Bitcoin (BTC) has recently seen a significant price drop, leading to concerns among those who anticipated a surge following its halving event. Since the fourth BTC halving, which occurred on April 20 at 12:09 AM UTC, BTC has fallen by 11%. The price is currently 22% down from its March 14 all-time high of $73,737.

On April 20, Bitcoin traded around $64,000. After the halving, BTC experienced a short rally, reaching above $67,000 on April 22. But since then, Bitcoin has been slowly dropping, falling below $57,000 on May 1, as per CoinMarketCap data. At the time of writing, BTC is trading at $57,995, down around 5.38% over the past 24 hours and more than 16.84% over the past 30 days.

The price drop is attributed to significant outflows in US-based spot Bitcoin Exchange-traded Funds (ETFs) and renewed geopolitical tensions in the Middle East. US ETFs recorded $343.5 million worth of net outflows in April, ending their three-month inflow streak.

Over $389 Liquidated

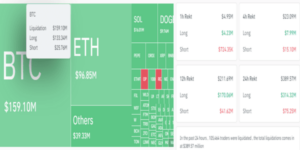

According to Coinglass data, over $389 million worth of leveraged positions have been liquidated on centralized exchanges (CEXs) over the last 24 hours due to the price drop. More than $314 million in long positions and $75 million in short positions have been liquidated. This widespread liquidation activity has affected 105,464 traders. Most liquidations happened on OKX and Binance, with $140 million and $148 million, respectively.

Bitcoin saw liquidations totaling $159 million, with $133 million from long positions and $25 million from short positions. The second-largest crypto, Ethereum (ETH), also experienced a 4.24% downturn over the past day — now trading at $2,880. ETH recorded liquidations amounting to $97 million, comprising $76 million from long positions and $21 million from short positions.

Bitcoin Could Fall Further to $50K, Says Standard Chartered

According to Standard Chartered Bank, BTC’s drop below the $60,000 mark could be the start of further pain to come. On March 1, the head of Standard Chartered Bank’s forex and digital assets research, Geoffrey Kendrick, told The Block that Bitcoin’s proper “break below $60K has now reopened a route to the $50-52K range”. Besides notable outflows from US ETFs, the poor response to the recent launch of spot BTC and ETH ETFs in Hong Kong is further putting pressure on BTC, Kendrick said.

Some crypto experts have previously predicted that BTC will drop following the fourth halving. In March, Bitcoin analysts from JPMorgan predicted BTC could fall toward $42,000 after the halving. Moreover, 10x Research CEO and head analyst Markus Thielen said Bitcoin could fall to $52,000 after the halving.