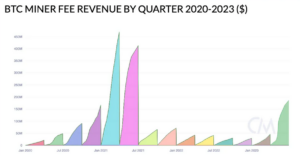

Bitcoin miners saw a significant surge in earnings during Q2 2023, with transaction fees alone reaching a staggering $184 million, marking a remarkable 270% increase compared to Q1 and surpassing the total revenue generated in 2022.

Such unprecedented growth can be attributed mainly to the recent upswing in Bitcoin’s value and the thriving market for BRC-20 tokens.

According to a report from Coin Metrics, a leading cryptocurrency analytics platform, the second quarter of 2023 has been highly profitable for Bitcoin miners.

In an astounding surge, transaction fees have skyrocketed by over 270% to reach a staggering $184 million, marking the first time since Q2 2021 that a quarter has surpassed the $100 million milestone.

Bitcoin miners receive transaction fees for each validated block, with the fee amount contingent upon data volume and user demand for block space. The recent surge in Bitcoin’s value has greatly boosted these “top-line revenues.”

Notably, only 7.7% of the total $2.4 billion earned by miners during the {quarter came from transaction fees. The majority of their revenue, on the other hand, stemmed from Bitcoin block rewards.

Currently, miners are rewarded with 6.25 BTC for solving each block. However, this reward is scheduled to halve to 3.125 BTC after the network’s next halving event, predicted to take place around May 2024.

Additional Elements Enhancing Revenue for Bitcoin Miners

Bitcoin miners had multiple reasons to celebrate in the second quarter of the year. In May, they achieved a significant triumph when the proposed Digital Asset Mining Energy tax by US President Joe Biden’s administration was blocked.

In this special edition of State of the Network, we take a data-driven look at the most important events that impacted the digital assets industry from Q2 2023.

Get the insights here: https://t.co/xpcE27j1Fz#FutureofFinance #PutTruthtoWork pic.twitter.com/67RDHKA2bT

— CoinMetrics.io (@coinmetrics) July 5, 2023

Furthermore, as inflation pressures eased, electricity prices also decreased for miners based in the United States. This reduction further amplified their profits.

Bitcoin’s hash rate has surged to new record levels in the past year, intensifying competition in the mining fee market. Coin Metrics added:

Competition remains as fierce as ever, with Bitcoin’s hashrate breaking new highs during the quarter at 375 EH/s […] We see that the overall network’s efficiency continues to increase with the adoption of modern ASICs such as the S19 XP.

Bitcoin miners experienced significant growth in the second quarter of 2023. The surge in Bitcoin’s price, the introduction of BRC-20 tokens, and favorable macroeconomic conditions contributed to this development.

Related Reading | Hong Kong’s Crypto License Demands Haven’t Increased Jobs

As we observe the evolution and expansion of the Bitcoin network, it will be captivating to witness how these trends unfold in future quarters.