Ethereum is riding the wave of a storm of backlash. It’s worth against BTC and Solana on Crypto X December 20, at essentially one-twentieth its value going into last year’s holidays. With declines like this, not seen since April 28 of last year, concerns have been voiced in the past about where Ethereum is headed–and they are being increasingly heard once again.

The peak of the Ether-to-Bitcoin ratio during that recent bull market was on September 12, when it hit a value over BTC. Since then, this has continually declined again. As of the early part of 2023, that ratio was just around 0.7 and has continued to plunge as Ethereum investors holding their breath are watching in dismay.

Critics on social media attribute Ethereum’s struggles to its transaction fees, a focal point for users seeking lower-cost alternatives. Jason A. Williams, a prominent advocate for Bitcoin, declared on December 20 that “Ethereum is broken,” urging users to explore fee-less options. Data from BitInfoCharts reveals that Ethereum’s fees averaged around $11 on December 19, while Bitcoin’s fees were comparatively higher at approximately $32. In contrast, Solana boasts consistently low fees, staying under $0.01, according to CoinCodex.

Ethereum is broken. You don’t have to pay those fees anymore. You have options.

Study #Bitcoin.

— Jason A. Williams (@GoingParabolic) December 20, 2023

Even Vitalik Buterin, one of Ethereum’s co-founders, has expressed concerns. He stated that Ethereum may face failure unless transaction fees become more affordable, especially during bullish market conditions.

Despite the criticisms, Ethereum has found staunch defenders within its community. Anthony Sassano, host of the Ethereum show The Daily Gwei, contends that Ethereum is undervalued in the current market. In contrast, Ryan Sean Adams, co-host of Bankless, expresses astonishment at the negative sentiment surrounding Ethereum. He affirms his confidence in the cryptocurrency with a resounding “Long ETH 2024.”

Solana Surges, Challenging Ethereum in Crypto Debate

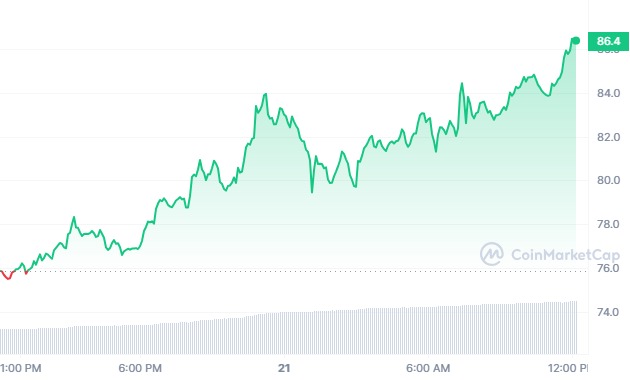

In the midst of Ethereum’s struggles, Solana (SOL) has emerged as a strong contender, according to CoinMarketCap. Its price surged 12% to $83 in the last 24 hours, outperforming various other cryptocurrencies. Solana’s proponents highlight its dominance in DEX, stablecoin, and NFT trading volumes over varying intervals. Some enthusiasts even go as far as to predict that Solana might eventually “flip” Ethereum.

However, Ethereum maintains its lead in total value locked (TVL) with $28 billion, while Solana holds the fifth position with a TVL of $1.15 billion, according to DefiLlama. Ethereum’s market cap/TVL (Mcap/TVL) ratio stands at 9.4, whereas Solana’s ratio is notably higher at 30.45. Users commonly use this metric to assess the intrinsic value of a blockchain.

As Ethereum faces these challenges, the crypto community remains divided, with some predicting its demise while others stand firm in their belief in its resilience and future potential. The evolving dynamics among Ethereum, Bitcoin, and Solana will shape the cryptocurrency market narrative in the coming months.

Related Reading | Bitwise Bold Bitcoin ETF Promo Precedes SEC Verdict