Data from CompaniesMarketCap shows that 16 publicly traded Bitcoin mining firms have experienced a loss of over $4.47 billion in the last 12 months (TTM). The Bitcoin mining industry faces many hurdles as BTC continues to experience a bear market. The leading cryptocurrency has seen its value fall from a one-time high of $69,000 to a low of $15,480 over the past year.

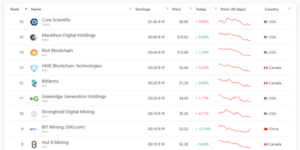

Core Scientific is the top loser in the industry, incurring a loss of $1.66 billion, as per data. Two major BTC mining companies, Riot Platforms Inc. and Marathon Digital Holdings Inc., owned by BlackRock, posted year-over-year (YoY) losses of over $600 million each.

Notably, all nine mining platforms with large losses have reported negative annual results of over $100. Interestingly, Canaan Inc. stands out as the sole company to sustain profitability in the sector, garnering earnings of $92.33 million over the past year.

Bitcoin Mining Industry Is Facing Challenges

The increasing complexity of the mining process is a major obstacle for Bitcoin miners. On August 22nd, the mining difficulty for BTC surged by 6.17%, reaching an all-time high of 55.62 trillion hashes.

The sustained difficulty has made it harder for miners to make profits. Since August 2022, the cost to mine one BTC has been higher than the average market price of one BTC in the market. Cambridge University calculated an average price of $45,877 per BTC mined on August 27. However, the spot price on the identical day was $26,089 for one BTC. It resulted in a loss of $19,588 for every unit of Bitcoin mined.

Moreover, crypto miners are moving towards AI platforms, according to a report. BTC miners are at the forefront among them. Ethereum miners are also leaving following the Ethereum Merge. GPUs used for ETH mining have lost their usefulness and value. Many have sold their mining systems to recover their investments.

Particularly, crypto miners want to reduce their dependence on crypto, tap into new revenue streams, and enter new business sectors.

The next BTC halving is expected to occur on April 26, 2024. It will decrease the reward from 6.25 BTC per block to 3.125 BTC per block. This will further impact the revenue of Bitcoin mining companies unless the value of BTC increases substantially.