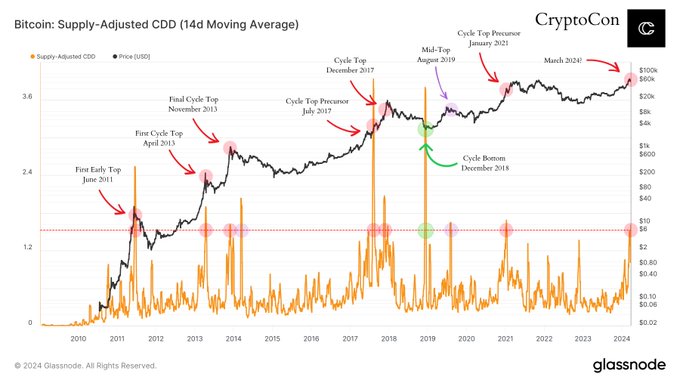

Several well-known crypto analysts are raising concerns over an unusual spike in activity from long-term Bitcoin holders. Crypto analyst CryptoCon highlighted that, there has been a significant increase in the number of old Bitcoins spent and transferred recently. This suggests that investors who have held Bitcoin for a long time are starting to sell.

The analysts are tracking this behaviour using the “coin days destroyed” metric. This metric measures the movement of coins and how long they stay inactive before someone transfers them. A high coin days destroyed value means long-term holders are selling a substantial amount of Bitcoin.

Historically, this type of heavy selling from long-term holders has often coincided with cyclical market tops for Bitcoin’s price. The analysts point to only a few instances where this magnitude of long-term holder selling did not mark a price peak – during the depths of the 2018 bear market and a brief period in 2019.

According to the analysts, the implications of the current spike in long-term holder selling concern Bitcoin’s price outlook in the near term. Some anticipate a precursor sell-off before new all-time highs, while others worry it signals an overheated bull cycle, potentially leading to a sizable price correction.

Bitcoin Faces Potential Pullback Before Resuming Uptrend

Crypto analyst EGRAG CRYPTO draws similarities between the current market and the 2017 bull run. According to this analyst, Bitcoin may experience a 30-40% pullback in the coming weeks or months before regaining momentum in its upward trend. During the 2017 bull market, Bitcoin went through several significant corrections while setting new record highs.

However, not all analysts agree that a deep retracement is inevitable. Some remain optimistic that Bitcoin will continue its upward grind from current levels. This would allow alternative cryptocurrencies like Ethereum, Solana, and others to see parabolic price appreciation against Bitcoin.

The next few weeks will likely be a crucial test for Bitcoin. If the pioneer cryptocurrency can shake off this latest round of profit-taking by long-term holders and push past stubborn resistance, it could encourage the market for another major leg up. However, if Bitcoin faces rejection at these levels, it could become vulnerable to a more prolonged pullback.

The crypto market awaits this pivotal moment to determine Bitcoin’s short-term trajectory. Investors and traders will closely watch market reactions to gauge potential correction or continuation of the uptrend.

Related Reading | Ava Labs CEO Exposes Warning Signs for Investments in Crypto Space