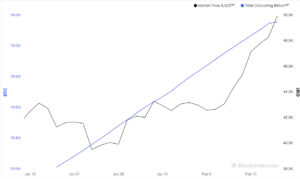

Bitcoin exchange-traded funds (ETFs) on the spot market scooped 10 times more Bitcoin than was mined on Monday, February 12. Preliminary data indicates that at least $493.4 million, or roughly 10,280 BTC, flowed into spot Bitcoin ETFs as of February 12. This massive inflow illustrates a significant shift in investor sentiment towards the digital asset market.

The largest inflows were to BlackRock iShares Bitcoin Trust, which took in massive inflows of $374.7 million. Meanwhile, the Fidelity Wise Origin Bitcoin Fund fund received $151.9 million, while Ark 21Shares Bitcoin ETF attracted $40 million of new money over the week. Grayscale outflows of $95 million and $20.8 million from the Invesco Galaxy ETF marginally offset this, resulting in nearly half a billion dollars in net inflows.

Bitcoin ETFs Surpass Miner Production

On the same day, Bitcoin BTC generated approximately 1,059 BTC, valued at around $51 million, according to data from Blockchain.com. This indicates that spot ETFs accumulated roughly 10% of the total Bitcoin mined on February 12. Approximately 12,700 BTC or $541.5 million worth of the asset flowed into the ETFs in aggregate on February 9, following a similar trend.

This contrasts with 980 BTC worth around $45 million added through mining. BlackRock led the way with a $250.7 million inflow, with Fidelity second at $188.4 million once more. Ark 21Shares experienced a significant inflow of $136.5 million.

Meanwhile, Grayscale’s outflows dropped to the lowest level in a week, totalling $51.8 million, culminating in a bumper day’s aggregate inflows. On February 12, Speaking on CNBC’s Squawk Box program, Anthony Pompliano underscored the growing affinity for Bitcoin on Wall Street, saying,

“There is 12.5x more demand for Bitcoin than what is being produced on a daily basis.”

He also noted that about 80% of the BTC supply had not changed hands for the past six months. “Only about $200bn worth in BTC is tradable. Hence, these ETFs have drawn 5% of the entire tradable supply of BTC in 30 days,” he pointed out, underlining the powerful influence of ETFs on Bitcoin’s liquidity and market dynamics.

Wall Street LOVES bitcoin.

They are buying up 12.5x more bitcoin per day than the network can produce.

The march to a new all-time high is underway if this continues.

I explain this on my segment with @SquawkCNBC this morning. pic.twitter.com/0zRc3RQ4hY

— Pomp 🌪 (@APompliano) February 12, 2024

In short, the big inflows into Bitcoin ETFs mark a sea change in investor perception, with Wall Street exhibiting a stronger interest in digital assets than ever. The expectation is that as ETFs continue to attract huge holdings over time, cryptocurrencies will grow and penetrate traditional investment portfolios.

Related Reading | Unveiling Bitcoin’s 2023 Revolution: The Impact of Inscriptions & BRC-20sa