The net aggregate flow of funds to the spot Bitcoin (BTC) exchange-traded funds (ETFs) turned positive for the first time since March 15. According to provisional data published by investment firm Farsid, spot BTC ETFs registered inflows totalling $15.4 million on March 25. This marks a reversal of a trend that led to net outflows of $887 million over the past week.

Fidelity’s FBTC received the highest single-day net inflow, about $261 million. BlackRock’s IBIT experienced an inflow of roughly $35.5 million. Other funds, like BTCO, EZBC, BITB, and BRRR, received between $11 million and $20 million each. Meanwhile, Grayscale’s ETF (GBTC) experienced a single-day net outflow of $350 million.

According to data, Grayscale has seen over $14.1 billion in outflows since its GBTC fund was converted to a spot ETF in mid-January. According to Bloomberg strategist James Seyffart, most GBTC outflows resulted from crypto firms’ bankruptcies. Seyffart expects this trend to slow down over the next approximately week.

Yea. Between Gemini and Genesis they had ~68 million shares of $GBTC. There was 100% a selfish interest in just being able to get out of those positions at NAV.

— James Seyffart (@JSeyff) March 25, 2024

The trading volume of spot BTC ETFs has also decreased steadily from its early March peak of nearly $10 billion. On Friday, trading volumes totalled $3.1 billion.

Bitcoin Surpasses $70K with a $1.39 Trillion Market Cap

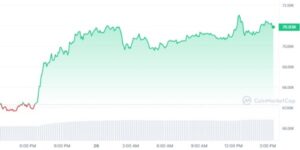

The shift in ETF flows coincides with Bitcoin’s rally to $71,000 in late trading on March 25. At the time of writing, BTC is trading at $70,925, up by 5.57% over the past 24 hours, according to data from CoinMarketCap. The flagship asset’s market capitalization is slightly above the $1.39 trillion mark, with a daily trading volume of $44.7 billion. BTC is up by almost 12% over the past week and around 39% over the past month. It is just 3.8% away from its all-time high of $73,750 registered on March 14.

Data from Santiment reveals that the number of whale transactions consisting of at least $100,000 worth of Bitcoin increased by 50.7% over the past 24 hours. Additionally, Bitcoin’s total open interest (OI) rose by $800 million. According to the data, the total BTC OI climbed from $11 billion to $11.8 billion in the last day.

Markus Thielen, founder of 10x Research, said:

“With bitcoin above $70,000, we can imagine that flows on Tuesday could also be positive again. With the quarter end, flows might be stronger than usual.”