Bitcoin acts more as a safe-haven asset and an asset for investors to pursue high-quality assets in economic uncertainty. The ARK Invest CEO has been expecting this trend to continue, especially with the ease with which investors can now trade Bitcoin using spot Bitcoin ETFs.

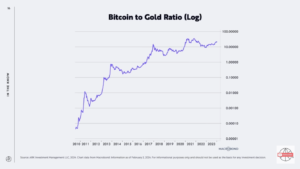

According to the CEO of ARK Invest, here is what happened: as soon as the spot BTC exchange-traded funds (ETFs) took off, the gold flows into Bitcoin (BTC) started outflowing into the hands of investors. Bitcoin has been rising relative to gold.

There is no substitution into BTC, and we think that is going to continue now that there is a less friction-filled way to access BTC, said Cathie Woods of ARK Invest in a YouTube video on February 4. Like gold, Wood expects Bitcoin to prove itself as a “risk off asset” when the banking sector weakens.

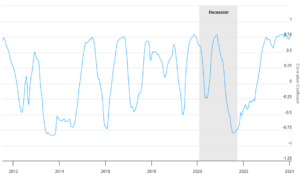

As per ARK Invest CEO, it was then that markets witnessed in March 2023 when the United States confronted a “regional bank crisis,” leading to Bitcoin’s price shooting up 40%. The Regional Bank index was imploding, and now, once again, the Regional Bank index is acting up, she said before adding,

“This idea that it’s a flight to quality or safety is reasserting itself here.”

Bitcoin-Gold Correlation Surge: Fidelity Analysis

A new analysis by Fidelity showed that the correlation between Bitcoin and gold increased this year and decoupled from its inverse relation to interest rates despite moving up in conjunction with inflationary expectations across the globe. As per longtermtrends, the one-year rolling correlation between Bitcoin and gold has reached a record high at 0.80.

On the spot Bitcoin ETF launch, Wood said that the price correction of a 20% decline in the price of BTC from $48,500 registered a couple of hours after launch to $38,740 on January 24, according to CoinGecko, did not surprise her. Before the launch, Wood predicted the launch would induce a “sell on the news” event.

However, she noted that 15 million of the 19.5 million BTC currently in circulation hadn’t moved in 155 days, so they remain in “strong hands,” which could signal that most Bitcoin holders are taking a longer-term view. Wood’s firm was one of 10 ETF issuers that launched a spot Bitcoin ETF on January 11 with the ARK 21Shares Bitcoin ETF.

The Ark 21Shares ETF had holdings worth $705.8 million in Bitcoin based on data in after-hours trading last week published by BitMEX Research. That puts it just behind GBTC from Grayscale, IBIT from BlackRock, and Fidelity’s FBTC. The ARK Invest, led by Wood, has emerged as a significant purchaser of Coinbase (COIN) stock, with holdings of 7.187 million shares.

Bitcoin Spot ETF Flow data

Up to 2nd Feb 2024 pic.twitter.com/gN2GKLedxn

— BitMEX Research (@BitMEXResearch) February 3, 2024

These shares, now valued at $843 million, are spread across several ETFs within Cathie’s ARK, according to data as of February 2022. ARK’s Coinbase investment reflects bullish views on the crypto exchange’s growth potential. However, the firm has been selling COIN rigorously since June 7, when it held 11.43 million shares.

Related Reading | Shiba Inu & K9 Finance Transform DeFi with Liquid Staking Partnership