The cryptocurrency ecosystem witnessed a remarkable beginning to 2023, with Bitcoin (BTC) and decentralized finance (DeFi) protocols experiencing substantial growth in market capitalization throughout the first quarter.

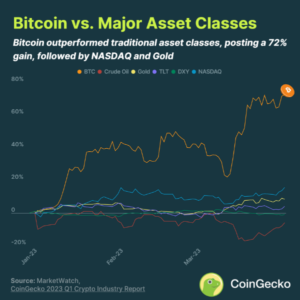

According to the Q1 2023 report released by CoinGecko on April 18, Bitcoin emerged as the best-performing asset. It boasted a 72.4% gain, surpassing other prominent assets such as the NASDAQ index and Gold. The NASDAQ experienced gains of 15.7%, while Gold had a modest 8.4% gain.

The report states that nearly all significant assets experienced Q1 growth, with the exception of crude oil, which dropped by 6.1%. This decrease was due to the reduction in oil demand mentioned in the United States inflation data, and the negative consequences of the U.S. banking crisis.

Overall Crypto Market Cap Reaches $1.2 Trillion

The overall crypto market rebounded In Q1, reaching a total market cap of $1.2 trillion by the quarter’s end. CoinGecko reported a 48.9%, or $406 billion, gain from the $829 billion market cap at the close of 2022.

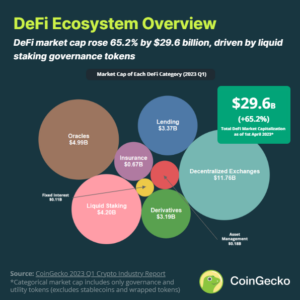

The DeFi space also excelled, increasing in value by $29.6 billion throughout the first quarter. The report emphasized the remarkable performance of liquid staking governance tokens, which experienced a 210% rise in market cap since 2023 began.

The Ethereum network’s Shapella upgrade significantly contributed to the increased capital inflows into liquid staking pools. With the upgrade, ETH staking reward withdrawals were finally unlocked. The report indicates that liquid staking has now become the third-largest category within the DeFi sector.

Stablecoins And NFT Markets Experience Contrasting Fortunes

While Bitcoin and DeFi have been the primary drivers of growth so far this year, the top 15 stablecoins experienced a $6.2 billion decrease in market cap. CoinGecko attributed this 4.5% drop to the closure of Binance USD by Paxos. Additionally, USD Coin faced temporary debugging during the Silicon Valley Bank collapse in March 2023.

Tether solidified its position as the largest stablecoin by market cap in 2023, adding $13.6 billion since the year began. Meanwhile, USDC and BUSD recorded market cap losses of 26.9% and 54.5%, respectively.

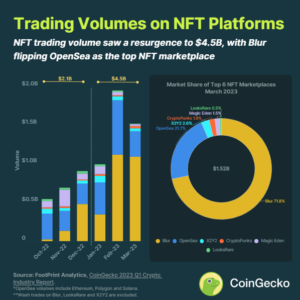

Nonfungible token (NFT) trading volume saw a 68% increase from Q4 2022 to $4.5 billion in Q1 2023. Blur, an NFT marketplace newcomer, accounted for most of the trading volume since its October 2022 launch. It comprises 71.8% of the NFT market share in March 2023.

Related Reading | Blockchain Association Files Extra FOIL And FOIA Requests Over Crypto-Friendly Banks Closures

Spot trading volume across the top 10 crypto exchanges reached $2.8 trillion in Q1 2023 which is an 18.1% increase from Q4 2022. During this period, DEXs had a better performance than CEXs. Specifically, decentralized exchanges saw an increase of 33.4%, whereas centralized exchanges increased by 16.9%. However, the CEX: DEX trading volume ratio remained above 90%.