Bloomberg’s chief commodity expert, Michael McGlone, has issued a warning about the future of Bitcoin. According to McGlone, as the U.S. Federal Reserve scales back its monetary stimulus and raises interest rates, Bitcoin may soon experience a significant reversal.

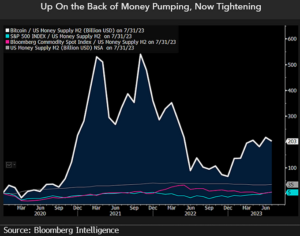

McGlone shared a chart on X (Twitter) showing that Bitcoin seems to be following a speculative pattern known as “it’ll go up because it went up,” which is common in volatile markets. McGlone highlighted two potential factors that could put pressure on Bitcoin and other risk assets: the negative U.S. money supply and the increasing T-bill rates.

He explained that these conditions have made the Fed more watchful and eliminated the “liquidity fuel” that had been supporting this year’s price rally. In fact, he suggested that Bitcoin might revert towards more sustainable levels by implying a downward correction.

The Fed’s response to the pandemic in 2020 involved printing trillions of dollars; however, it has recently started reducing its balance sheet. In February of this year alone, the M2 money supply experienced its fastest decline since America faced the Great Depression in the 1930s.

An article from Reuters reported that, according to experts, there might be an upcoming shift in direction for the Fed. This shift is specifically related to cutting interest rates once again.

Bitcoin And Stock Market Of 1929 – A Comparison

McGlone drew a comparison between Bitcoin and the stock market of the 1920s. He pointed out that both experienced significant peaks followed by crashes.

In particular, he highlighted similarities such as “parabolic price moves,” “excessive liquidity and speculation,” and the emergence of revolutionary technologies like electricity, telephone, automobiles, and air travel during that era.

However, McGlone also noted a key difference between then and now. In 1929, the Federal Reserve was cutting rates whereas currently, they are being increased. He cited a Bloomberg report which revealed that Bitcoin’s 100-week moving average has started to decline.

The report raised questions about how long it would take for risk assets to regain liquidity. As of now, Bitcoin is trading at around $26,026.40, according to CoinMarketCap, experiencing an over 11% drop last week. Since then, its value has remained relatively stable, around the $26,000 mark.

Related Reading | Bitcoin ETF Hopes Fade, Weekly Crypto Outflows Reach $55M

This decline was attributed to rumors suggesting that Elon Musk’s SpaceX sold a large amount of Bitcoin. Some also speculate that this dip is characteristic of pre-halving periods. Additionally, anticipation grows since the next halving is expected in May next year. However, the market’s unpredictability makes definitive conclusions challenging.