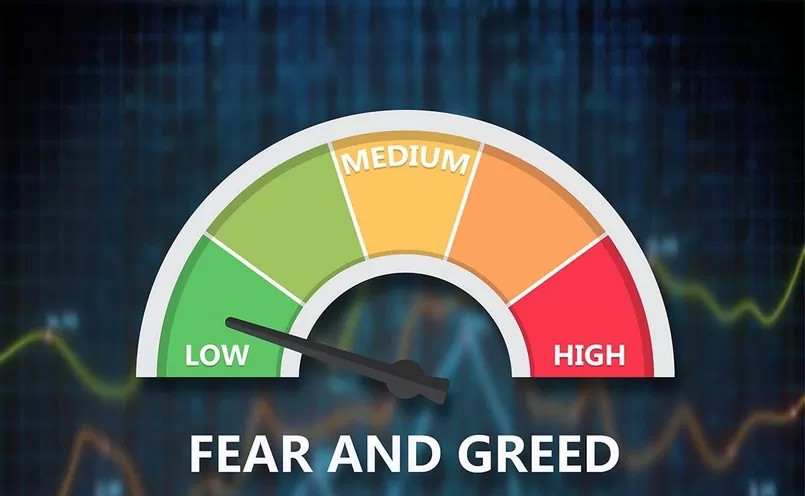

Investors Spark Crypto Hype as Bitcoin Fear & Greed Index Soars to 61, a 1-Year Peak Indicating Greed Over Fear. In addition, Investors are feeling the rush of a bullish market as Bitcoin hits new all-time highs.

However, the Fear & Greed Index, which has been tracking market sentiment for over a decade, gives a clear picture of the present status of the crypto market.

Financial experts have issued warnings about a potential market bubble, but many investors are still drawn to the crypto market. They fear missing out on the potential profits.

Institutional investors are entering the market, and mainstream acceptance is growing, driving the increasing demand for Bitcoin. The demand fuels its upward trajectory.

Furthermore, it is crucial to keep in mind that high risk also brings the potential for high reward. While the Bitcoin Fear & Greed Index reaches new peaks, it is essential for investors to proceed with caution and evaluate the long-term potential of their investments.

Institutional Support Boosts Bitcoin’s Growth

A rising variety of variables, including increased institutional acceptance of Bitcoin and other cryptocurrencies, can be attributed to the spike in greed.

However, with more significant companies entering the market, it’s no surprise that the crypto industry is on a roll. Analysts predict continued growth as more institutional investors enter the market, boosting cryptocurrency prices.

As the market sentiment leans towards greed, it’s crucial to keep in mind that sudden corrections or pullbacks could occur, leading to significant losses for ill-prepared investors. It’s essential to approach all investments, including cryptocurrencies, with caution and a solid investment plan.

Additionally, the Bitcoin network’s mining difficulty rose 4.68% on January 29th. This adjustment in difficulty increases the challenge of adding new blocks to the blockchain.

Related Reading | Ethereum Adoption On The Rise As ETH Reaches 12-Week Peak

Furthermore, the network’s hashrate also rose, reaching 295 EH/s, reflecting an increase in the number of miners participating in the network and contributing to its overall security.

Moreover, this boost in hashrate and difficulty highlights the growing interest and investment in Bitcoin and strengthens the stability of the cryptocurrency network.