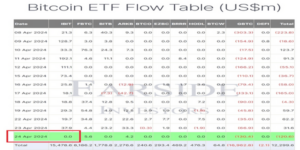

On April 24, BlackRock’s spot Bitcoin exchange-traded fund (ETF), which trades under the ticker IBIT on Nasdaq, recorded zero net inflows for the first time since its launch in the United States on January 11. IBIT has continuously attracted millions of dollars in daily investments, totaling about $15.5 billion in just 71 days.

Out of the 11 Bitcoin ETFs registered in the US, only ARK 21Shares Bitcoin ETF (ARKB) and Fidelity Wise Origin Bitcoin Fund (FBTC) saw inflows of $4.2 million and $5.6 million, respectively. Eight other funds recorded zero flows.

Meanwhile, the Grayscale Bitcoin Trust ETF (GBTC) continued to bleed. GBTC recorded $130.4 million in outflows, bringing net outflows for spot Bitcoin ETFs to $120.6 million for the day. Grayscale’s total outflows now stand at approximately $17 billion. Overall, the US Bitcoin ETF market has accumulated $12.3 billion in BTC since January 11.

In a post on X, Eric Balchunas, a Bloomberg Intelligence ETF analyst, praised the IBIT ETF for its impressive 71-day streak of consistent inflows. The fund has outperformed the Global Jets ETF, as well as Vanguard’s bond market ETF and developed-markets ETF — funds that Balchunas described as “one-hit wonders” and “cash vacuum cleaners.” The streak places BlackRock’s IBIT among the top 10 funds.

$IBIT inflow streak now 71 days which has it officially in the Top 10 all time after passing the ETF One Hit Wonder $JETS (remember JETSanity?). Also passed $BND and $VEA which are cash vacuum cleaners. Lot of mountain still left to climb tho. h/t @thetrinianalyst pic.twitter.com/NpZzgQe4v3

— Eric Balchunas (@EricBalchunas) April 24, 2024

Rachael Lucas, a crypto analyst at BTC Markets, told The Block that days with zero inflows are common and do not necessarily indicate a product’s failure. She added that such occurrences also coincide with geopolitical tensions and market performance, which highlight the complexities beyond ETF flows. Moreover, the head of institutional marketing of BIT crypto exchange, Joe Caselin, said zero flows in an ETF are not unusual but a cooling of ETF enthusiasm.

Bitcoin Plunges by 4.5%

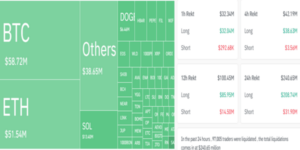

According to CoinMarketCap data, BTC saw a rapid decline of about 4.5% in just a few hours, dropping from $66,700 to $63,500. Some large-cap altcoins, including Solana, Avalanche, Shiba Inu, and Cardano, dropped even more than Bitcoin, with losses exceeding 7% each.

Bitcoin’s fall dragged a large portion of the crypto market down, wrecking over 97,005 traders with liquidations running into $240 million, per data from CoinGlass. Short liquidations totaled $32 million, while long positions were $208 million.