Bitcoin layer-2 network tokens saw a significant surge on Monday, outperforming the broader cryptocurrency market. This surprising turn of events even overshadowed Bitcoin, which reached its 25-month high during the same period.

Layer-2 Tokens Lead Surge

Leading the charge were layer-2 network tokens such as Stacks (STX) and RSK Infrastructure Framework (RIF), saw double-digit increases in a wide crypto rally. STX token was up 109% on the daily chart and is now a mere 9% away from the all-time high of $3.39 in December 2021.

In any case, this period has experienced an extraordinary surge in social activity, where the social intelligence company LunarCrush could note that it has been tracking nearly 16,000% growth in Stacks-related track social interactions. In this past year, interest in Bitcoin’s lay-2 solutions has reflected a surge in social interaction at Stacks.

Which asset has seen the largest increase in social activity over the last year? One of the strongest has been $STX. With excitement about #Bitcoin Layer 2s increasing, so has social activity for @Stacks.

Social interactions are up nearly 16,000% with activity accelerating as… pic.twitter.com/xPSJ8JyTCI

— LunarCrush (@LunarCrush) February 27, 2024

The native coin of the RSK Infrastructure Framework (RIF) witnessed a substantial pump, adding 25% from its intraday low of $0.193. It reached a local top area at $0.242 before retracing slightly.

The RIF serves as a service layer over the Rootstock blockchain, providing smart contract facilities for Bitcoin. It allows for decentralized applications (DApps) deployment while maintaining compliance with the core values of Bitcoin.

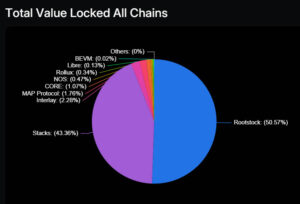

Data from DefiLlama reveals that Rootstock’s amount leads in terms of 50.16% of the complete share locked across all Bitcoin sidechains, or approximately 161 million USD. At the same time, Stacks has a TVL of $138 million, which places it at 43% of the above sum.

BRC-20 Tokens Follow Suit

The positive momentum in the cryptocurrency market is not limited to Bitcoin alone. Other Bitcoin-related scaling and smart contract tokens are also experiencing gains. For instance, MAP, the native token for the Bitcoin Layer 2 peer-to-peer omni-chain MAP Protocol, surged by 16% to $0.035 during early trading on February 27, according to CoinGecko.

Moreover, BRC-20 tokens like Multibit (MUBI), OriginTrail (TRAC), INSC, Pepe, and MEME surged, each gaining at least 20% in value. During early trading on February 27, Bitcoin reached its highest price since December 2021, touching $56,700. This surge has created a bullish sentiment in the cryptocurrency market.

However, at the time of writing, Bitcoin had slightly retreated to trade at $55,684. This underscores the rapid and dynamic nature of changes in today’s digital asset landscape. Investors and enthusiasts are watching these moves closely, with the crypto market showcasing relentless innovation and resilience.

Related Reading | ZachXBT Highlights Suspicious Activity on BitForex Crypto Exchange