Bitcoin price has fallen since Bitcoin ETFs were approved. This week, we assess the claims behind fear, uncertainty, and doubt (FUD), pointing to the Grayscale Bitcoin ETF. We analyze aggregate ETF flows while considering the increased holdings by BTC whales and underreported factors possibly dragging the market.

Since the launch of spot ETFs, market observers and analysts have pointed fingers at Grayscale, holding it responsible for BTC’s continued downtrend. Grayscale’s GBTC had carried a discount on its BTC holdings for two years. However, the firm converted it to an ETF and has suffered big outflows since then.

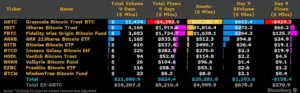

Grayscale withdrawals cast doubt on the overall efficacy of the market and increase doubt over the success of Bitcoin ETF launches. The greatest beneficiaries of the outflows include FTX and CoinShares. Since its launch, GBTC has experienced outflows of over $4.3B.

The bankruptcy estate of FTX held GBTC at a discount and chose not to realize a loss by selling ahead of the likely ETF conversion. Many other entities, including DCG (the parent company of Genesis), holding at a loss, likely decided to exit GBTC. The decision was made, especially when it was transformed into an ETF and its discount reached zero.

However, despite the $4.4B in outflows from GBTC. Notably, all the other Bitcoin ETFs received, in aggregate, $820M+ in inflows. So, that indicates net buying activity from the Bitcoin ETFs despite their price trading being lower than when these were launched. Also, there has been additional buying demand from BTC whales.

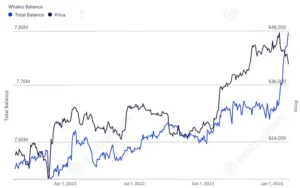

Bitcoin Whales Surge: ETFs & Market Shifts in 2024

The amount of BTC held in addresses with over 1,000 BTC has accelerated in 2024. “Whales” are any entity, individual, or fund (including the ETFs) holding over 1,000 BTC. Bitcoin ETFs saw $820M net inflows, while BTC whales have increased ~$3B (76,000 BTC) in 2024.

With GBTC included, Bitcoin ETFs now own 3.23% of the circulating supply of Bitcoin. This compares to the case of gold, where $110B out of ~$10T market cap is held in US-traded ETFs (about 1% of supply). Despite the correction in Bitcoin, high ownership of Bitcoin ETFs suggests these have gained traction among traditional finance investors.

In Q4, this likely pushed the market higher, and it may lead to a drop in Q1 2024 as traders close these carry trade positions. Just a month before the approval of the ETFs, Bitcoin futures were trading at a premium (contango) of over 2% to spot prices. This indicates a notable shift in market dynamics leading up to the ETF approval.

Funds engage in a carry trade strategy by taking a long position in spot markets and a short position in futures. The goal is to profit from the price difference, yielding annualized profits ranging from 25 to 30 percent. The premium in futures quickly turned to a discount as the ETF approval window opened. This shift was led by BitMEX [green] on Jan 6. This suggested that firms were beginning to make a profit.

Related Reading | Swan Bitcoin Unveils New Mining Unit, With 750 BTC Mined Already