Bitcoin’s rise has Morgan Stanley’s head of digital assets, Andrew Peel, warning of a potential seismic shift with far-reaching implications for the U.S. dollar’s global dominance. In a note dated Jan 12, Peel expressed concern about a potential “paradigm shift” in the perception and use of digital assets, such as Bitcoin, currently valued at $42,760.

Moreover, he suggested that this shift could threaten the traditional supremacy of the U.S. dollar. The U.S. dollar holds a substantial share, roughly 60%, of global foreign exchange reserves. Peel’s note highlights the vulnerability of this position. It is particularly exposed to a paradigm shift in the perception and use of digital assets.

Peel notes that one significant accelerant in this shift is the recent approval by the U.S. Securities and Exchange Commission (SEC) of several spot Bitcoin exchange-traded funds (ETFs). The approval has resulted in a surge of weekly inflows into these new investment products, exceeding a staggering $1.18 billion.

Peel highlights the remarkable global adoption of Bitcoin over the past 15 years. He cites that 106 million people worldwide now hold the cryptocurrency. He also highlights the widespread presence of Bitcoin ATMs in over 80 countries, emphasizing the undeniable momentum behind the digital currency.

US Dollar’s Challenges: Bitcoin, CBDCs, Stablecoins

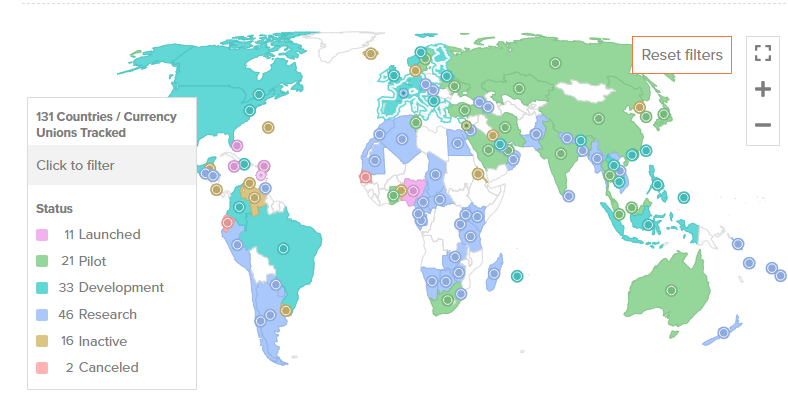

Peel highlights the growing prevalence of Central Bank Digital Currencies (CBDCs) in 131 countries, posing additional challenges for the U.S. dollar. These developments contribute to the complexities surrounding the currency’s prospects. CBDCs threaten the dominance of the U.S. dollar by facilitating swift cross-border payments without a common currency.

Peel concludes by underscoring the transformative potential of stablecoins, particularly those pegged to fiat currencies. He refers to these stablecoins as the “killer app” of the crypto world. The speaker foresees a transformation in the global financial sector driven by the growing importance of dollar-backed stablecoins. This shift is expected to change the dynamics of cross-border money movements fundamentally.

Furthermore, Andrew Peel of Morgan Stanley warns of a shifting landscape, with the U.S. dollar encountering challenges from Bitcoin’s ascent, the emergence of CBDCs, and the increasing impact of stablecoins. This could potentially reshape the financial order as we currently understand it.

Related Reading | Solana Breakout: $150-$165 Price Surge Predicted