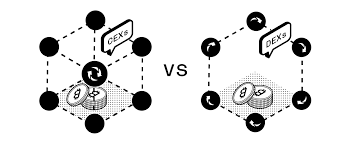

Platforms like Cryptocurrency exchanges allow people to buy and sell cryptocurrencies. Two types of Exchanges are centralized (CEX) and decentralized (DEX). You might be curious about the distinction if you’re new to cryptocurrencies. This blog will explain the fundamental distinctions and how they work. It will also highlight the need to pick a suitable exchange. This blog helps you to choose which type of exchange is ideal for you.

Decentralized exchanges (DEXs)

DEXs are cryptocurrency trading platforms that operate without external oversight. Users have immediate access to and trading access to crypto assets thanks to their decentralized operating system.

Decentralized exchanges avoid the risk of a single point of failure or potential manipulation by other parties. On-chain transactions are finished, and the blockchain serves as the trading infrastructure. Users can consistently handle their money; consequently, a central server is no longer required.

DEXs are significantly safer than centralized exchanges because of peer-to-peer network technology. They do this to exploit any holes in defense or points of control. Because no personal information is transferred during trading, DEXs provide much more privacy.

You can purchase and sell cryptocurrencies directly with other individuals without using a middleman by using a DEX. Doing this will save funds since you won’t have to pay the extra charges like traditional exchanges.

Centralized exchanges (CEXs)

Anyone can purchase, sell, and trade cryptocurrencies through mobile apps and websites known as centralized exchanges (CEXs). It brings buyers and sellers together to trade virtual money like a marketplace. In contrast to other exchanges, CEXs are run by a single entity that manages the platform, the funds, and the transactions.

Comparatively to decentralized exchanges, this provides higher security and confidence (DEXs). Furthermore, a variety of advantages offered by CEXs attract traders to them. They consist of margin trading, order kinds, and access to sophisticated trading tools. A higher level of liquidity is also typically found on CEXs, which can lead to more rapid trades and better pricing.

However, these benefits come at a cost – fees. Due to their overhead costs, trading fees on CEXs can be significantly higher than DEXs. Furthermore, because of the centralization of CEXs, there is an inherent danger that your assets might be misplaced or stolen if their system is breached.

The benefits of DEXes

As decentralized exchanges (DEXs) offer several advantages over centralized exchanges, they are worth considering (CEXs). The following are a few of the critical advantages of employing DEXs:

Additional Financial Control

DEXs provide users more control over their money by replacing the need to keep currency with a third-party custodian. Because only the user can access their money, they are entirely responsible for keeping it secure.

Enhanced Security

DEXs are frequently more secure than CEXs since they don’t depend on one point of failure. User funds are instead held on a decentralized computer network, making it almost impossible for criminals to access them. Many DEXs also use smart contracts to optimize deals and increase security.

Anonymity and Privacy

Users that utilize decentralized exchanges (DEXs) have the benefit of privacy and anonymity, which enables them to remain unknown and avoid having to comply with know-your-customer (KYC) and anti-money laundering (AML) requirements. Individuals prioritizing confidentiality will likely be attracted to DEXs because they can trade without disclosing their identities.

Lower Fees and Fairer Trading

DEXs typically have lower fees than CEXs since they do not require traders to pay a commission when buying or selling assets. Furthermore, as DEXs operate on decentralized networks, no single entity can control prices, lowering the possibility of market manipulation and promoting more equitable and open trade.

The benefits of CEXes

Centralized exchanges (CEXes) are popular among cryptocurrency traders due to their various benefits. Below are some of the advantages that make CEXes attractive to traders:

Convenience

Easy-to-use user interfaces and advanced trading features such as margin trading, high liquidity, and advanced order types make it quick and efficient for users to buy and sell cryptocurrencies on CEXes.

Security

CEXes generally require users to create accounts with KYC requirements and other security measures, making them more secure than Decentralized Exchanges (DEXes).

Customer Support

CEXes provide customer support through live chat and email; some even offer beginner educational resources. This can be helpful when users encounter problems while trading.

Accessibility

As many CEXes offer mobile apps, consumers can easily trade cryptocurrencies while on the road. Several CEXes also provide customers with storage options, eliminating the need for external wallets. Nevertheless, there can be extra charges for certain services. Users can easily start trading without purchasing bitcoin from outside sources because CEXes accept various payment methods, including bank transfers and credit cards.

The drawbacks of DEXes

While choosing which exchange to utilize for cryptocurrency trading, investors should consider the distinct constraints of decentralized exchanges (DEXes). Some of the major issues with DEXes are listed below:

Slower and More Complex Trading Processes

DEXes take longer to complete trades and are generally more complex than centralized exchanges (CEXs). This is because matching orders, clearing trades, and settling payments occur on the blockchain, resulting in a slower trading experience. Additionally, DEXes often require users to have more technical knowledge to navigate the platform successfully, which can be intimidating for beginners.

Less User-Friendly Platform

Compared to CEXs, DEXes are generally less user-friendly, requiring users to have higher technical expertise to trade. As a result, new investors can need help to use DEXes effectively. Experienced traders, on the other hand, want a platform that is easier to use so they can concentrate on trading rather than learning to utilize complicated interfaces.

Susceptible to Security Risks

DEXes are more susceptible to fraud and hacking since no strict restrictions exist. Moreover, because users are not required to reveal their names, it is easier for criminals to commit awful acts like money laundering or funding terrorism. So, before utilizing a DEX to trade or exchange cryptocurrencies, it’s crucial to perform your research and confirm that it has strong security measures and abides by the regulations.

The drawbacks of CEXes

Users can buy or sell cryptocurrencies easily using centralized cryptocurrency exchanges (CEXs). Users should be aware of a few potential downsides, nevertheless, that they can have.

Security Risks

Due to its centralized design, CEXs are susceptible to hacking and theft, which implies that a single point of failure might result in the loss of all cash kept in the exchange.

Limited Insurance

Users can not have their funds insured, which means they cannot recover any lost funds if the exchange fails or is hacked.

Government Regulations

CEXs are subject to government regulations, which can limit user access in certain countries and can also impact the overall user experience.

High Trading Fees and Slow Processing Times

CEXs often have high trading fees and slow processing times, making it difficult for traders to exploit market opportunities.

Identity Verification

Before being able to trade, users must undergo an identity verification procedure that can be time-consuming and invasive.

Limits on Deposits and Withdrawals

CEXs often limit how much money users can deposit and withdraw daily, which can be inconvenient when users need access to their funds quickly.

Which one should you use?

The two basic exchange options for trading crypto assets are centralized exchanges (CEXs) and decentralized exchanges (DEXs). Customers must carefully consider their demands and preferences when selecting an exchange type because each has pros and cons.

CEXs for Beginners and Convenience

CEXs are easier to use, making them an excellent option for beginners who are just beginning out in cryptocurrency trading. Finding the ideal assets for your portfolio is simple, thanks to their large selection of tokens and currencies.

Moreover, CEXs often have better liquidity than DEXs, making acquiring and selling assets simple. Customer support services are provided by CEXs, which might be beneficial if you run into problems with a purchase or transaction.

The disadvantage of CEXs is that they demand customers hand over sensitive data and entrust their money to a third party, which poses a security risk. Moreover, they sometimes charge larger costs than DEXs, which can reduce your profits.

DEXs for Control and Anonymity

Contrarily, DEXs give customers additional security, privacy, and anonymity. Because middlemen offer you complete control over your money, you do not need to commit it to them. DEXs also provide lower fees because of their decentralized nature, allowing you to save money.

The peer-to-peer approach used by DEXs, which settles orders between users directly rather than passing via a centralized third party, is one of its key features. Because of the improved security and privacy provided by this, DEXs are a viable choice for people who place a high value on these aspects.

Automated arbitrage opportunities are another unique feature of DEXs that can help traders generate profits from price discrepancies across multiple platforms. On the downside, DEXs can be more complicated than CEXs and can not offer as many tokens and currencies to trade.

Conclusion

It will ultimately come down to personal choice when determining which kind of cryptocurrency exchange to utilize. A CEX may be the ideal choice if convenience is important to you and you feel comfortable disclosing personal information. If your top priorities are anonymity, privacy, and financial control, a DEX could be the best option. Consider the advantages and disadvantages of each before selecting the platform.