethereum ecosystem, the gas limit dictates the maximum gas utilized in a block, impacting the cost of mainnet transactions. Bons criticizes the decision to remove this incremental increase, emphasizing that it has historically helped lower gas fees, especially during periods of increased demand. As of December, the gas limit stood at 30 million gwei, based on Etherscan data.

Furthermore, Bons also takes issue with Ethereum developers branding the chain as a “B2B” enterprise. He argues that by positioning itself as an “enterprise chain,” Ethereum risks alienating regular users in favor of “rent-seeking” layer-2s and developers holding layer-2 tokens, potentially causing long-term harm to the network.

Ethereum Layer-2 Pivot: Sharding Delay Concerns

Recent insights from Ethereum developer discussions suggest a strategic shift towards becoming a host for layer-2 solutions. This shift is primarily driven by roll-ups and other variants incorporating zero-knowledge proofs to enhance privacy.

Moreover, despite the transaction fee benefits and offloading of mainnet load associated with roll-up solutions, Bons contends that this approach might mean postponing the crucial on-chain scaling technique of sharding. Sharding involves breaking the mainnet into smaller interconnected units to process transactions and reduce fees independently.

Bons cautions that Ethereum’s focus on layer-2 solutions could lead to a delay in sharding implementation. Sharding is vital for on-chain scaling and ensuring the network’s long-term sustainability.

Related Reading | Bitcoin Soars: Eyes on Federal Reserve and Economic Indicators